The industrial sector is experiencing an unprecedented shift, driven by automation, artificial intelligence (AI), and global supply chain disruptions. As companies strive to increase efficiency, enhance product quality, and meet sustainability standards, the need for strategic mergers, acquisitions, and partnerships has never been more crucial.

With geopolitical tensions reshaping global trade and technological advancements driving innovation, M&A in industrial equipment, machinery, and aerospace & defense presents lucrative opportunities. Companies seeking growth, market consolidation, or technological integration are actively engaging in cross-border deals, joint ventures, and strategic acquisitions to future-proof their businesses.

At IMAP, we specialize in navigating the complex landscape of industrial M&A. Our team provides expert guidance, industry-specific insights, and access to key strategic relationships that help clients make data-driven, confident investment decisions. Whether you're looking to sell your

company, expand internationally, or restructure operations, our global partnership and market expertise ensure that you seize the right opportunities at the right time.

IMAP's expertise spans a broad range of industrial subsectors, allowing us to tailor strategies to the nuances of each market. We advise clients operating in:

The industrial M&A sector has remained a major driver of global deal-making, with 18,000 completed transactions between 2019 and 2024, amounting to over €580B in total reported deal value.

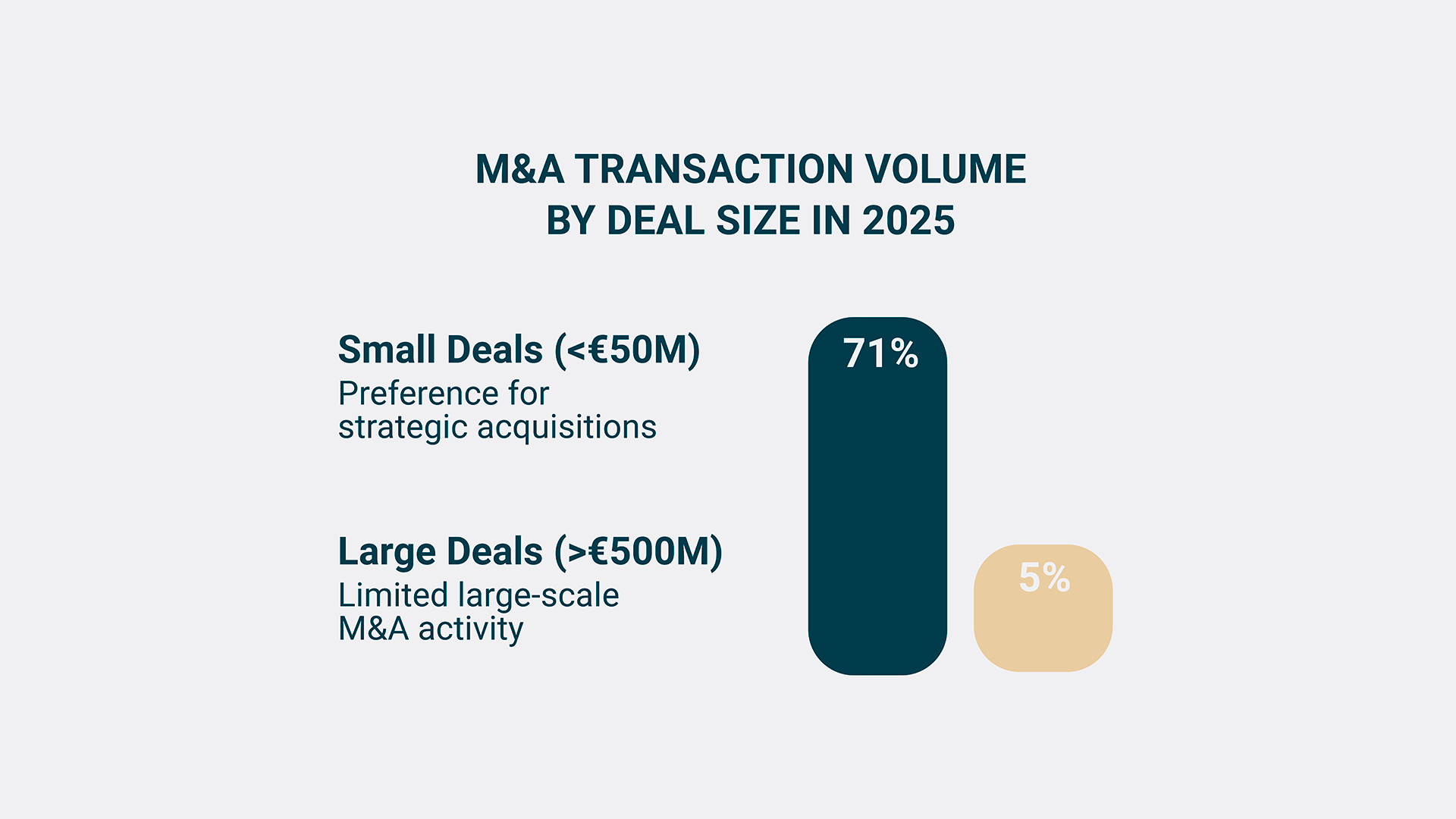

The industrial sector continues to see dynamic shifts in M&A activity, influenced by economic conditions, geopolitical factors, and technological advancements. While deal volumes have fluctuated over recent years, the sector remains highly active, with strong investment interest in mid-market transactions.

The industrial M&A sector has remained a major driver of global deal-making, with 18,000 completed transactions between 2019 and 2024, amounting to over €580B in total reported deal value.

Mid-market M&A in the industrials space remains a key tool for driving strategic growth, accessing emerging technologies, and expanding into new regional markets. Buyers are increasingly targeting specialized, profitable firms that support automation, sustainability, and efficiency across the industrial value chain.

Recent IMAP-advised transactions illustrate how industrial buyers are responding to

macroeconomic pressures and digital transformation by acquiring innovative suppliers

and service providers in niche segments.

Zunehmende Automatisierung und künstliche Intelligenz in Verbindung mit einem sich verändernden geopolitischen Umfeld bedeuten, dass die Balance zwischen Effizienz, Qualität und Nachhaltigkeit im Maschinen- und Anlagenbau noch nie so herausfordernd war wie heute. Dieses empfindliche Gleichgewicht bietet interessante Möglichkeiten für Partnerschaften, Umstrukturierungen oder Übernahmen.

Bei IMAP verfügen wir über das Branchen-Know-how und die strategischen Beziehungen, die unseren Kunden einen Wettbewerbsvorteil auf einem der vielversprechendsten internationalen Märkte verschaffen. Wir liefern Ihnen die richtigen Informationen zur richtigen Zeit, damit Sie kluge strategische Entscheidungen treffen und diese souverän umsetzen können.