Capstone Headwaters advises EB Industries, LLC on its acquisition by MCM Capital Partners

EBI provides highly specialized outsourced precision manufacturing and engineering services related to complex critical components. It is one of the leading domestic providers of electron beam and laser welding services and supports sectors including aerospace & defense, medical device, semiconductor and energy industries that require the upmost in weld integrity and reliability.

Capstone Headwaters advised EB Industries, LLC (“EBI”) on its acquisition by MCM Capital Partners (“MCM”). Terms of the deal were not disclosed.

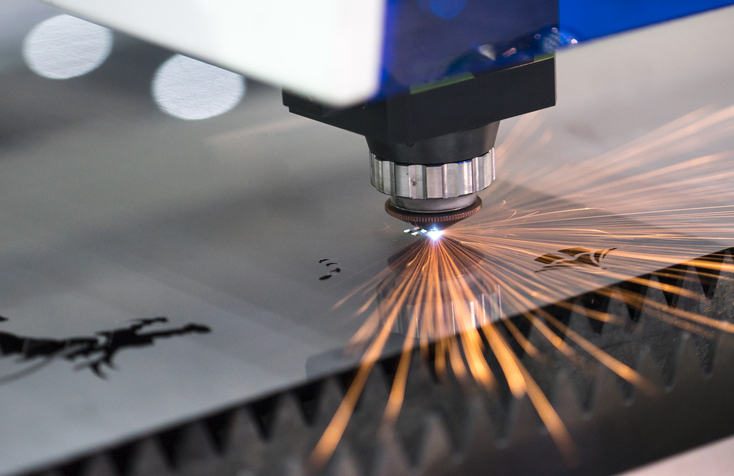

EBI provides highly specialized outsourced precision manufacturing and engineering services related to complex critical components. It is one of the leading domestic providers of electron beam and laser welding services and supports sectors including aerospace & defense, medical device, semiconductor and energy industries that require the upmost in weld integrity and reliability. Over the past 50+ years, EBI has developed a best in class reputation for its quick turnaround/prototype capabilities, exceptional high energy welding services, and ability to develop welding solutions for complex precision components. Based in Farmingdale, New York, the Company also provides additional value-added services such as 3D laser cutting, engineering, tool design and fabrication, destructive and non-destructive testing, and supply chain management.

MCM Capital Partners is a microcap private equity firm focused on acquiring niche manufacturers, value added distributors and specialty service companies generating up to $75 million in annual revenues and having enterprise values up to $50 million.

Steve DeLalio, owner and CEO of EBI commented

“After a thorough vetting of all the firms and offers made for the business, I decided to partner with MCM Capital. They successfully demonstrated that they were clearly the best partners to satisfy all the goals I wanted to achieve when I started on this journey. Being a longstanding employee of a family owned business, it was a life changing and emotional decision to give up equity and control by selling to a private equity firm. I couldn’t imagine going through this process without the expertise and guidance of my investment banking advisors at Capstone Headwaters. They were extremely thorough as they clearly and concisely laid out the options in front of me. Without their commitment to keeping this process moving and getting over the goal line, I am confident the deal would not have closed, and I thank them for keeping me focused and grounded. Congrats to Team Capstone as well."

Managing Director Ted Polk noted

“It was a true pleasure to represent Steve DeLalio. He runs a top-notch business and it was no surprise to us that such strong interest was expressed in EBI.

Co-lead Eric Williams shared a similar perspective

“Many business owners would benefit from mentoring by Steve. His approach to customer service is world class. EBI has multi-decade client relationships and is a sought-after resource for aerospace & defense assemblies as well as medical device and surgical instrument manufacturers that have exacting demands for precision, reliability, and weld strength.”