The Canada and South America Mining Trifecta: A Tale of Strategic Collaboration by IMAP Partners

In the intricate world of international mergers and acquisitions, partnerships are not just beneficial—they are vital. Among the notable collaborations in recent history, the "Canada and South America Trifecta" stands out as a testament to the power of global synergy.

This series of three strategic collaborations, totalling USD 125 million, involved IMAP partners Morrison Park Advisors (MPA) - IMAP Toronto Canada and their counterparts in South America - South Andes Capital - IMAP Chile, SUMMA - IMAP Peru, and FS Partners - IMAP Argentina. Together, they tackled high-profile transactions that not only redefined mining investments but also showcased the potential of cross-border cooperation.

Stephen Altmann, Managing Director at Morrison Park Advisors, remarked:

Our collaboration with IMAP Partners has been nothing short of exceptional. These partnerships not only drove the success of these transactions but also set the stage for ongoing engagement as we explore exciting new opportunities together.”

Chapter 1: The Sierra Norte Copper Project

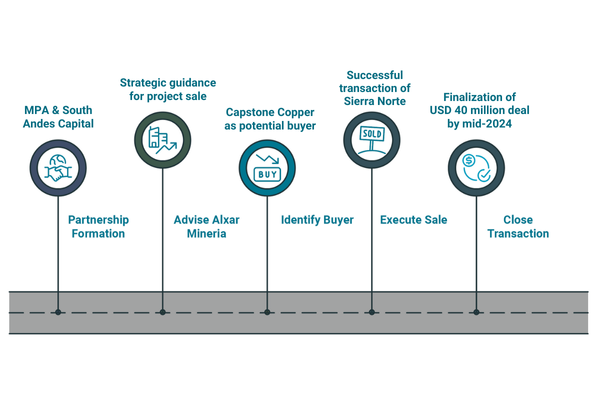

The first chapter of this compelling trilogy is the most recent transaction where MPA joined forces with South Andes Capital in Chile to advise Alxar Mineria, the mining subsidiary of Empresas Copec S.A., on the sale of the Sierra Norte Copper Project to Capstone Copper.

Nestled in the mineral-rich landscapes of South America, the Sierra Norte Copper Project represented a significant opportunity for expansion and investment in the global copper industry. Empresas Copec S.A., one of Chile's most influential conglomerates, with a market cap close to USD 8.8 billion, sought to align its mining project with a potential buyer capable of unlocking the project’s full potential.

Stephen Altmann and Julian Storz from MPA worked alongside Gabriel San Martin and Patricio Giglio from South Andes Capital, bringing together their combined expertise in corporate finance, global mining operations, local sector expertise and strategic negotiations to ensure the successful sale to Capstone Copper, a leading copper producer in the Americas.

The transaction not only marked a milestone for the involved parties but also underscored the significance of international collaboration in the Mining sector. The transaction was closed by mid-2024, for a total consideration of USD 40 million.

Copper, a critical component in renewable energy systems, electric vehicles, and infrastructure, plays an indispensable role in today’s global economy. Its increasing demand underscores its strategic importance in shaping the future of energy and technology.

Gabriel San Martin, Managing Partner at South Andes Capital, shared:

Working on the Sierra Norte transaction was a remarkable experience. Joining forces with MPA allowed us to combine our local insights with their global expertise, creating a partnership that truly brought out the best in this project. It’s rewarding to see such a transformative outcome for everyone involved.”

Chapter 2: Strategic Investment in Ascot Resources

In the second chapter, MPA collaborated with SUMMA in Peru to advise Ccori Apu, a Peruvian investment powerhouse and major shareholder of Compañía Minera Poderosa S.A., on its USD 45 million strategic equity investment in Ascot Resources, a Canadian mining company.

This transaction was a bold move that bridged the investment ambitions of South America with the mining opportunities of North America. Ascot Resources, renowned for its expertise in gold and silver mining, was on the cusp of significant growth, and Ccori Apu’s capital infusion provided the financial muscle needed to propel its projects forward.

Stephen Altmann and Julian Storz from MPA collaborated with Carlos Garcia, Daniela Polar, and Guido Vingerhoets from SUMMA to ensure that the deal was structured to maximize value for both sides. The partnership enabled Ccori Apu to secure a strategic foothold in Canada’s competitive Mining sector while strengthening Ascot’s operations and development pipeline.

Gold, revered as a safe-haven asset, remains crucial in stabilizing economies during turbulent times. Its enduring value and widespread use in financial systems, technology, and jewelry highlight its indispensable role in the global economy.

MPA and SUMMA have expanded their collaboration, securing additional mandates and actively pursuing new opportunities to drive value and foster cross-border growth.

Carlos Garcia, Founder and Managing Director of SUMMA, shared:

This transaction was deeply meaningful to us, as it showcased the power of collaboration and trust between our teams and MPA. Helping Ccori Apu secure this strategic investment was not just about the numbers - it was about building lasting relationships and creating value on both sides of the table.”

Chapter 3: The Sale of Minera Don Nicolas

The final chapter brought MPA and FS Partners in Argentina together to advise a consortium of Argentine industrial and technology companies on the sale of Minera Don Nicolas (MDN), an operational gold mine located in Argentina, to Cerrado Gold, a Canadian-listed gold company. This transaction, valued at USD 40 million, exemplified the intricate balance of local expertise and international market access.

The consortium, which had nurtured Minera Don Nicolas into a productive and sustainable operation, sought a buyer who could continue its legacy while driving further growth. Stephen Altmann from MPA partnered with Pedro Querio from FS Partners to identify the right buyer, negotiate terms, and navigate the complexities of cross-border regulations.

The sale to Cerrado Gold highlighted the transformative impact of collaboration, allowing both the sellers and the new owners to achieve their strategic objectives. Gold’s vital role in financial systems, technology, and jewelry ensures its enduring demand. Its importance to global trade and investment makes it a cornerstone of the modern economy.

Pedro Querio, founding partner and managing director of FS Partners stated,

Working together we were able to rapidly and efficiently provide the selling consortium a proposal which satisfied their combined interests.”

A Legacy of Excellence

The Canada and South America Trifecta is more than just a series of successful transactions; it is a case study in the art of global collaboration. Through their combined efforts, MPA and their South American IMAP partners facilitated deals that not only created value for their clients but also contributed to the growth and dynamism of the international Mining industry.

These transactions underscore the essence of IMAP’s mission: to connect businesses across borders and enable transformative opportunities. By leveraging their collective expertise, MPA, South Andes Capital, SUMMA, and FS Partners demonstrated the power of partnerships in shaping the future of industries and economies worldwide. MPA continues to actively work with their South American IMAP firms to identify further cross-border opportunities.