AI’s Impact on M&A Activity: Market Trends and Strategic Insights

As the midpoint of 2025 passes, the mergers and acquisitions (M&A) landscape is being shaped by a convergence of economic shifts and the emergence of artificial intelligence (AI) as a transformative force, reflecting broader global mid-market M&A trends.

While macroeconomic issues - tariffs, inflation, and interest rates - continue to exert pressure, AI’s impact on M&A is fundamentally altering both the strategic rationale behind deals and the mechanics of the process itself. This article examines how these global M&A technology trends are playing out in the current M&A market. Central to the change in the M&A landscape is the impact of AI in mergers and acquisitions, both as a driver for deal rationale and as a set of tools that are reshaping processes.

AI’s Impact on M&A: A Strategic Catalyst

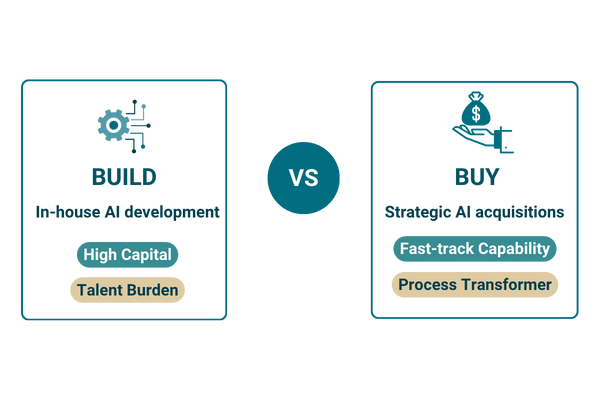

Deep investment in AI capabilities is becoming a competitive necessity; yet, for many historically successful mid-market firms, the capital and talent burden of developing in-house solutions is significant. The solution increasingly is strategic AI acquisitions - to buy rather than build. This has led to a surge of activity among firms seeking to fast-track AI capability acquisition.

In parallel, companies that have established AI expertise - by deploying AI within their core business - are becoming attractive acquisition targets for both domestic and international buyers, often driving cross-border M&A with AI as a differentiator.

There are several recent deals in Canada that capture this dynamic:

-

Brainbox AI’s acquisition by Trane Technologies (January 2025): Brainbox AI is specialized in autonomous AI-driven Heating, Ventilation and Air Conditioning (HVAC) solutions. Prior to the acquisition Trane, a global leader in HVAC systems, lacked AI-driven HVAC optimization technology. The companies partnered for several years prior to the merger to selectively integrate Brainbox AI’s capabilities into Trane’s existing systems. The acquisition deepened that relationship further, enabling Trane to fully integrate all of Brainbox AI’s advanced technology, to better meet the rising demand for energy-efficient autonomous building solutions

-

Shopify’s purchase of Vantage Discovery (March 2025): Vantage Discovery is an AI-powered search platform designed for retailers. The acquisition now strengthens Shopify’s on-site search and advertising capabilities and supports its advertising initiatives by delivering more personalized and intent-driven experiences for shoppers. This move marks the company’s continued focus on AI adoption in corporate strategy following six similar acquisitions in 2024. Shopify has focused on purchasing specialized AI companies to gain faster access to cutting-edge technologies and top-tier talent, enabling quicker integration of advanced features for users

-

Mapmygenome’s acquisition of Microbiome Insights (May 2025): Mapmygenome leverages AI-driven genomics, while Microbiome is a global leader in microbiome sequencing and bioinformatic analysis. The acquisition allows the company to leverage is AI expertise to enhance Microbiome insights, service quality, and advanced client solutions

AI-Driven Efficiencies in M&A: Process and Limitations

AI’s impact on M&A processes is seen most clearly in the efficiencies delivered throughout both the buy- and sell-sides. Advisors now rely on AI in due diligence, AI-enabled transaction analysis, and AI-driven acquisition target identification.

Tasks once requiring exhaustive manual labor - such as compiling potential buyer lists, screening confidential information memoranda, or researching market data - are now streamlined with AI tools for M&A integration planning and AI-powered valuation models.

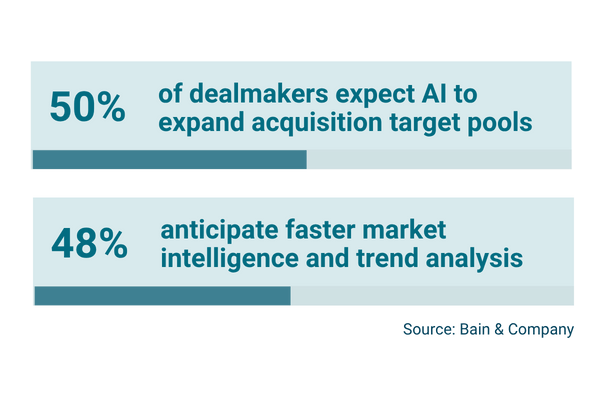

Recent survey data from Bain & Company illustrate that dealmakers expect to see AI continuing to add value to the M&A market:

-

50% anticipate AI will increase the pool of acquisition targets reflecting the expanding reach of AI in investment banking

-

48% expect AI to materially reduce the time required to understand industry trends and market data, a crucial advantage for AI in financial service M&A

However, in the drive to leverage AI-driven efficiencies in M&A, practitioners must remain cognizant of the limitations of AI in M&A and AI impact on deal efficiency. For example, a recent in-house test undertaken by Capital West – IMAP Canada used AI-driven deal sourcing to identify the top 30 potential buyers for a recent sale, but the technology omitted both the eventual high bidder and several other serious suitors.

The limitations of AI in dealmaking underscore that market intelligence, experience, and human acumen cannot yet be replicated by algorithms.

AI excels when it comes to pattern recognition, speeding up research, and automating repetitive back-office tasks. But when the stakes require negotiation acumen, nuanced structuring, or creative transaction design, the human element is indispensable.

Outlook: Blending Technology and Tradition

As the second half of 2025 unfolds, AI innovation in M&A processes is poised to expand further. The next era of top deals will be defined by companies and advisors who blend the power of strategic AI acquisitions and advanced analytics with seasoned human expertise. Those who leverage AI-driven efficiencies and navigate cross-border M&A with AI will set the standards in global M&A technology trends – unlocking the potential of AI adoption in corporate strategy, financial service, and beyond.