Filtration and Purification Technology Demand Pique Flow Control M&A Interest

As companies integrate real-time monitoring, automation, and artificial intelligence (AI)-driven analytics in the Flow Control sector, the need for “smart” valves, pumps, and actuators that can communicate data and self-adjust in response to system conditions has grown.

The advancement of internet of things (IoT) and predictive maintenance has driven significant demand for high-technology flow control products, particularly in emerging end markets like Water & Wastewater Treatment, Pharmaceuticals & Life Sciences, Energy Power Transmission & Distribution, Oil & Gas, and Cryogenics, with Capstone noticing a heightened interest among sector acquirers.

M&A Deal Volume and Valuations Remain Healthy

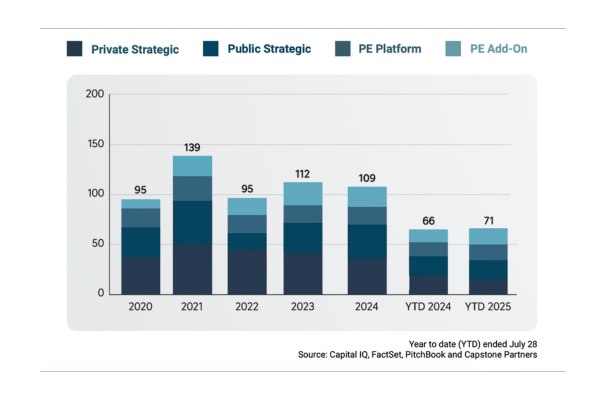

M&A volume in the Flow Control sector has totaled 71 deals through year-to-date (YTD) 2025, up 7.6% year-over-year (YOY), and is on track to surpass 2024’s total. Transaction backlog in 2025 has remained robust in the space as engineered products players look to roll up competitors to bolster portfolios globally. Strategic buyers have cooled acquisition activity, while private equity (PE) firms have ramped up. Private strategic deal volume has remained flat and public strategic deal volume has fallen by eight deals to date.

Meanwhile, PE platform deals have increased from seven to 10, and add-on acquisitions have risen from 11 to 19 YOY through YTD, together accounting for 40.8% of total sector deal volume. This marks the highest PE buyer composition recorded in Capstone’s Flow Control precedent transaction database. Financial buyers have shown a willingness to transact in the Flow Control sector, opting to grow portfolios inorganically, deploy dry powder reserves, and utilize debt financing.

The sector has remained a compelling place for PE as many sponsors have bolstered portfolio companies' operations, technological capabilities, and strategic investments to generate healthy long-term returns.

Energy Infrastructure Investments Boost Sector

The Energy Power Transmission & Distribution segment within the Flow Control sector has matured as utilities and grid operators prioritize efficiency, reliability, and grid modernization. Increased electrification and the integration of renewables has driven demand for improved valves, actuators, and control systems that optimize fluid and gas management in substations and high-voltage networks.

Early players that have harnessed AI technology to build autonomous distribution systems have gained a competitive advantage, attracting more interest from acquirers. M&A activity in the space reflects a push toward consolidation, with companies seeking to expand their technological capabilities and geographic reach to meet growing global demand.

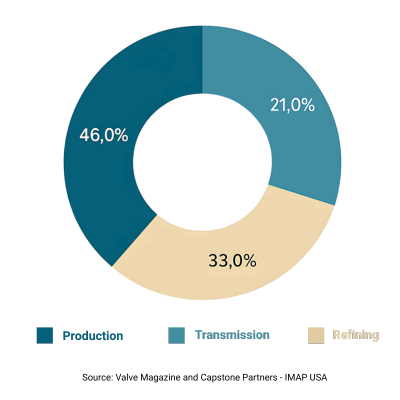

The current U.S. administration’s funding for the Oil & Gas industry has had a significant positive impact on the Flow Control sector. Enhanced support for exploration, production, and distribution has led to increased demand for flow control products and services. Crude oil production (46% of valve shipments in 2024) is expected to increase in 2025 and catalyze growth for petroleum valve shipments, which may increase as much as 5%, according to the Valve Magazine issue.

Notably, President Trump has greenlit liquefied natural gas (LNG) exports for Commonwealth LNG in Louisiana. Manufacturers in the Oil & Gas space have become incentivized to innovate, leading to advancements that can improve performance, reduce costs, and minimize environmental impact.

The above is an excerpt from Capstone Partners’ Partners’ Flow Control M&A Update – Filtration and Purification Technology Demand Pique Flow Control M&A Interest. For over 20 years, Capstone Partners has been a trusted advisor to leading middle market companies, offering a fully integrated range of investment banking and financial advisory services uniquely tailored to help owners, investors, and creditors through each stage of the company's lifecycle. For more information, visit www.capstonepartners.com.