Growing Emphasis on ESG and Sustainable Business Practices Driving M&A in Japan

CHUAN ZHANG

Associate

Pinnacle – IMAP Japan

c.zhang@imap.com

In 2020, Japan’s then Prime Minister, Yoshihide Suga declared the country’s goal to achieve carbon neutrality and a decarbonized society by 2050. Around the same time, the Energy sector in Japan, until then known for its high dependency on coal-fired power plants, had also begun to call for a strong push towards decarbonization. In response, Japanese companies have since begun to increase their M&A activities to promote Sustainable Development Goals (SDGs) and ESG initiatives.

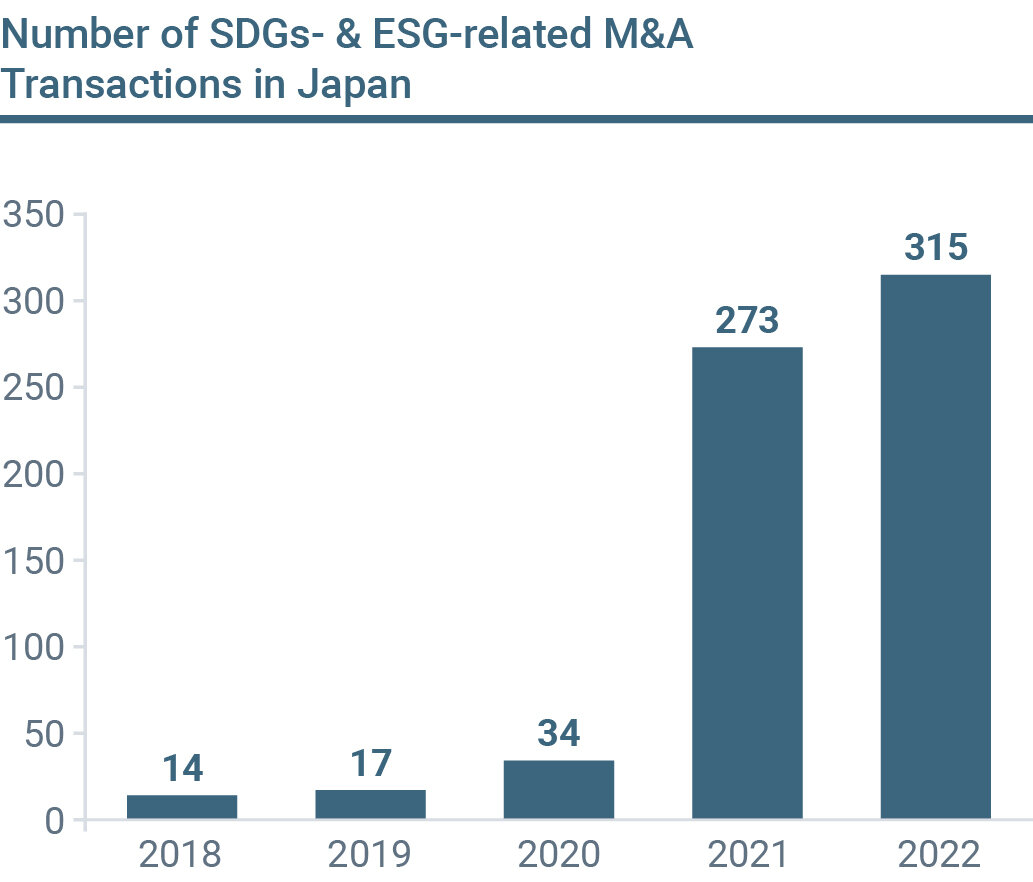

From 2019 to 2020, the number of SDGs- and ESG-related transactions doubled to 34. One notable transaction was that of Seven & I Holdings and its acquisition of Speedway, the third-largest convenience store arm of Marathon Petroleum Corp. in the U.S., for $21 billion. The acquisition aimed to promote sustainable management by utilizing scale advantage to reduce CO2 emissions and adopting energy-saving lighting equipment and renewable power generators not only in the existing stores but also in the new ones.

In 2021, this number surged to 273, marking an eightfold increase compared to the previous year. We also saw this trend continue in 2022, with 315 deals, representing a 15.4% growth. Furthermore, these deals accounted for 7.3% of the total number of deals (4,304) in Japan. As of February 2023, there were 47 SDGs-and ESG-related transactions, surpassing the same period last year, approaching 10% of the total number of deals (584), clearly demonstrating that SDGs and ESG have become a notable driving force in Japanese companies’ M&A activities.

Sectors Seeing Most SDGs- and ESG-Driven Transactions

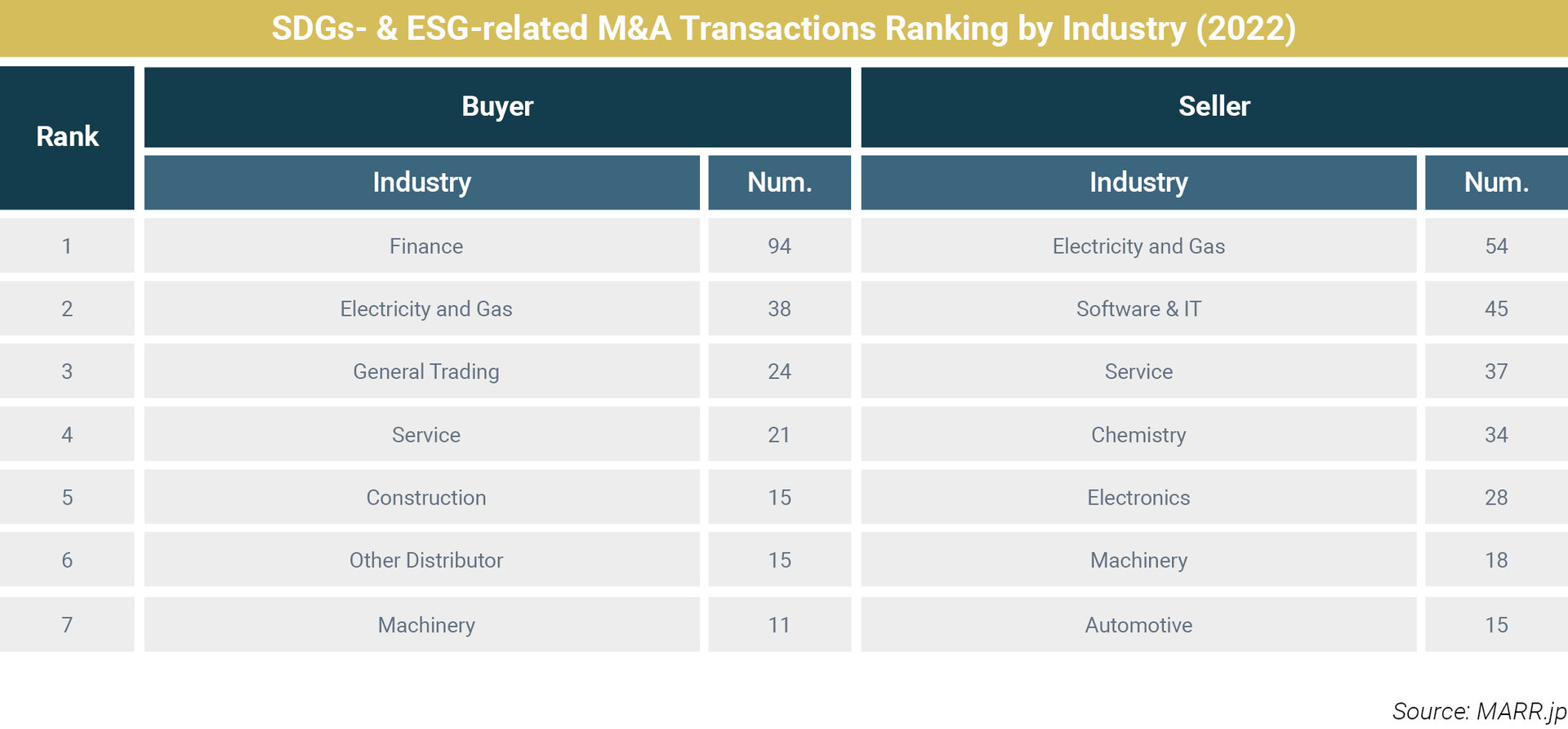

While the Gas & Electricity sector has witnessed the most activity in terms of both buy & sell sides, other industries such as Finance, General Trading, Construction, and Software/IT have also seen a significant level of M&A activity during the last two years.

Today, out of the 40 industries listed (based on MARR Industrial Classification), 35 of them have recorded at least one SDGs- and ESG-related M&A activity.

We have also seen there is a noticeable trend towards strengthening renewable energy businesses:

- Renewable Japan, a company primarily focused on solar energy, acquired Japan Renewable Energy Infrastructure Investment Corporation. They aim to achieve a more flexible and efficient operation by integrating ownership and operation

- WWB, a wholly owned subsidiary of Abalance and a solar power generation business in Tokyo, acquired two companies: Nippon Mirai Energy and J. Mirai in Sendai City, which are both involved in power generation, management, operation, electricity supply, and sales through natural energy sources. Abalance aims to promote a recurring revenue business model

- JERA, a joint venture company owned by Tokyo Electric Power Fuel & Power and Chubu Electric Power, acquired two U.S. companies that hold assets in thermal power stations, including the Canal Generating Plant. They are considering supporting the development of large-scale renewable energy projects to promote decarbonization efforts further

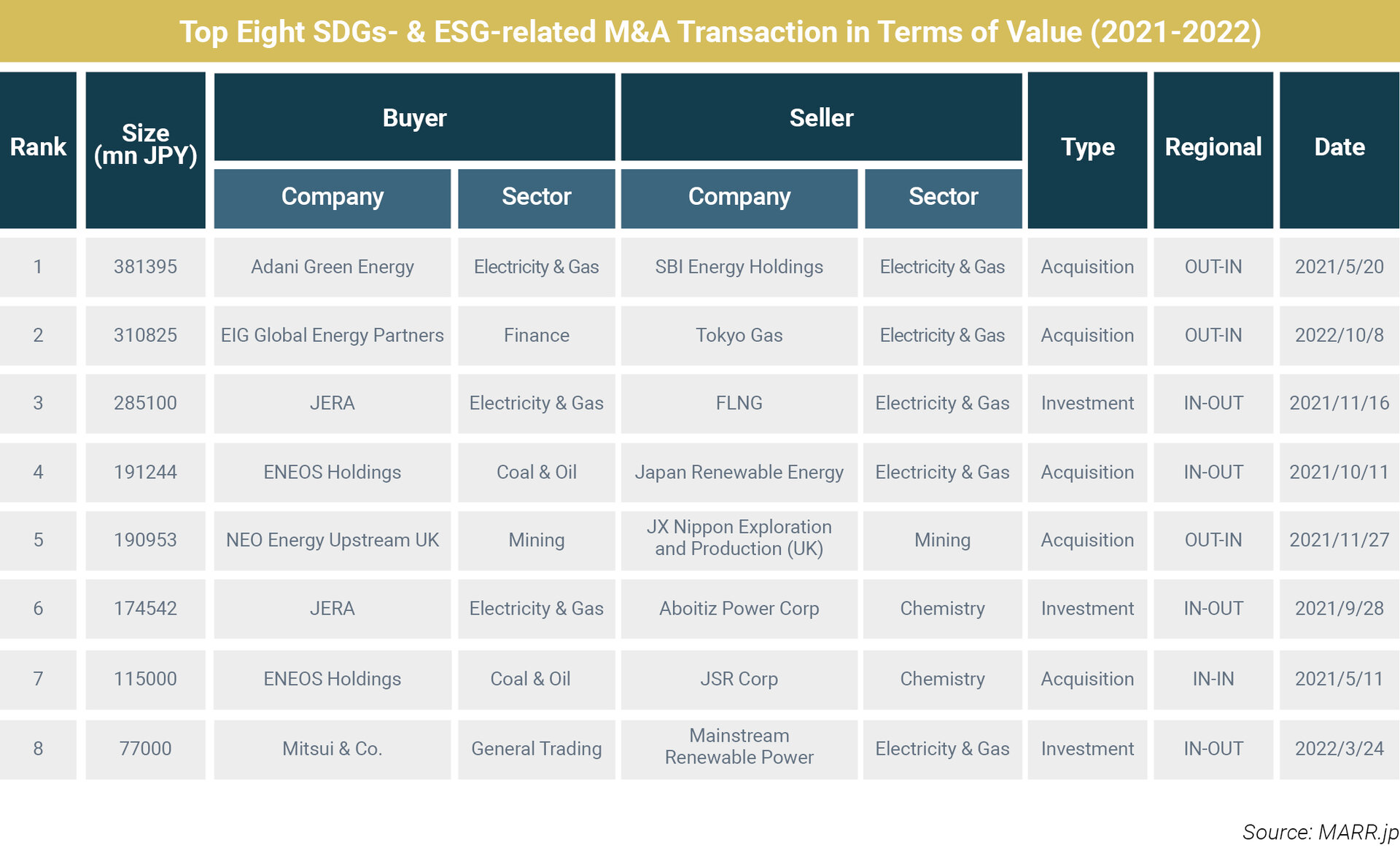

Among the sellers, there have been several carve-out projects in which major energy companies were involved. Tokyo Gas, a major gas company, has sold its rights in four Australian LNG projects to EIG Global Energy Partners, an infrastructure investment firm, for approximately JPY310 billion. Since 2003, Tokyo Gas has been expanding its business of holding upstream LNG interests. This sale is part of their efforts to adjust their asset portfolio.

Looking at activity by sectors, in the General Trading sector, Mitsui & Co., has invested approximately JPY77 billion in Mainstream Renewable Power Limited, a renewable energy company based in Ireland. This investment aims to enhance the quality of their electricity power-related portfolio and accelerate the reduction of greenhouse gas emissions.

In the Construction industry for example, we have also begun to see an increase in investments in decarbonization-related technology startups:

- Shimizu Corporation has invested in Clean Energy Connect (Tokyo), a startup offering B2B green power solutions

Hazama Ando and Daiwa House Industry have invested in Global Energy Harvest (Fujisawa City), a startup that specializes in developing power generation technology. The company has developed a new pumped-storage hydroelectricity system which utilizes wave power to pump water and generate energy, combining it with existing small-scale hydropower generation technology to provide a stable energy supply

In 2022, the breakdown of the 315 SDGs- and ESG-related M&A cases in 2022 by region was

- 199 domestic acquisitions (IN-IN)

- 106 involved domestic companies being acquired by foreign companies (IN-OUT)

- 10 were foreign acquisitions of domestic companies (OUT-IN)

The proportion of IN-OUT cases is relatively high at 33.7%, accounting for 17.0% of the total IN-OUT transactions (625).

Notably, there have been prominent cross-border transactions in the Gas & Electricity industry. SoftBank Group sold its Indian renewable energy subsidiary to Adani Green Energy, a player listed on the Bombay Stock Exchange. Tokyo Gas, on the other hand, sold its four Australian LNG projects to EIG Global Energy Partners, an infrastructure investment firm based in the U.S.

This surge in M&A activity across various industries reflects the growing emphasis on ESG considerations and the pursuit of sustainable business practices in Japan. Companies are seeking opportunities to enhance their environmental and social performance, address climate change challenges, and align with global sustainability goals, driving the increase in M&A deals aimed at promoting SDGs and ESG initiatives. Therefore, Japanese companies can be expected to increasingly seek ESG targets in their outbound M&A deals.