The European Automotive Aftermarket: A Sector in Transformation

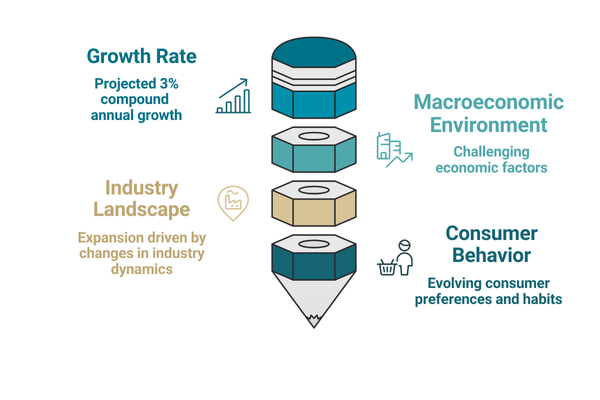

The European Automotive Components Aftermarket is poised for continued growth, with experts projecting a compound annual growth rate of approximately 3% in the coming years.

This expansion is driven by a challenging macroeconomic environment that is reshaping the industry landscape and consumer behavior.

We have identified four key trends which we believe will shape the future of the industry:

1. Aging Vehicle Fleet

One of the primary factors fueling the aftermarket's growth is the increasing average age of vehicles on European roads. In 2023, the average vehicle age in the EU reached 12 years, a significant increase from 8-9 years in 2010. This aging fleet directly correlates with higher annual maintenance costs, boosting demand for aftermarket services and parts

2. Consolidation Wave

The industry is experiencing a strong consolidation trend, particularly among parts distributors. These companies are seeking to achieve critical mass and leverage economies of scale to remain competitive. Major industry players have been actively acquiring local distributors across Europe, reshaping the competitive landscape

3. OEM Strategy Shift

Original Equipment Manufacturers (OEMs) are facing pressure on their aftermarket business as their market share in older vehicle segments declines. In response, they are expected to diversify their operations, potentially establishing their own networks of repair shops that cater to multiple car brands.

4. Digitalization and Consumer Behavior

The digitalization of sales channels is revolutionizing the customer purchasing process. Increased access to price information and customer reviews is putting pressure on profit margins for suppliers and distributors. This shift emphasizes the importance of service quality and is driving the adoption of big data and advanced analytics to better understand and meet customer needs.

Market Dynamics and Investment Activity

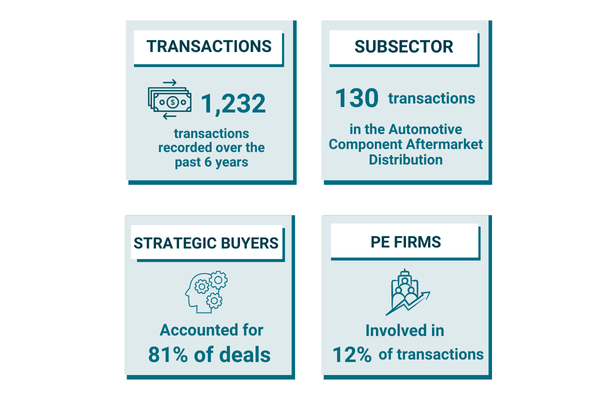

The Automotive Components industry has seen significant investment activity, with 1,232 transactions recorded over the past six years. According to IMAP research and Mergermarket, of these, 130 transactions were directly related to the Automotive Component Aftermarket Distribution sub-sector. Strategic buyers dominated the field, accounting for 81% of the deals, while private equity firms were involved in 12% of the transactions.

Key Players and Investors

Prominent investors in the sector include Alliance Automotive Group, Swiss Automotive Group AG, Relais Group Oy, Parts Holding Europe SAS, Genuine Parts Co, and LKQ Corporation. These companies have been at the forefront of the consolidation trend, seeking to strengthen their market positions through strategic acquisitions.

Geographic Focus

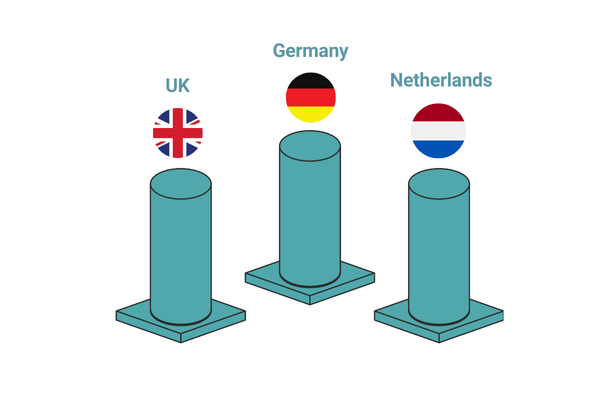

The United Kingdom, Germany, and the Netherlands have been hotspots for M&A activity, collectively accounting for 41% of the target companies in these transactions. This concentration suggests that these markets are seen as particularly attractive for expansion and consolidation efforts.

Industry Challenges and Opportunities

While the Automotive Aftermarket offers significant opportunities, in the current economic climate it also faces challenges.

Inflation, energy shortages, and geopolitical conflicts are decreasing disposable income and increasing prices, which affects the demand for new vehicles and could also impact consumer spending on vehicle maintenance. However, these same factors are also contributing to the trend of consumers keeping their vehicles longer, which in turn, benefits the Aftermarket.

Looking Ahead

As the industry continues to evolve, several key trends are expected to shape its future:

- The emergence of multinational wholesalers with revenues exceeding €1-2 billion

- Increased professionalization of wholesalers and workshops

- Growing importance of private labels

- Rising significance of e-commerce and online competition

- Suppliers focusing on top market players, potentially squeezing out smaller competitors

The European Automotive Aftermarket is at a crossroads, facing significant changes driven by technological advancements, shifting consumer preferences, and economic pressures. We foresee companies that can adapt to the new landscape - embracing digitalization, achieving scale through consolidation, and meeting evolving customer needs - are likely to emerge as the leaders.