IMAP Strengthens its Foothold in CEE with new Partner BICF in Romania

IMAP welcomes BICF as its exclusive corporate finance partner for M&A activities in Romania, further expanding its reach in the CEE region. BICF’s Founder and Managing Partner, Bogdan Illiescu, and Partner, Alin Pop talk to Creating Value about the firm’s history and activities and explains why Romania has been an under-served market to date yet is becoming increasingly attractive to investors, especially for strategics which remain

BOGDAN ILIESCU

Founder & Managing Partner

BICF - IMAP Romania

bogdan.iliescu@imap.com

ALIN POP

Partner

BICF - IMAP Romania

alin.pop@imap.com

Proven Credentials & Established Team

BICF is a boutique investment bank founded six years ago and located in Bucharest. Together, our team have accumulated over 50 years of experience in capital markets, corporate finance, mergers and acquisitions, capital raising, and valuations. We have successfully closed over 150 transactions, and advise primarily shareholders, senior management teams, boards, as well as investors on M&A, market entry strategies, business planning, valuations, capital markets and business restructuring and development.

Leveraging our extensive experience in corporate finance and capital markets, we have an extensive service portfolio enabling us to offer our clients:

- Buy- and sell-side advisory

- Sale preparation

- Merger advisory

- Exploration of company’s listing opportunity

- Capital structure & capital raising options

- Valuation exercises for management information

- Assistance after listing to comply with regulatory reporting obligation

Romania – Opportunity for Investors in a Previously Under-Served Market

As can be seen below, there are many factors that together, create favourable market conditions which have led to Romania becoming an increasingly attractive market for investors.

Romania joined NATO in 2004 and became a full member of the EU in 2007

The 8th largest European country by population (19 million), after Poland, and the second largest in Central Eastern Europe

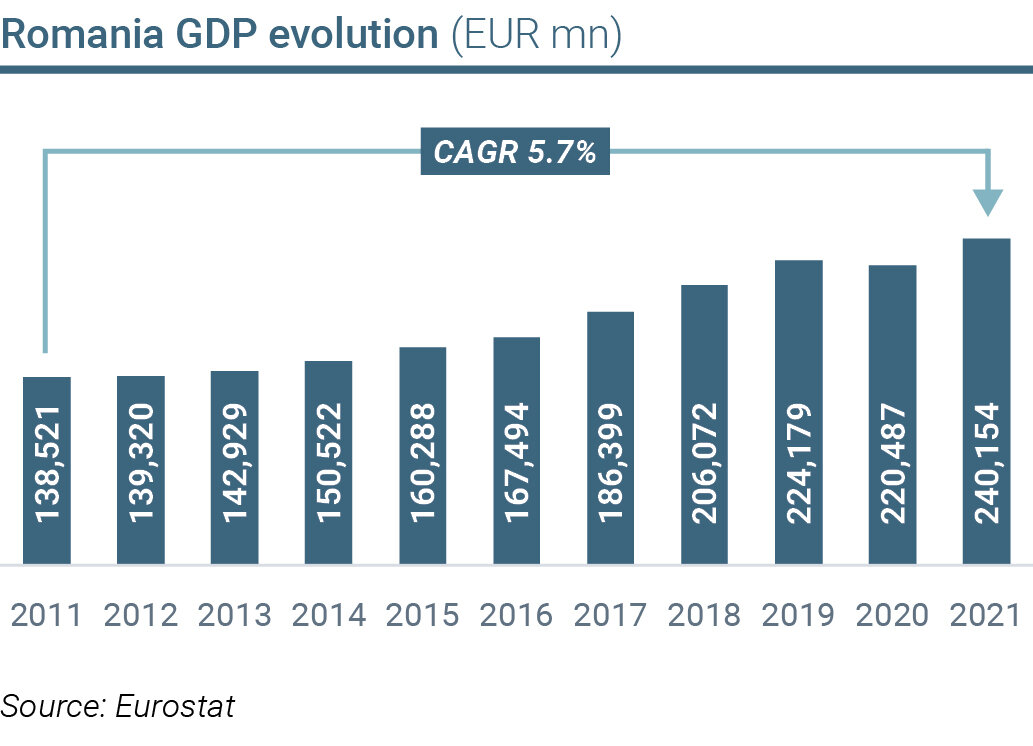

One of the highest growing economies in the region with strong growth prospects. According to the latest Eurostat information, in Q2 2022, it experienced one of the highest GDP growth rates (2.1%) among the EU Member States. Furthermore, the European Commission predicts that Romania’s GDP is estimated to grow 4.2% in 2022 (YoY) and 4.5% in 2023 (YoY)

Benefits from macro-economic stability reforms supervised by International Financial Institutions including the International Monetary Fund, European Bank for Reconstruction and Development, and the International Finance Corporation

As of 2021, 54.3% of Romania’s population lived in urban centres, compared to 45.7% in rural areas

Highly-skilled multilingual workforce, and low labour and operating costs with an average gross labour cost of €8.5 per hour

Holds a BBB-/Baa3/BBB- Investment Grade Sovereign Rating

Romanian M&A Market Highlights

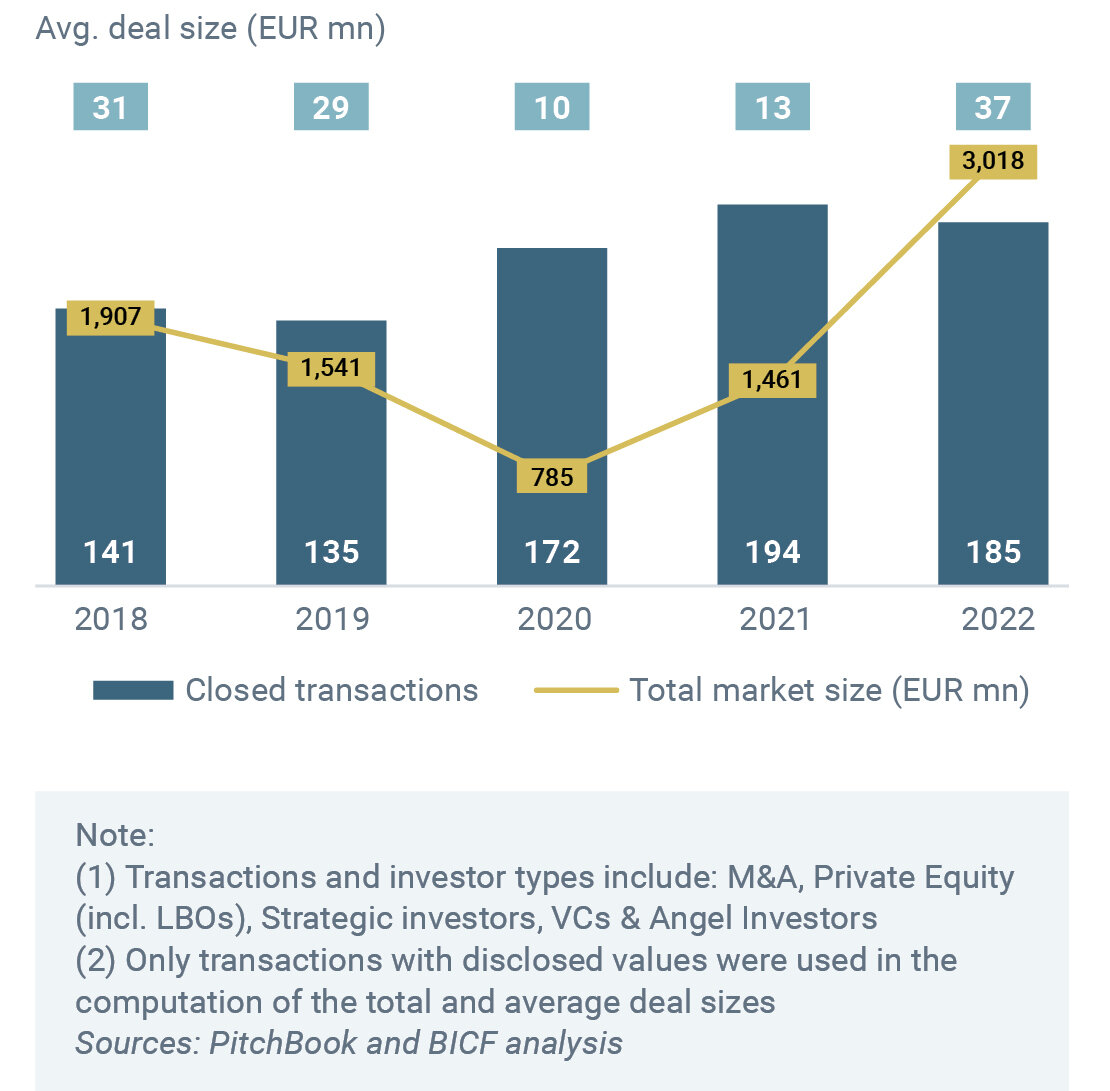

If we look at the evolution of the M&A market in Romania over the last five years, we see that 2021 was a record year with 194 deals closed and an deal value of €13 million, higher than in 2020, but considerably lower than in 2018 and 2019, at €31 million and €29 million respectively. In 2022, while less deals were closed, 185 in total, the average deal value and total market size surpassed all expectations, at €36 million and €3,018.5 million respectively.

With some local players accumulating more dry-powder and an increasing number of Romanian based PE houses, local buyers are competing on deals with international players

Evolution of the Romanian M&A Market in the Last Five Years

In 2022, the Technology industry was once again by far our top performer in terms number of deals closed, followed by Business Services. Consumer & Retail and Healthcare came in joint third, followed by Building Products & Services which overtook Energy & Utilities to come in fourth.

In terms of hot sectors for M&A next year, we have identified seven industries as having strong growth potential in Romania in which we are seeing more and more focus from both foreign and local investors:

Agriculture & Farming

- Top geographical location

- Leading producer within the CEE region combined with medium decline of agricultural areas

- Current difficult situation in Ukraine

- Long-term growth in demand for food

Food & Beverages

- Growing consumption in line with the income increases

- Positive trend towards healthier organic products

Renewable Energy

- Large number of new developments boosted by the abnormally high electricity prices

- Increased consumption due to the limited gas imports and lifestyle changes (such as adoption of electrical cars)

Building Products

- Increased need for new constructions and refurbishments

- There are still sub-sectors within the strong local players

Technology

- One of the highest numbers of IT specialists in the region

- Large pool of emerging companies within the sector

- Recent success stories of start-ups from Romania driving interest

- Entrance of larger VC funds on local market

Industrials

- Numerous companies developed thanks to the good economic development over the last decade

- Skilled workforce

- In-shoring of various industries

Real Estate

- High economic growth and increasing disposable income due to COVID

- High percentage of old housing stock

Positive M&A Outlook in Romania for 2023

The overall geopolitical situation is fairly stable. Following a three-month governmental crisis in late 2021, the two main opposing political forces have joined together to form the current government with the intention of rotating the prime minister after 18 months. The macroeconomics are balanced with a 5% growth in GDP growth in the first three quarters but with an inflation rate of 15.9% which triggered an important rise in interest rates. There are high hopes that Romania will become part of Schengen in 2023 and the Cooperation and Verification Mechanism (CVM) will be lifted, both of which are expected to further increase the confidence of foreign investors.

In the first half of 2022, the Ukrainian war had a negative impact on investor appetite, however, sentiments have now calmed and there are plenty of transactions on-going. Looking at the effervescence of the M&A landscape, we expect 2023 to be a very good year and to compensate the decrease during the first half of this year. We see large transactions happening already and this trend will continue next year.

The EU Resilience Plan will boost the investments in infrastructure and good portion of the funding will be directed toward green energy transition and digitalization, both sectors being on the radar of foreign investors. Furthermore, the trend to re-locate manufacturing capabilities from South East Asia (and lately from the CIS region) will create opportunities for production platforms to be acquired by strategic investors.

We estimate that PE, both local and international, will accelerate investments in Romania as there are many newly financed PEs focusing on Romania or CEE which are eager to deploy their funds into the market to avoid inflation effects. Another driving factor for increased PE investments on the local market are the European Investment Fund fund-of-funds co-financing schemes which are both, increasing the number of funds and providing capital to existing PEs for lunching new funds.

Romania’s strong and sustained economic growth, combined with the availability of significant consolidation opportunities has caught the interest of Pan-European funds and we are seeing some large players considering investments on the local market. Historically, the local market was dominated primarily by foreign investors, but recently, due to some local players accumulating more dry-powder and the increase in number of Romanian based PE houses, local buyers have begun competing on deals with international players.

Due to both macroeconomic considerations and the emergence of industry leaders across most sectors, strategic and financial investors are increasingly looking at Romania as a “go to” market with potential for high returns.

Joining IMAP – Expanding our International Reach & Services Portfolio

When we founded the company, we were dedicated to advising Romanian entrepreneurs and focused on our local market. However, following several successful cross-border transactions we found ourselves a preferred M&A advisor for international companies as well. Therefore, as we increasingly began to look beyond Romania, we also began to look for a reputable global partner whose access to international investors and established relationships with key players would help us strengthen our international foothold. Furthermore, we were looking to improve the quality of our service offering and with IMAP ranked one of the top-ten global mid-market advisory partnerships and over 450 experienced professionals in 41 countries, we can guarantee superior advisory expertise to our clients wherever they are.

Our objective is to become the number one M&A advisor in Romania, and partnering with IMAP is the first step to achieving this. At the same time, with our M&A experience, having closed over 150 transactions, along with our knowledge and connections in the local market, BICF also strengthens IMAP’s foothold in the CEE.

Since joining IMAP, we are already collaborating with IMAP colleagues in Belgium, Czech Republic, Germany, Hungary, India, Poland, and Spain on various sell-side projects we currently have, as well as exploring new opportunities.