IMAP advised the shareholder of EMS Elektro Metall Schwanenmühle GmbH (EMS), specializing in high-current electrical connection technology, on its acquisition by International Wire Group (IWG), an Olympus Partners portfolio company.

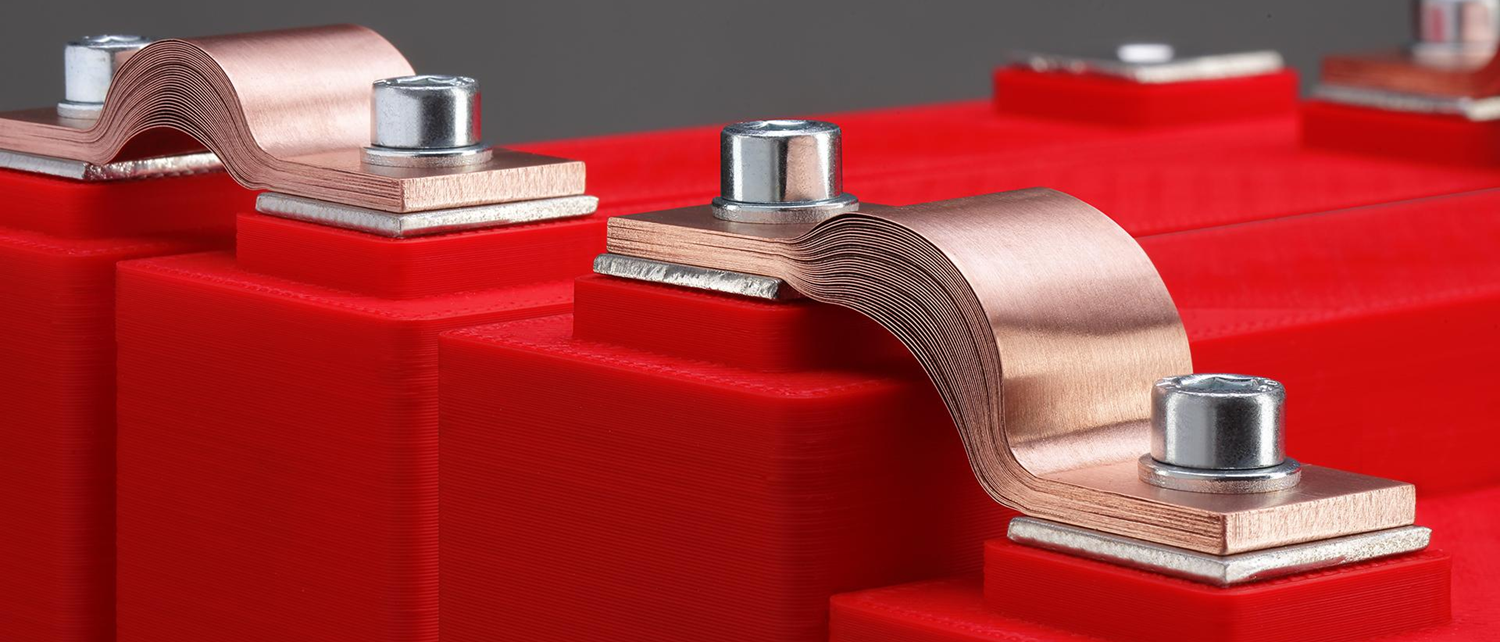

Based in Horbach, Germany, and with operations in Orozkow, Poland, EMS is a market leading supplier for engineering and manufacturing of customized high current busbars used in electrical power generation, transmission, distribution and storage. With roots tracing back to 1755, EMS has been a proud and important contributor in the development of electrical infrastructure in Europe. EMS has developed a respected reputation offering products and services to meet the market needs of i.e. electrical infrastructure, data centers, battery storages, electrolysis, industrial applications electric vehicles and renewables.

Gregory Smith, CEO of International Wire Group, said, “This acquisition leverages many existing customer relationships while expanding our geographic presence in the electrical infrastructure ecosystem. Together, with our recent acquisition of Hussey Coppper, EMS will play a key role in offering mission critical products and services for key markets including electrical infrastructure, AI/data centers, renewable energy, transformers, switchgear and electric vehicles.”

“Joining IWG and Hussey Copper is a natural fit, deepening our existing customer relationships, geographic reach and product offerings”, said EMS management “We would like to express our special thanks to the IMAP team for their professional preparation, advice, and tireless efforts in making this future-oriented transaction happen.”

Headquartered in Camden, New York, IWG is the largest non-vertically integrated copper, copper-alloy, and copper busbar products manufacturer in the United States and maintains operations in Europe, all supported by unparalleled global engineering capabilities. IWG is highly regarded for its capacity and broad product portfolio, servicing a wide range of applications in energy, green electrification, industrial, automotive, aerospace, data communications and other major markets.

Olympus Partners is a private equity firm focused on providing equity capital for middle market management buyouts and for companies needing capital for expansion. Olympus manages funds in excess of $12 billion mainly on behalf of corporate pension funds, endowment funds and state-sponsored retirement programs. Founded in 1988, Olympus is an active, long-term investor across a broad range of industries including business services, consumer products, healthcare services, financial services, industrial services and manufacturing.

The IMAP team, consisting of Karl Fesenmeyer, Carl-Benedict Schmucker and Sven Kantwill advised the shareholder of EMS exclusively throughout all phases of a structured M&A process until its successful closing.