Brazil’s Food Industry: Affordability, Innovation & Global Ambition

Brazil’s Food industry stands as a pillar of the nation’s economy and a significant player on the world stage.

As the world’s seventh most populous country and the tenth largest economy, Brazil combines demographic strength, urbanization, and a growing middle class. Yet, the sector’s evolution is shaped not only by these macroeconomic fundamentals but also by persistent affordability concerns, rapid food innovation, and an increasingly dynamic M&A environment.

A Sector of Scale and Influence

Brazil’s Food industry is vast, comprising over 41,000 companies - 94% of which are micro, small, or medium-sized enterprises. The sector directly employs approximately 2.1 million people in formal jobs and generates an estimated 8.3 million indirect jobs. In 2024, Brazil produced 283 million tons of food, with 72% destined for the domestic market. This scale positions Brazil as a global leader in several commodity food products, including:

-

#1 in sugar and orange juice exports

-

#2 in beef and soybean oil exports

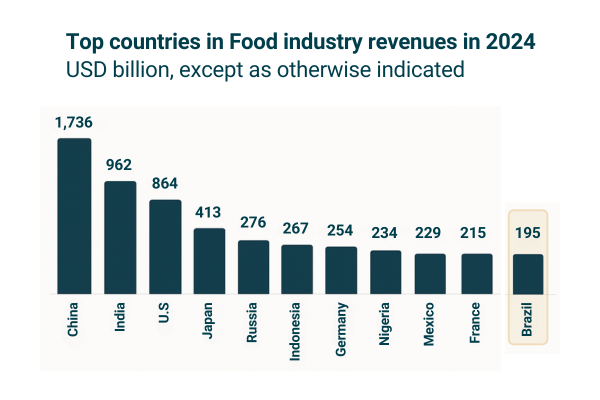

Brazil’s food exports have made the country a powerhouse in global Commodity markets, with Food industry revenues ranking number 11 in the world in 2024.

Brazilian Food Market Trends and Segments

Brazil’s Food industry is characterized by a diverse range of segments, each reflecting unique consumption patterns and competitive dynamics. Here we focus on packaged foods, primarily branded and for domestic consumption, which represent a significant portion of consumer spending:

-

Dairy: USD 22.4 billion in 2023, with milk, cheese, and yogurt as leading categories. Relevant players in Brazil include internationals such as Nestle and DANONE, as well as Brazilian companies such as Aurora Coop and Piacanjuba

-

Biscuit, Pasta, and Industrialized Bread & Cake: USD 12.3 billion in 2024. Relevant players include U.S., Mexican, Swiss, and Brazilian companies

-

Rice and Beans: Estimated consumer spending of USD 11.5 billion in 2023, underscoring their status as dietary staples. Players are all Brazilian and include Camil, Josapar, Urbano, among others

-

Processed Meat: USD 8.2 billion consumer spending in 2023, with the segment dominated by Brazilian companies. Major players include JBS, Marfrig, and Minerva, all of which have expanded their product portfolios to include both traditional and innovative offerings

-

Chocolate and Confectionery: USD 7.1 billion consumer spending in 2023, with multinationals holding a dominant position

Affordability in the Brazilian Food Sector

Affordability is a defining theme in Brazil’s Food industry. With 171 million people - 81% of the population - belonging to lower-income segments (Classes C, D, and E), food costs are a central concern. These consumers typically allocate up to 23% of their monthly income to food and essential goods, a figure that has risen from around 18% in 2018. As a result, affordable products in small pack sizes account for more than 60% of everyday consumer goods sales by volume.

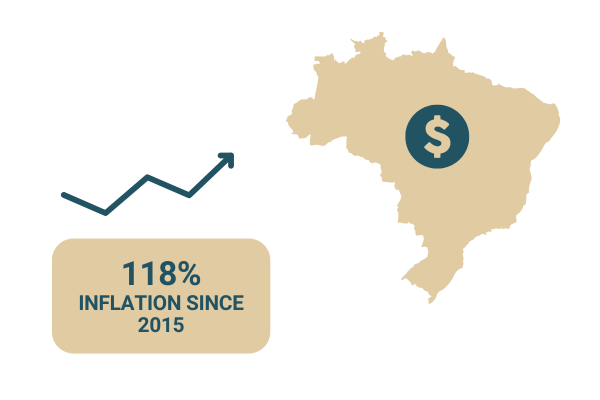

Inflation in the basic consumer basket has surged by 118% since 2015, further intensifying the focus on affordability. The industry’s response has been to innovate with product formats and pricing strategies that cater to the needs of price-sensitive consumers.

Case Studies in Affordability

Brasilpar – IMAP Brazil played a significant advisory role in two notable transactions within Brazil’s Food industry, both of which illustrate the sector’s evolving landscape.

-

Fuji Oil’s Acquisition of Harald: Advised on Fuji Oil’s acquisition of Harald, a leading B2B chocolate and compounds producer in Brazil. Harald is recognized as the top producer and seller of compound chocolate, widely used by industries, bakery shops, pastry shops, and home bakers (micro entrepreneurs) across the country. The acquisition allowed Fuji Oil to strengthen its presence in the B2B chocolate segment, particularly among professional users

-

PepsiCo’s Acquisition of Lucky: Advised Lucky, a prominent producer of salty snacks in Brazil, on its sale to PepsiCo. Lucky’s main brands, Fofura and Torcida, are well established among Class C and D consumers - the largest consumer base in the country. These products benefit from strong distribution in small retailers, neighborhood shops, and even bus stops. Through this acquisition, PepsiCo expanded its reach in the affordable snacks segment.

Brazil is rapidly aligning with global trends in food innovation, driven by shifting consumer preferences and health consciousness. This is also reflected in increasing M&A activity.

Plant-Based Food in Brazil: Brazil is emerging as a leader in Latin America’s Plant-based Food sector, with sales growing at more than 30% per year.

Local innovators such as Fazenda Futuro and The New Butchers are gaining traction, while traditional meat giants like JBS, Marfrig, and Aurora Coop are launching plant-based lines to remain competitive. Multinationals, including Nestlé, Unilever, and PepsiCo, are also introducing dedicated vegan and vegetarian product lines.

-

Functional Foods in Brazil: The Functional Foods category - products offering health benefits such as gut health, immunity, and energy - has seen rapid growth, particularly in the wake of the pandemic. Probiotic yogurts, kombuchas, and high-protein snacks are increasingly popular, with dairy companies, multinationals and specialized local players leading the way in functional nutrition

-

Clean Label Trends: Brazilian food brands are responding to consumer demand for simpler, more natural ingredients. According to Nielsen, 65% of Brazilian consumers are willing to pay more for clean label products. This trend is evident across categories, from chocolate and bread to seasonings, as companies remove artificial additives and highlight natural attributes

Brazilian Food Exports and Global Integration

Brazil’s Food industry is deeply integrated into global supply chains, with a strong export orientation in key commodity categories. The country’s scale, agricultural productivity, and established trade relationships position it as a reliable supplier to global markets. This export strength provides resilience and growth opportunities, even as domestic consumption patterns evolve.

Food M&A Brazil: A Dynamic Market for Investment

Mergers and acquisitions are reshaping Brazil’s Food industry, reflecting both global and local players’ ambitions. Recent transactions highlight the sector’s attractiveness:

-

Multinational giants are investing in plant-based, functional, and clean label segments.

-

Local players are accelerating growth through expansion and targeted acquisitions.

This M&A activity is fostering innovation, enhancing competitiveness, and expanding the reach of Brazilian food brands both domestically and internationally.

Food Sector Valuations Brazil: Discount to Global Peers

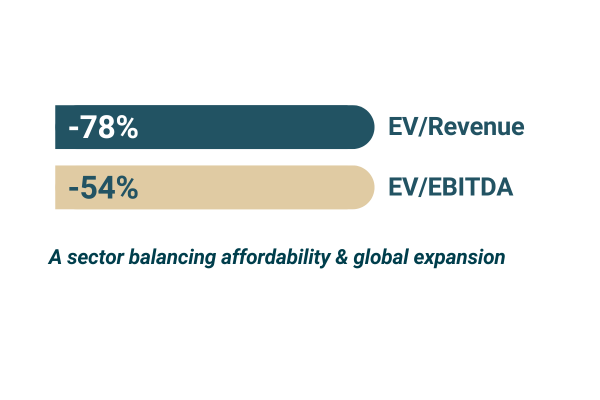

Brazilian food companies currently trade at a significant discount compared to U.S. peers. As of April 2025, the Brazilian Ibovespa index trades at a 62% EV/EBITDA discount to the S&P 500. Specifically, Brazilian food companies exhibit a 78% EV/Revenue discount, and a 54% EV/EBITDA discount compared to U.S. counterparts. For investors, this valuation gap presents opportunities, particularly as the sector continues to innovate and expand.

A Market Balancing Affordability and Innovation

Brazil’s Food industry is defined by its scale, diversity, and adaptability. Affordability remains a central concern for the majority of consumers, shaping product development and pricing strategies. At the same time, the sector is embracing innovation, with rapid growth in plant-based, functional, and clean label foods. M&A activity and global integration are further accelerating the industry’s transformation.

As Brazil continues to balance the imperatives of affordability and innovation, its Food industry is well positioned to capture growth opportunities at home and abroad, reinforcing its status as a global food powerhouse.

Click HERE to download the full Brazilian Packaged Food Industry Report.