Capstone Partners (IMAP USA) Reports on Pet Market M&A Activity

Robust Spending Fuels Pet Care Market M&A For Diversified End Markets

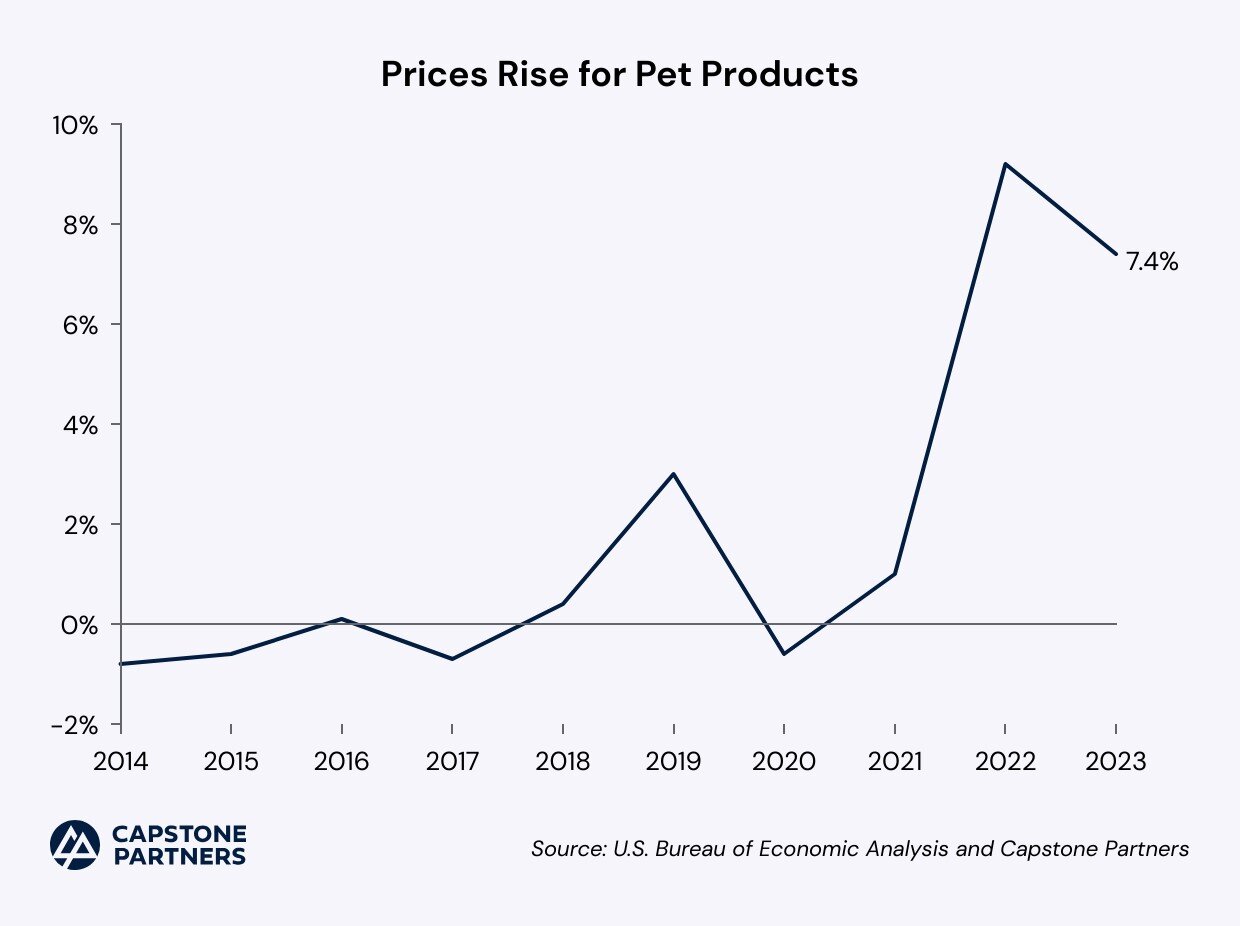

The growing notion that pets serve as vital members of the family has bolstered the popularity and demand for pet products, services, and consumables. Notably, 66% of U.S. households own a pet and total sector expenditures were projected to have risen 5.0% year-over-year (YOY) from $136.8 billion in 2022 to $143.6 billion in 2023, according to the American Pet Products Association (APPA). The nondiscretionary nature of sector spending has persisted despite consumer prices for pets and pet products rising 7.4% YOY in 2023, according to the U.S. Bureau of Labor Statistics. Leading sector participants have garnered healthy revenue increases amid steady consumer demand.

High End Pet Consumables Assimilate to Human Habits

The Pet sector has continued to trend toward greater humanization in dietary requirements, and supplements as pet owners have increasingly demanded high-quality, healthy products. Quality consumables businesses have felt the effects of increasing prices as input costs rose. However, demand for these high-end goods has remained robust.

Owners have continued their purchasing habits to ensure their pets receive the best products and care. Notably, pet owners in the U.S. have spent an average of $780 on their dogs and $523 on their cats, annually, for products, whether that be treats, food, vitamins, beds for dogs, or high-end kitty litter, according to a report by the APPA.

Increased regulation from the Association of American Feed Control Officials (AAFCO) and consumer demand for higher standards in the Pet Food & Ingredients segment have attracted new sector participants. Notably, Thrive Foods announced its acquisition of NutriBites, UBite and Hoopla brands parent, Canature, in December, combining the two freeze-dried pet food and treat producers. Terms of the deal were not disclosed. The acquisition will allow Thrive Foods to leverage Canature’s expertise in wet processing, an increasingly sought-after category within the Freeze-Dried Pet Food segment, according to a press release.

Consumer Packaged Goods Players Focus on Pet Space

Sector M&A volume rose 10.8% YOY from 102 deals announced or completed in 2022 to 113 in 2023, outperforming the broader Consumer industry. Strategic buyers commanded the lion’s share (67.3%) of deal activity in the space with a 50% increase in strategic activity (63 deals announced or completed in 2023 compared to 42 in the prior year). Financial buyers continued to scale back acquisition pursuits in 2023, accounting for 32.7% of transactions compared to 47.1% in 2022. Add-on acquisitions declined 51.4% from 37 deals announced or completed to 18. However, despite a tightened credit market, select sponsors continued to pursue platform investments in the space which rose from 11 deals in 2022 to 19 deals in 2023. Capstone expects strong deal volume to continue as growth in Pet Products, Services, and CPG end markets drive sector dealmaking in 2024.

I would have predicted that the insatiable appetite for Pet Consumables amongst PE firms would have allowed them to keep pace with strategic buyers in 2023. However, what we saw was 11% growth in the number of transactions with a pull back from PE doing almost half the deals in 2022 to only one-third in 2023. As interest rates rose, the consistent theme with PE owners was a focus on improving operations at their portfolio companies and not a focus on aggressively acquiring. I expect the pendulum to swing back by the second half of 2024 with PE firms getting more active and hopefully more aggressive.

Tom Elliot, Managing Director, Capstone Partners.

Public strategics (11.5% of total transactions) have noticed the upward trajectory of the space, and large CPG players have leveraged their investment arms to gain exposure to the sector. Of note, General Mills (NYSE:GIS) has established Gold Medal Ventures, a growth equity fund, which acquired Fera Pets, a vet-created, science-backed supplement company, for an undisclosed sum (November). The acquisition, a first for the newly launched equity fund, has diversified General Mills’ portfolio into the Pet Supplement segment. "The Pet Wellbeing category is on the rise, as more families look to take care of their pets the same way they take care of their own health," commented John Parrish, Vice President of Disruptive Growth at General Mills, in a press release. General Mills has become another player in the notable list of strategics who have launched investment arms to capitalize on Pet sector trends like Mars’ $300 million Companion Fund II launch in October 2023 and Merck’s (NYSE:MRK) Animal Health Ventures.

The above is an excerpt from Capstone Partners’ March 2024 Pet M&A Coverage Report. For more than 20 years, Capstone Partners has been a trusted advisor to leading middle market companies, offering a fully integrated range of investment banking and financial advisory services uniquely tailored to help owners, investors, and creditors through each stage of the company's lifecycle. Capstone Partners is IMAP's partner in the USA. To learn more, visit www.capstonepartners.com.