Measuring Sustainable Impact: Investment Funds and Inclusive Finance in Africa

As the investment landscape evolves, the focus on sustainable impact measurement for investment funds has never been more critical. Verdant Capital - IMAP South Africa recently launched VCHF, a pioneering force in pan-African inclusive finance.

VCHF integrates rigorous impact measurement and management strategies to drive positive social and environmental changes across its portfolio of Inclusive Financial Institutions (IFIs) that empower MSMEs.

Advancing Sustainable Impact Measurement for Investment Funds

Sustainable impact measurement for investment funds is integral to ensure that capital deployment is not only delivering financial returns but also generates measurable developmental benefits.

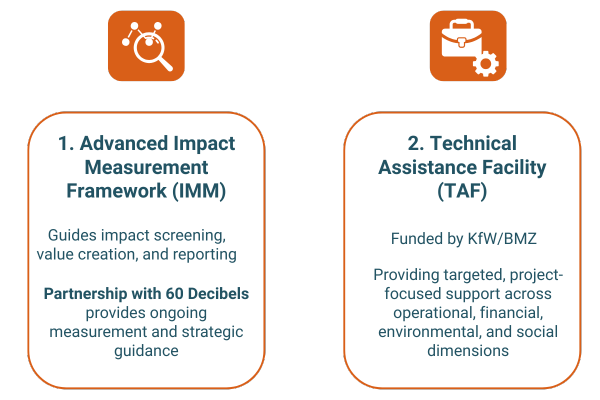

The Fund’s Technical Assistance Facility (TAF) funded by KfW Development Bank on behalf of the German Federal Ministry for Economic Cooperation and Development (BMZ), marks a significant step forward.

This facility enhances the impact performance and sustainability of IFIs by providing targeted, project-focused support across operational, financial, environmental, and social dimensions.

At the core of this effort is an advanced Impact Measurement Framework (IMM) that guides VCHF’s impact screening, value creation goals, assessments and reporting processes.

The partnership between VCHF and 60 Decibels, tasked with delivering ongoing impact measurement, impact management, and strategic guidance for portfolio companies, exemplifies how investment funds can embed an IMM to monitor and refine their development footprint. The approach ensures comprehensive impact screening, enabling investors to track progress on social impact and other inclusive finance metrics crucial to scaling sustainable finance in Africa.

Driving Positive Social and Environmental Change with IFIs

IFIs are at the frontline of delivering financial services to traditionally underserved populations. VCHF’s focus on IFIs that support MSMEs is a deliberate strategy to drive systemic change in inclusive finance. Through the infusion of capital combined with strategic technical support, the Fund ensures that investees improve operational efficiency, risk management, and social and environmental risk mitigation.

By leveraging its TAF for IFIs, VCHF helps investees refine their business models to align with inclusive finance metrics, thereby amplifying the positive social and environmental changes they create.

This creates a virtuous cycle where investments are not just measured in financial terms but also tracked for their developmental contributions, exemplifying best practices in impact screening and ongoing impact measurement frameworks for IFIs.

Prioritizing Gender Inclusion and Women-Owned MSMEs’ Impact

Gender inclusion in investing is a growing priority for funds committed to sustainable development, and the Fund is advancing efforts to embed this within its investment strategy. VCHF supports investees in developing gender-smart strategies - a vital extension of sustainable impact measurement for investment funds focused on inclusivity.

These include:

-

Gender Assessments: Conducting baseline assessments to understand gender gaps within an IFI’s operations, workforce, and customer base

-

Gender Action Plans (GAPs): Co-creating practical, measurable plans with clear Key Performance Indicators (KPIs) to promote gender equity across hiring product development, governance, and workplace culture

-

Capacity Building: Providing tailored training for leadership and staff on unconscious bias, inclusive recruitment, and sensitive gender-related topics

-

Product Innovation: Supporting the designing of gender-responsive financial products and services, especially for women-led businesses and underserved female customers

-

Monitoring and Evaluation: Tracking progress using gender-disaggregated data and impact metrics aligned with the 2X Challenge criteria

The Verdant Hub: Transforming Deal Execution and Transparency

In parallel to its impact measurement efforts, Verdant Capital has launched the Verdant Hub, a proprietary digital platform designed to streamline capital raising transactions across Africa. Now fully operational, with more than 175 investors registered, the platform has become instrumental in managing deal execution, investor engagement, and data transparency across Verdant Capital’s mandates.

By integrating real-time data and analytics, the Verdant Hub enhances the efficiency and clarity of investment processes, contributing indirectly to the Fund’s sustainable impact measurement goals by ensuring that investment decisions are data-driven and transparent. This technological innovation complements the VCHF’s broader mission of creating value through sustainable and inclusive finance.

Verdant Capital’s approach underscores the growing imperative of sustainable impact measurement for investment funds, especially those focused on IFIs and gender inclusion. Through a combination of strategic partnerships, technical assistance, and systemic impact management frameworks, it is advancing a model of investment that prioritizes positive social and environmental change alongside financial returns, supporting responsible and impactful finance.

More articles

Poradce je Vaším kompasem.

Obraťte se na nás pro nezávaznou konzultaci se specialistou na fúze a akvizice, který si pozorně vyslechne Vaše potřeby a upřímně a nezaujatě posoudí nejlepší možné řešení.