HOME

/

PRŮMYSLOVÁ ODVĚTVÍ

/

STROJÍRENSTVÍ

The industrial sector is experiencing an unprecedented shift, driven by automation, artificial intelligence (AI), and global supply chain disruptions. As companies strive to increase efficiency, enhance product quality, and meet sustainability standards, the need for strategic mergers, acquisitions, and partnerships has never been more crucial.

With geopolitical tensions reshaping global trade and technological advancements driving innovation, M&A in industrial equipment, machinery, and aerospace & defense presents lucrative opportunities. Companies seeking growth, market consolidation, or technological integration are actively engaging in cross-border deals, joint ventures, and strategic acquisitions to future-proof their businesses.

At IMAP, we specialize in navigating the complex landscape of industrial M&A. Our team provides expert guidance, industry-specific insights, and access to key strategic relationships that help clients make data-driven, confident investment decisions. Whether you're looking to sell your

company, expand internationally, or restructure operations, our global partnership and market expertise ensure that you seize the right opportunities at the right time.

IMAP's expertise spans a broad range of industrial subsectors, allowing us to tailor

strategies to the nuances of each market. We advise clients operating in:

The industrial M&A sector has remained a major driver of global deal-making, with 18,000 completed transactions between 2019 and 2024, amounting to over €580B in total reported deal value.

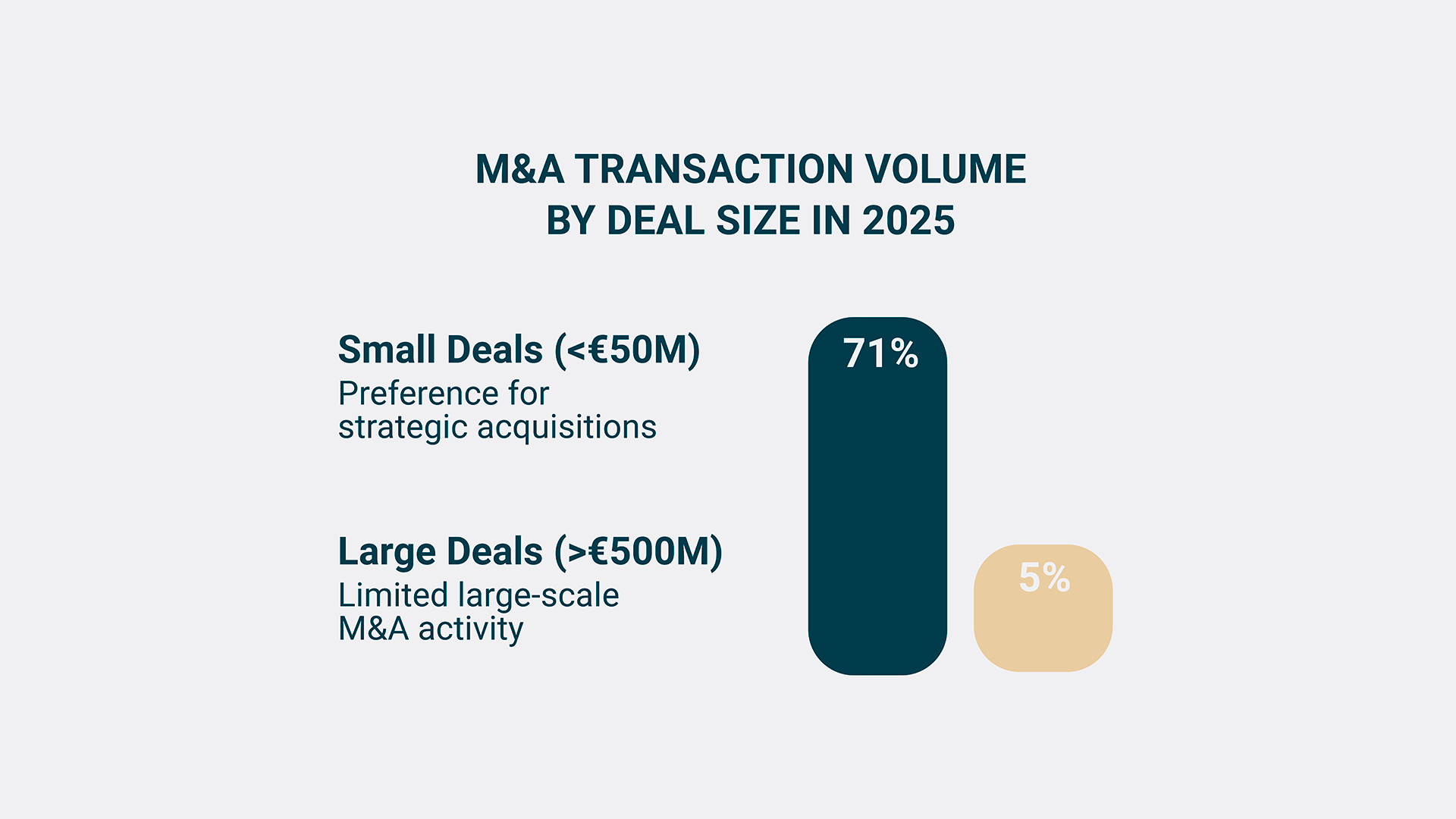

The industrial sector continues to see dynamic shifts in M&A activity, influenced by economic conditions, geopolitical factors, and technological advancements. While deal volumes have fluctuated over recent years, the sector remains highly active, with strong investment interest in mid-market transactions.

The industrial M&A sector has remained a major driver of global deal-making, with 18,000 completed transactions between 2019 and 2024, amounting to over €580B in total reported deal value.

The industrial M&A sector has remained a major driver of global deal-making, with 18,000 completed transactions between 2019 and 2024, amounting to over €580B in total reported deal value.

Vzestup automatizace a umělé inteligence spolu s měnící se geopolitickou situací znamenají, že balancování mezi efektivitou, kvalitou a udržitelností nebylo v oblasti průmyslu nikdy tak náročné. Tato křehká rovnováha otevírá cestu k potenciálně zajímavým partnerstvím, restrukturalizacím nebo akvizicím.

V IMAP jsme vybaveni odvětvově specifickými odbornými znalostmi a strategickými vztahy, které našim klientům poskytují konkurenční výhodu na jednom z nejslibnějších globálních trhů. Umožníme Vám získat správné informace ve správný čas, abyste byli schopni přijímat správná strategická rozhodnutí a s jistotou je realizovat.

Trh fúzí, akvizic a podnikových financí je světem příležitostí, který je v neustálém pohybu.

Obraťte se na nás pro nezávaznou konzultaci se specialistou na fúze a akvizice, který si pozorně vyslechne Vaše potřeby a nezaujatě posoudí a navrhne nejlepší možné řešení.