IMAP closes 47 M&A transactions in Q1 2024

Q1 was another great quarter for IMAP, and now, after what effectively was a global trade and manufacturing recession, it seems that we are past the worst and are at an inflection point of sustained growth. There are, of course, geopolitical dangers that could derail this recovery, yet IMAP advisors will continue to help clients navigate whatever conditions lie ahead.

IMAP closes 47 M&A transactions in Q1 2024

IMAP Q1 2024 REVIEW + PARTNER PERSPECTIVES

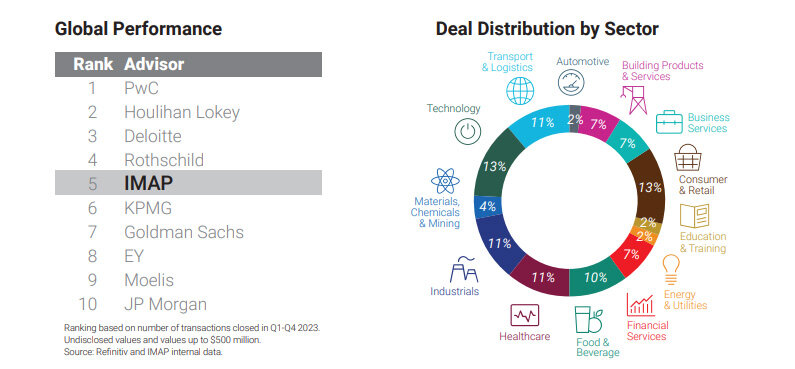

The uptick in middle-market deal activity registered towards the end of last year carried into 2024 and IMAP dealmakers

closed 47 M&A deals around the world worth more than $3 billion in Q1. Confidence has generally strengthened over

the past several months with fears of a recession essentially dismissed, inflation lower, but still high relative to pre-2020

standards, improvements in the financing environment and buoyant stock market gains. Company earnings and profits are

recovering compared to this this time last year and high-quality businesses with strong margins continue to attract interest

from well positioned strategic buyers who remain the dominant force in M&A.

Many financial buyers continue to sit on the sidelines pending visibility regarding the timing of interest rate cuts. Moreover,

there is still an ongoing disconnect between seller and buyer valuation expectations. Overall confidence has increased in Q1,

although buyers continue to be very careful in their analysis of the strategic fit of target companies and when performing

due diligence. About a third of IMAP transactions in Q1 were cross-border as IMAP dealmakers continued to leverage their

international reach and help clients seize opportunities abroad. From a sector perspective, IMAP was most active in the

Consumer, Industrials, Technology, Healthcare and Services segments.

Going forward, the global economic and geopolitical landscape will remain dynamic, but IMAP partners are reporting strong

and growing pipelines. The bubbling sense of optimism in the market could grow further with potential rate cuts later

this year, and perhaps most importantly, if PE players start to make moves. In fact, many PE funds are under increasing

pressures to put their capital to work.

IMAP Q1 2024 REVIEW + PARTNER PERSPECTIVES