Strategic NPL Management in the GCC: Turning Risk into Resilience

Non-Performing Loans (NPLs) have long been a barometer of financial stress within banking systems. As macroeconomic headwinds persist and regional debt profiles evolve, NPL management in the Gulf Cooperation Council (GCC) has become a priority for regulators, investors, and institutions alike. In the GCC, NPLs are emerging as both a challenge and an opportunity.

1. NPL Management in the GCC: Market Overview and Key Ratios

According to S&P Capital IQ data as of March 2025, the GCC ranks 5th globally in terms of total NPLs, with a reported SAR 215 billion in defaulted loans. While the region only comprises 2.8% of global banking assets, it accounts for 5.5% of the world's non-performing loans-a disproportionate share that reflects both regional structural pressures and asset quality dynamics.

2. Resilience Through NPL Resolution Strategies: Lessons from Saudi Arabia

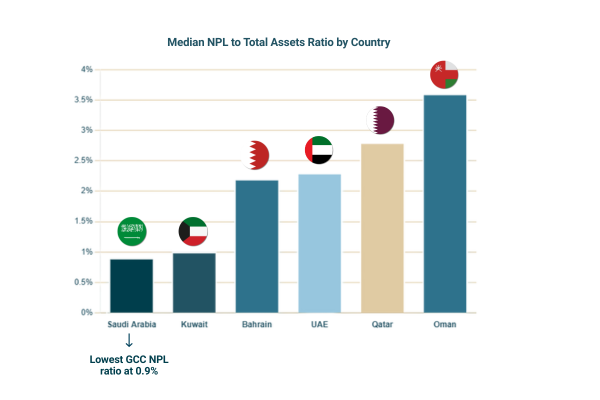

NPL’s in Saudi Arabia are closely watched. Encouragingly, Saudi Arabia stands out for prudent lending practices, boasting the lowest NPL-to-total assets ratio in the region, underpinned by strong capital adequacy and high profitability. Median NPLs among Saudi banks are just 0.9% of total assets, compared to 2.3% in the UAE and 3.6% in Oman. Asset quality of GCC banks is a major competitive factor.

Even in this healthy ecosystem, restructuring non-performing loans impacts profitability. Saudi banks average of 8.4% of net interest income (NII) allocation to NPL provisioning- reducing earnings that could otherwise be returned to shareholders or reinvested into the economy.

Outside Saudi Arabia, the stress from unresolved NPLs is even sharper. In Qatar, banks devote 33.5% of their NII to impairments, with UAE banks at around 17.3%. These figures reveal the drag that unresolved NPL resolution strategies can impose on the financial system.

Provisioning for loan impairments significantly eats into the net interest income region-wide, showing why NPL resolution strategies are essential to preserving profitability and credit availability.

Of the three credit risk stages outlined in IFRS 9, a rise in loans classified as stage 2 (significant increase in credit risk, lifetime expected losses) and stage 3 (defaulted loans, lifetime expected losses) underscores the urgency.

3. A Strategic Approach to Non-Performing Loans: Risk Diagnostics and Restructuring in GCC Banks

An effective strategic approach to NPLs unlocks shareholder value. Non-performing loans are not just accounting issues - they represent capital locked in unproductive assets. Returns to health require decisive strategic action, financial agility, and stakeholder trust.

Resilience through NPL management is more critical than ever. High NPL levels mean elevated provisioning costs, tighter capital, and less fresh credit. For borrowers, strained creditor relations and liquidity bottlenecks are common. The overall economy suffers as financial resources are tied down and investment slows.

IMAP Haykala - IMAP Saudi Arabia brings deep expertise in helping companies and financial institutions manage financial distress, particularly non-performing loans (NPLs). From redesigning debt structures to negotiating with creditors, it ensures capital is realigned and stakeholder interests are preserved through strategic, data-driven solutions.

NPLs are more than balance sheet issues - they represent locked capital and potential value loss. IMAP Haykala leverages its experience in sectors such as Manufacturing, Retail, and Contracting to tailor restructuring plans that align with both market realities and regulatory expectations. The team’s ability to combine financial modelling, regulatory alignment, and execution makes them uniquely effective in high-stakes turnaround scenarios.

Crucially, IMAP Haykala serves as a trusted intermediary in creditor-borrower negotiations, helping avoid value-destructive outcomes. With its integrated advisory approach and proven regional insight.

More articles

Poradce je Vaším kompasem.

Obraťte se na nás pro nezávaznou konzultaci se specialistou na fúze a akvizice, který si pozorně vyslechne Vaše potřeby a upřímně a nezaujatě posoudí nejlepší možné řešení.