Degroof Petercam – 150 Years in the Making and Original Founders Still at the Helm

This year, Degroof Petercam – IMAP’s partner in France & Belgium commemorates its 150th anniversary and boasts a rich history dating back to 1871.

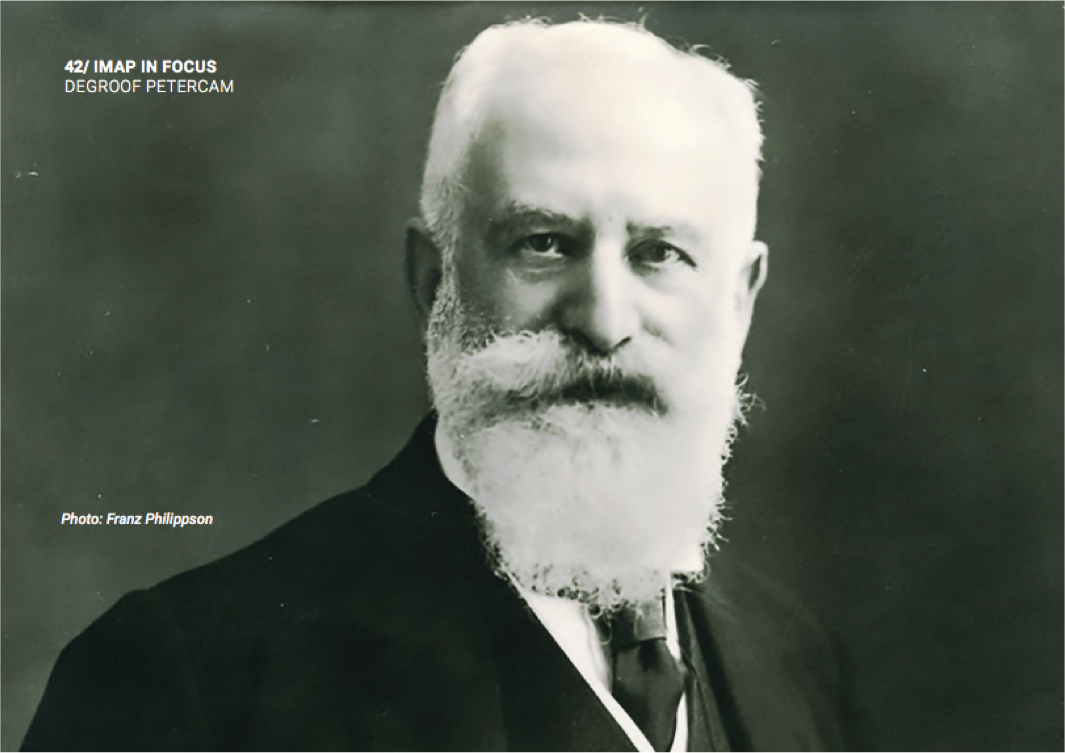

Photo: Franz Phillippson, care of Degroof Petercam

This year, Degroof Petercam – IMAP’s partner in France & Belgium commemorates its 150th anniversary and boasts a rich history dating back to 1871. Nowadays, celebrating such longevity in any institution is rare and a testament to the solid foundations and fundamentals in place and even more so when you consider that Degroof Petercam remains in the hands of the original family shareholders, who still own a sizeable share of the business.

IMAP and Degroof Petercam not surprisingly, share many of the same values at their core. It was IMAP’s spirit of partnership, quality of the board and level of professionalism of IMAP members that were key criteria for Degroof Petercam when it was selecting an M&A advisory to partner with to strengthen its international reach. Likewise, IMAP has found a partner whose exemplary transaction record, high levels of trust and client commitment complement the values across the global partnership.

Degroof Petercam were due to host IMAP’s 2021 Spring Conference in Paris this April. However, this was made impossible due to COVID pandemic and instead, IMAP members from around the world joined forces for a 4-day virtual conference. With sector credentials at the very forefront of the program, the sessions encapsulated best practices from partners across the globe who even during COVID, have successfully adapted, aligned and in many cases, grown their business.

François Wohrer, Head of Investment Banking and Executive Board Member at Degroof Petercam said:

“Being the oldest institutional firm in the IMAP partnership, Degroof Petercam has faced and successfully navigated many waves, peaks and troughs over the years. Since joining IMAP, we have been able to offer our clients new international M&A opportunities and together with our IMAP colleagues, we are exploring potential new areas for collaboration in equity and debt capital markets. Unfortunately, circumstances forced us to postpone our physical conference this year, but we very much look forward to welcoming our IMAP colleagues to Paris in April 2022.”

Read the full article in IMAP's Creating Value magazine.

Degroof Petercam's 150 Year History

The story begins with 20-year-old Franz Philippson, who beginning his career in arbitrage, quickly went on to set up the Banque Philippson and several industrial businesses. With the help of his sons Jules and Maurice, the bank played a key role in major public loan issuances, the stabilization in the Belgian Franc and the privatization of the Belgian railways. When Germany invaded Belgium and France in 1940, and the Philippson family were forced to flee, two partners, including Jean Degroof continued to manage operations and the bank subsequently changed its name to Bank Degroof.

Over the following years, the bank expanded the scale of its operations, opened branches in other countries and continued to play a pivotal role in the financial industry, including making the first successful privatization in Belgium. Degroof Petercam as it is known today, is also closely tied to two other stockbrokers Léon Libert and Émile Van Campenhout, with a history dating back to 1919 and 1927, respectively. In 1934, after the great depression, Léon’s son-in-law, Lucien Peterbroeck, begins working with him.

Later, in 1966, Jean Peterbroeck, specializing in private banking and Etienne and Emmanuel Van Campenhout, experts in currency trading, international arbitrage, and institutional investor relations, would go on to play a key role in the reforming of the stockbroking profession. In 1968, they form their own company, Peterbroeck and Campenhout & Co. also known as ’Petercam’. Over the decades, both companies have contributed to prosperity by opening doors to new opportunities with the launch of numerous IPO’s, the introduction of collective investment funds and the privatization of high-level institutions.

Many years later in 2015, Degroof merged with Petercam, to become Degroof Petercam as it is known today. Employing over 1400 professionals and with c.90 billion dollars/75 billion euros of Asset under Management, it offers a unique combination of services in Private Banking, Institutional Asset Management, Investment Banking, and Asset Services. To this day, more than 70% of the company remains in the hands of family shareholders.

A vintage picture of the Petercam parners pre-merger. Image care of Degroof Petercam.

Poster promoting a loan to support post-war restoration works as an illustration of Degroof’s contribution towards economic development and society by helping financing the infrastructure works after the war. Image care of Degroof Petercam.