HEM

/

INDUSTRIER

/

INDUSTRI

The industrial sector is experiencing an unprecedented shift, driven by automation, artificial intelligence (AI), and global supply chain disruptions. As companies strive to increase efficiency, enhance product quality, and meet sustainability standards, the need for strategic mergers, acquisitions, and partnerships has never been more crucial.

With geopolitical tensions reshaping global trade and technological advancements driving innovation, M&A in industrial equipment, machinery, and aerospace & defense presents lucrative opportunities. Companies seeking growth, market consolidation, or technological integration are actively engaging in cross-border deals, joint ventures, and strategic acquisitions to future-proof their businesses.

At IMAP, we specialize in navigating the complex landscape of industrial M&A. Our team provides expert guidance, industry-specific insights, and access to key strategic relationships that help clients make data-driven, confident investment decisions. Whether you're looking to sell your

company, expand internationally, or restructure operations, our global partnership and market expertise ensure that you seize the right opportunities at the right time.

IMAP's expertise spans a broad range of industrial subsectors, allowing us to tailor

strategies to the nuances of each market. We advise clients operating in:

The industrial M&A sector has remained a major driver of global deal-making, with 18,000 completed transactions between 2019 and 2024, amounting to over €580B in total reported deal value.

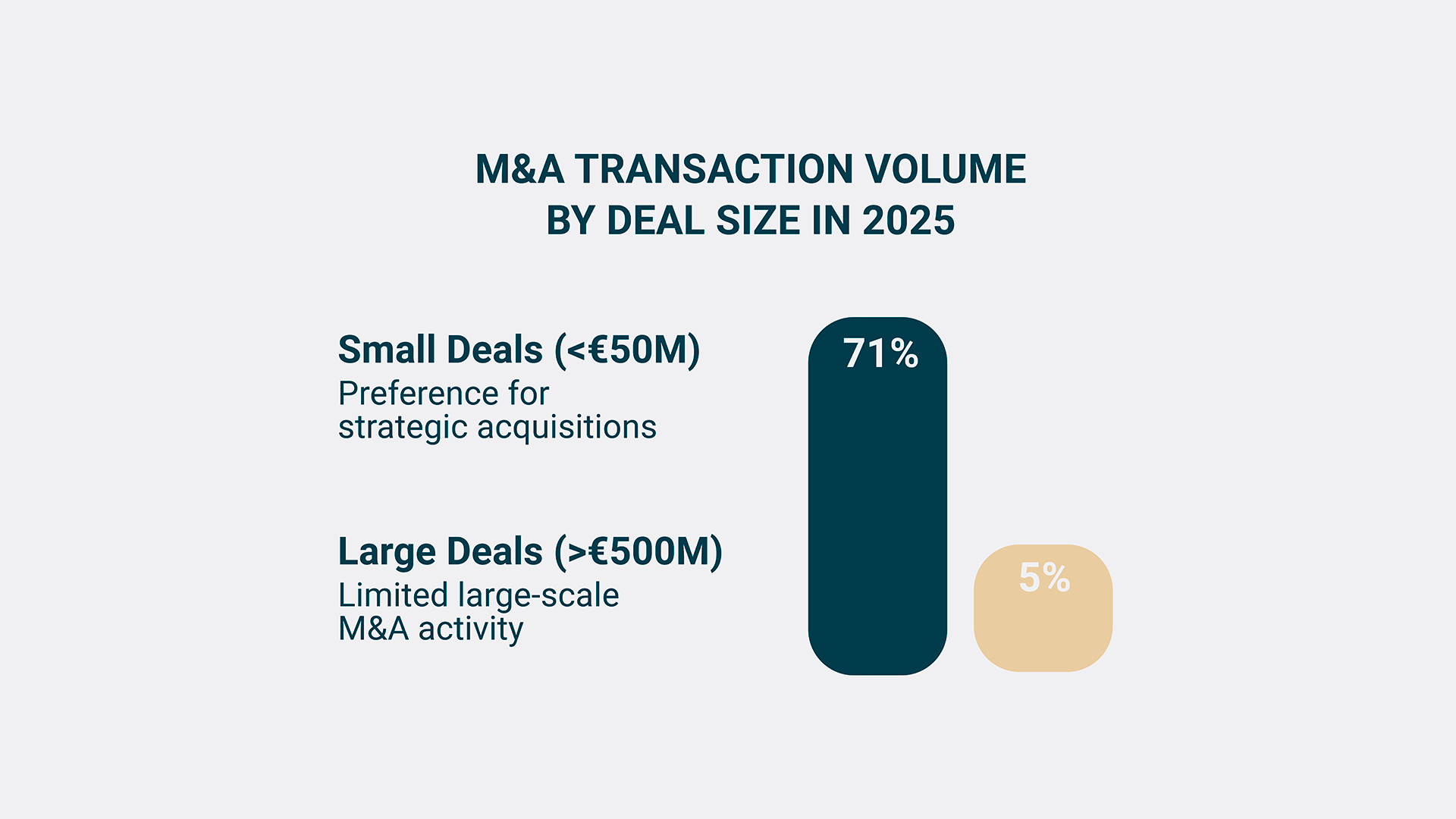

The industrial sector continues to see dynamic shifts in M&A activity, influenced by economic conditions, geopolitical factors, and technological advancements. While deal volumes have fluctuated over recent years, the sector remains highly active, with strong investment interest in mid-market transactions.

The industrial M&A sector has remained a major driver of global deal-making, with 18,000 completed transactions between 2019 and 2024, amounting to over €580B in total reported deal value.

The industrial M&A sector has remained a major driver of global deal-making, with 18,000 completed transactions between 2019 and 2024, amounting to over €580B in total reported deal value.

Ökad automation och artificiell intelligens i kombination med en föränderlig geopolitisk miljö gör att balansen mellan effektivitet, kvalitet och hållbarhet inom industriella maskiner & utrustning, flyg och försvar aldrig har varit mer utmanande än den är idag. Denna känsliga balans ger intressanta möjligheter för partnerskap, omstruktureringar eller förvärv.

På IMAP har vi branschexpertis och strategiska relationer som ger våra kunder en konkurrensfördel på en av de mest lovande internationella marknaderna. Vi förser dig med rätt information vid rätt tidpunkt så att du kan fatta smarta strategiska beslut och implementera dem med tillförsikt.

M&A inom midmarket-segmentet är en värld av möjligheter som kommer med en mängd olika alternativ och olika aspekter. Din rådgivare är din kompass genom hela processen.

Oavsett i vilket skede du befinner dig bör du ta kontakt med en branschexpert så tidigt som möjligt så vi kan hjälpa dig att komma på rätt kurs direkt och ge dig de bästa förutsättningarna för en lyckad transaktion.

När du kontaktar IMAP får du en förutsättningslös diskussion med en M&A-specialist som lyssnar noga på dina funderingar och ger dig klarhet om den bästa vägen framåt och de olika alternativen.