Lubricant Market Dynamics: Consolidation, Circularity, and ESG

The Lubricant market is undergoing a profound transformation, shaped by shifting regional demand, regulatory imperatives, and the strategic pursuit of circular economy models.

Against a backdrop of supply tightness and evolving environmental, social, and governance (ESG) expectations, the sector is witnessing a wave of consolidation and a redefinition of value pools. This article explores the key Lubricant market dynamics, with a particular focus on synthetic lubricants demand, the rise of re-refined base oils (RRBO), and the implications for market participants and investors.

Industrial Oils and their Applications

Before we consider the Lubricant market dynamics, it is key to understand the different types of industrial oils as they form their own subsectors. Oils in liquid form can be classified into three major categories:

-

Natural Oils: These oils are obtained from natural sources (such as animal fats and vegetables) without excessive processing. Natural oils tend to be unstable products, oxidizing easily at high temperatures, causing them to lose their properties. For this reason, we do not use natural oils for machine lubrication

-

Mineral Oils: These are lubricants derived from petroleum. As such, all mineral oils are hydrocarbons. As petroleum products, they have impurities that affect their performance. There are three categories of mineral oils (Group I, Group II, and Group III) depending on their level of sulfur, saturates and viscosity

-

Synthetic Oils: These oils were developed in response to some of the disadvantages of other oils. They are produced through chemical processes to create a more advanced alternative. Group IV corresponds to PAO synthetic lubricants, while Group V is all other base oils

Lubricant Market Dynamics: Stability, Growth, and Quality Shifts

Global lubricant demand fell 6 % in 2024, led by a 9% drop in consumer-automotive volumes. Europe remains a stable, albeit slightly contracting, market with a -0.5% CAGR. Notably, demand for synthetic lubricants is high, reflecting both OEM requirements and consumer preference for higher-performance products.

In contrast, Asia-Pacific (APAC) demonstrates robust growth at a +2.3% CAGR, propelled by heavy-duty motor oils (HDMO), industrial greases, and infrastructure expansion. The Commonwealth of Independent States (CIS) region shows modest growth (+0.7% CAGR), with Central Asian demand offsetting the decline in Russia.

The share of Group I oils in Europe fell below 20% in 2024; APAC still uses predominantly Group I but is gradually moving away from them in favor of higher quality products. This move is driven by regulatory pressures, OEM specifications, and the quest for improved lubricant performance and sustainability.

Supply Tightness and ESG Regulations in the Lubricant Industry

Sanctions and geopolitical disruptions have exacerbated supply tightness, particularly in traditional sourcing channels. This environment has catalyzed the search for regional circular economy solutions, with re-refined base oils (RRBO) gaining strategic importance - especially in tightly regulated markets.

Key Developments:

-

EU Waste-Framework Directive Article 21 explicitly states that “regeneration shall take priority over any other waste-oil treatment option”. Mandates from both regulators and OEMs now encourage sustainable, traceable, and circular supply chains

-

Scope-3 accounting under the Corporate Sustainability Reporting Directive (CSRD) will oblige EU-listed lubricant producers to disclose RRBO share by FY 2027 - pulling RRBO demand forward

RRBOs and the Premium for Sustainability

RRBO is a process where used lubricating oil is treated to remove contaminants and restore its chemical composition, making it suitable for reuse as a base oil in new lubricants. This process can effectively reduce environmental impact compared to using virgin base oil, as it recycles resources and minimizes waste.

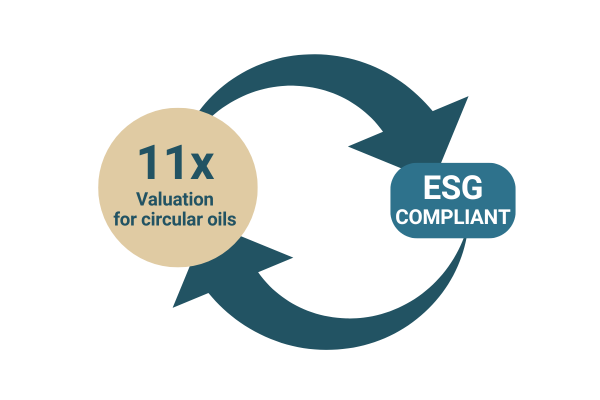

Re-refiners are now producing high-quality Group II RRBOs that align with both OEM and regulatory requirements. These assets have proven their ability to achieve premium valuation multiples - trading at 8-11x forward EBITDA, compared to 6-8x for traditional blenders. Investors are willing to pay up for regeneration capacity, viewing it as a dual play on supply security and ESG compliance.

RRBOs are thus central to:

-

Enhancing lubricant supply security amid geopolitical risk

-

Reducing dependency on virgin oil and supporting the use of sustainable raw materials for lubricants

-

Strengthening the ESG positioning of lubricant brands and producers

Lubricant Market Consolidation: Strategic M&A and Value Creation

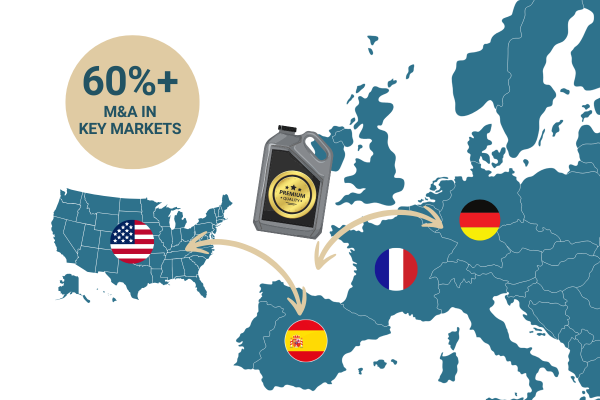

The Lubricant sector is in the midst of significant consolidation, with strategic M&A in lubricants driven by the need to secure circular economy capabilities, premium brands, and specialized assets.

More than 60% of the 400+ recorded deals since 2015 have targeted companies in Germany, the UK, France, Italy, Canada, or the United States. These regions are characterized by mature vehicle fleets (both industrial and commercial) ESG compliance, and a proliferation of independent players ripe for aggregation.

Notable Trends Driving Lubricant Market M&A Activity:

-

Blockbuster Deals: Focused on acquiring branded, high-margin portfolios and premium base-oil technology

-

Big-ticket signal that brand & chemistry is where value pools concentrate (e.g., Saudi Aramco’s acquisition of Valvoline GPG or the Quaker-Houghton merger)

-

BP’s potential divestment of Castrol (<USD 8 billion bids vs USD 8-12 billion ask) is a live stress-test for premium brand valuation

-

Shell’s 2024 acquisition of MIDEL/MIVOLT (synthetic ester dielectrics) shows buyers extending into EV-adjacent niches

-

Repeat Acquirers: Firms such as Fuchs, Motul, Shell/Pennzoil-QS, and PE-backed Reladyne are leading the charge, signaling ongoing pressure on independents to scale or specialize

-

Circular-Economy Drives Lubricant Trading Premiums: Regeneration capacity is viewed as both a supply security asset and an ESG call-option

-

Buyer Profiles and Upstream Integration in Lubricants

Active buyers in the Lubricant market span a diverse spectrum:

-

Lubricant Brands: Seeking sustainable raw materials and reduced dependency on virgin oil

-

Re-Refineries: Pursuing upstream integration and direct access to used oil streams, often partnering with downstream players for scale and stable offtake. Example: Avista Oil now contracts 450 kilotons of used-oil feedstock per annum via joint ventures with collection fleets, thus illustrating the feedstock security premium.

-

Regional Oil Companies: Diversifying into adjacent value chains, to improve sustainability credentials and meet government mandates, by integrating used-oil recovery and processing into downstream footprint

-

Eastern European Oil Majors: Aiming to enter new markets or reinforce regional presence by acquiring distribution, brand access, or processing infrastructure

-

International companies: Circular investments align with net-zero ambitions and unlock new growth platforms

-

Industrial Groups and Financial Institutions: Attracted by the scalability, asset intensity, and cash flow visibility of circular-economy platforms

Outlook: Future Lubricant Market Dynamics

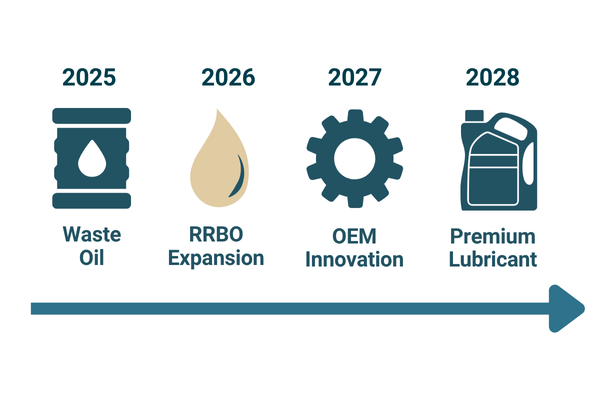

The Lubricant sector is pivoting from a volume-driven business to a value-chain-control play, where regulatory latitude, feedstock security, and ESG signaling determine winners.

Over the next five years, expect the following forces to set the tone:

-

OEM fuel-economy targets and longer drain intervals keep demand for premium Group III/IV and fully synthetic oils rising even as overall volumes level off

-

RRBO continues to be the mainstream as producers seek carbon-credit credibility and a securing raw-material stream

-

Tightening regulations strain small blenders and collectors, prompting accelerated consolidation driven by buy-outs by larger strategics and private equity platforms

-

Companies that recycle waste oil into specification-grade products will gain a circular premium in valuations, thanks to stronger ESG appeal and steadier margins

Circularity, not capacity, is becoming the primary engine of value creation. Strategic M&A, integration, and credible RRBO scaling are no longer defensive hedges, they are pre-requisites for securing market share, regulatory headroom, and investor attention in an increasingly volatile and decarbonizing market. In such an environment, lubricant producers must stay agile and customer-focused.

“Whether geopolitical or economic: volatility is the new normal. Our response? At FUCHS, we stay close to our customers worldwide, combining our application expertise with smart lubricant and service solutions – supporting them with unconditional reliability, even in turbulent times.”

— Stefan Fuchs, Chairman of the Executive Board, FUCHS SE (Annual Report 2024)

Key contacts

More articles

Poradce je Vaším kompasem.

Obraťte se na nás pro nezávaznou konzultaci se specialistou na fúze a akvizice, který si pozorně vyslechne Vaše potřeby a upřímně a nezaujatě posoudí nejlepší možné řešení.