Brazil Emerges as a Data Center Powerhouse in LATAM

The global Data Center market is experiencing unprecedented growth, driven by increasing demand for digital infrastructure, cloud computing, and AI, it is attracting significant private equity investments, expenditure by global technology players and sovereign fund investments.

This article explores the dynamics of the market, including colocation services, hyperscale facilities, and broader trends such as the impact of AI on data centers. It also sheds light on data center expansion in Brazil and the country’s strategic role in this market for Latin America.

Trends in AI and Cloud Computing Shaping the Data Center Market

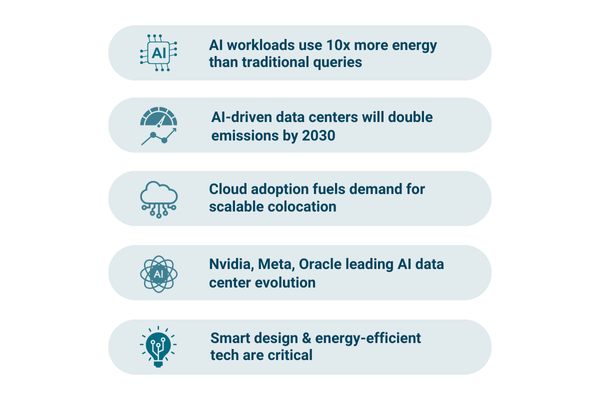

Several transformative trends are driving the evolution of data centers:

1) Impact of AI on Data Centers: The rise of AI is significantly influencing data center design and operations. AI workloads require high-density GPU clusters, increasing computing demand. Large-scale AI training models drive higher energy consumption and infrastructure investments. This trend underscores the need for scalable facilities capable of handling complex computational tasks. The main players in this segment are Microsoft, Oracle, Nvidia, and Meta.

2) Cloud Adoption Trends: Enterprises are increasingly migrating workloads to cloud-based platforms, relying on data centers as providers for delivering these services. Cloud computing enables businesses to access scalable resources like servers, storage, and networking remotely. The main players here are Equinix, NTT Global Data Centers, Digital Realty, China Telecom, and CyrusOne.

3) Energy Efficiency Challenges: As mentioned, AI is profoundly impacting power consumption in data centers, driven by the computational intensity of AI workloads. For example, a single ChatGPT query consumes ten times more electricity than a Google search.

This surge in energy usage is expected to double carbon emissions from AI-driven data centers between 2022 and 2030.

Additionally, AI's growing role in data center operations is contributing to broader power demand increases, with U.S. electricity consumption projected to rise by 2.4% annually through 2030, and data centers accounting for 30% of this growth. Europe also anticipates that data center expansion will account for 40-50% of their electricity demand increase. By 2030, the Data Center sector will have the 6th highest energy demand of any sector.

From a regulatory perspective there are International Guidelines for design, construction, and operation of data centers which cover aspects such as availability, security, and energy efficiency.

Competitive Landscape Analysis

The competitive landscape of the Data Center market can be divided into two clear subsectors:

Hyperscale Data Centers: At the forefront of technological innovation in the worldwide data center market. These massive facilities are designed to provide the digital transformation infrastructure to support high-performance computing needs for AI companies, cloud providers, social media platforms, and other digital enterprises.

Major global players in data centers including AWS, Microsoft Azure, Google Cloud, and NVIDIA are leveraging hyperscale facilities to deliver cutting-edge services while driving digital transformation worldwide.

Colocation Data Centers: Have become an integral part of the digital ecosystem. These facilities provide shared infrastructure that caters to a diverse range of industries, including financial institutions, telecommunications companies, cloud service providers, and government entities. By offering secure and scalable solutions, colocation services enable organizations to optimize their IT operations without investing heavily in proprietary infrastructure. In this segment worldwide players include Equinix (USA), Global Switch (UK), NTT Global (Japan), China Telecom (China), and Digital Realty (USA).

Key Investment Trends and M&A Activity in Data Centers

Robust Data Center market growth has attracted substantial interest from private equity firms and sovereign funds. Over the past five years, more than USD 200 billion has been transacted globally in mergers and acquisitions within the sector and during the past four years, USD 100 billion of this was invested by private equity funds and sovereign funds.

Notable deals include Abu Dhabi's sovereign wealth fund’s investment in Yondr Group, value of transaction not disclosed, DigitalBridge & IFM Investors have completed the USD 11 billion acquisition of data center firm Switch Inc, American Tower acquired Coresite for USD 10.1 billion, and Blackstone invested around USD 16 billion in Airtrunk, an Asian company focused in hyperscale data centers.

These investments highlight the sector's potential for scalability and profitability. Hyperscale data centers are particularly appealing to investors due to their ability to accommodate AI-driven applications and cloud computing services.

In 2024 the total value of closed M&A deals in the global data center sector reached USD 73 billion, setting a new all-time record for the industry.

Future Outlook for Data Centers: Sustained Growth on the Horizon

Companies that operate with hyperscale are expected to attract the most investment, while data center companies will continue to expand. It is expected that more than USD 100 billion will be invested in the Data Center sector in 2025. Nvidia, Microsoft, Equinix, and Blackstone have announced investments for 2025, while reports have surfaced about potential public funding initiatives in the U.S. targeting digital infrastructure. For Latin America, five companies (V.tal, Odata, Ascenty, Scala, and HostDime) have announced 2025 investments totaling USD 8.9 billion.

The outlook for global data center revenue remains highly optimistic with a predicted 8.5% compound annual growth rate (CAGR) through 2029. Investments from global technology giants and financial institutions are expected to continue in line with the rising adoption of AI-driven applications that demand high-performance computing capabilities. For investors seeking opportunities in a high-growth market with significant scalability potential, the Data Center market offers an attractive proposition backed by strong fundamentals and forward-looking policies.

Focus on Brazil’s Burgeoning Data Center Market

Brazil is emerging as a critical hub for data centers in Latin America. At 707 MW as of 2023, Brazil’s colocation capacity accounts for 95% of Latin America's Colocation market. São Paulo stands out as the epicenter of this activity, boasting 670 MW of operational power and an additional 770 MW under construction or planned. Other states such as Rio de Janeiro, Ceará, and Rio Grande do Sul are also contributing to this expansion with significant projects underway.

Globally, Brazil ranks among countries with the highest number of data centers (13th worldwide) reflecting its growing importance in meeting regional and international digital infrastructure demands. This growth is further fueled by rising data consumption and cloud adoption trends in the country, which are reshaping industries and driving digital transformation across sectors.

Brazil's Data Center market is at the heart of Latin America's digital transformation journey. With its strategic location, robust investment activity, and focus on innovation through hyperscale and colocation facilities, the country is well-positioned to meet growing demands for digital infrastructure scalability. Its position as a regional leader will likely strengthen further as new facilities come online and existing ones scale up operations. As cloud adoption trends continue to reshape industries and AI revolutionizes computing needs, Brazil's data centers will remain indispensable assets for enabling technological progress across sectors within the region.

Key contacts

More articles

Poradce je Vaším kompasem.

Obraťte se na nás pro nezávaznou konzultaci se specialistou na fúze a akvizice, který si pozorně vyslechne Vaše potřeby a upřímně a nezaujatě posoudí nejlepší možné řešení.