Healthcare Distribution Trends in a Post-Pandemic World

The global Healthcare industry is undergoing a seismic shift, spurred by technological advancements, evolving demographics, and changing patient needs. At the heart of this post-COVID healthcare transformation lies healthcare distribution, an essential element of the healthcare supply chain. Positive tailwinds across the broader industry are driving growth in this sector, but it also faces challenges such as regulatory hurdles and economic pressures.

The Evolving Healthcare Distribution Market

The Healthcare Distribution market encompasses the channels and networks that deliver pharmaceutical products, medical devices, and healthcare services from manufacturers to end-consumers such as hospitals, clinics, and retailers.

Healthcare supply chain management is relatively globalized, with key manufacturing countries including Germany and Japan. Investment in cold chain logistics is crucial for ensuring a safe and reliable supply chain, especially for biopharmaceutical products in pharmaceutical distribution.

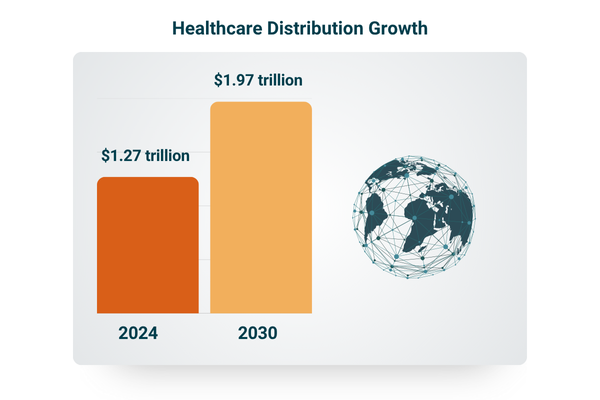

The global Healthcare Distribution market was estimated at USD 1.27 trillion in 2024 and is projected to reach USD 1.97 trillion by 2030, growing at a CAGR of approximately 7.4%.

Key Healthcare Trends

Several key trends are shaping the Healthcare market:

- Consumer Demand: Growth is heavily driven by aging populations, as well as increased prevalence of chronic diseases worldwide

- Worker Shortfall: Amidst increasing demand and a lack of new workers entering the market, companies are increasingly looking to automate

- Preventative Healthcare: Consumer focus has shifted towards preventative rather than reactionary care with increasing individual investment in health

- Regulatory Landscape: High regulatory scrutiny in key geographies has inhibited growth, with a prudent approach becoming a competitive advantage

Ireland's Healthcare Landscape

Ireland's healthcare system reflects these global trends with some unique characteristics. Hospitals (EUR 14.8 billion cumulative revenue in 2023) and general medical practices (EUR 1.5 billion) dominate the Irish end-user landscape, employing more than 80,000 people.

The Health Service Executive (HSE) accounts for two-thirds of Irish hospital providers, with the remainder being private.

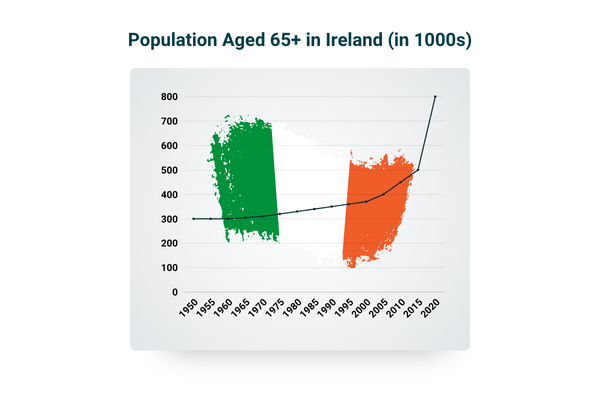

Ireland has experienced outsized relative growth in demand due to demographic shifts such as aging and worsening general consumer health. As a result, distributors are crucial in preventing supply chain shortages, leading to strong demand in the subsector.

Key Market Drivers in Ireland

Several factors are driving both the Irish Healthcare market and the market globally:

-

Ageing Population: Ireland, like many developed countries, is adapting to higher life expectancies and lower birth rates. The estimated population aged over 65 is steadily increasing.

-

Government Expenditure: A healthy government surplus and rising consumer demand have boosted public investment in healthcare in recent years.

-

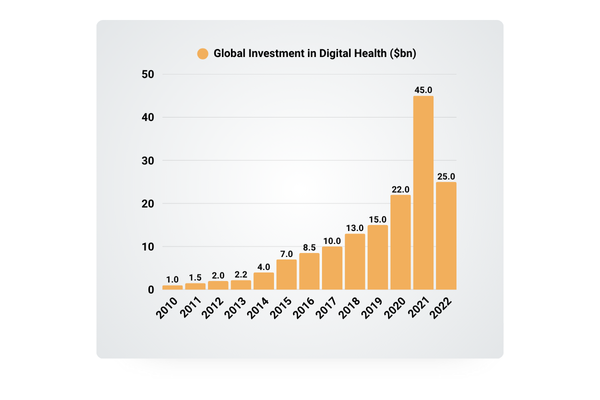

Technological Advancements in Healthcare: Healthcare distribution is constantly advancing through advances in temperature-controlled packaging, real-time monitoring, and automation

-

Threat of Inflation: COVID-related business supports, (relief packages and grants), supply chain shortages, and geopolitical friction have driven up purchase prices across Europe.

-

Broadening Product Range: With continued government support, patients requiring more niche support and treatments are increasingly becoming an area of focus. Certain niches, including orthopedic, general surgery, cardiac surgery, and ophthalmological care, have been a key focus for Ireland's private system.

M&A Activity in Healthcare Distribution

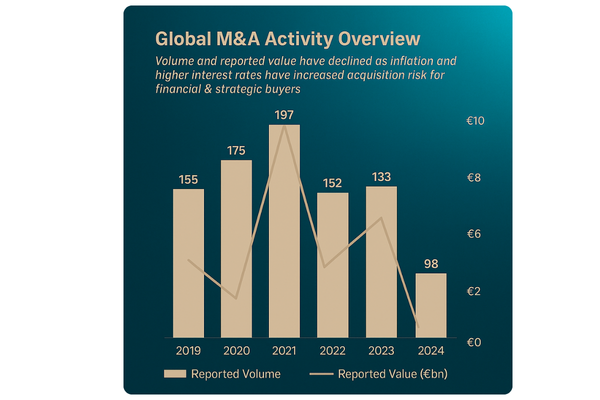

The Healthcare Distribution sector is an active space for M&A activity, with 910 transactions globally in the last five years. However, deal volume and reported value have declined as inflation and higher interest rates have increased acquisition risk for financial and strategic buyers:

-

Deal Type: Majority transactions account for most of the deal volume, at 82% in the last five years

-

Private Equity in Healthcare: While most acquisitions are by strategic trade players, there is consistent private equity interest at 19%

-

Stratification by Transaction Value: The lower middle market (LMM) accounts for 83% of volume, with a steady flow of megadeals at 4%

-

Domestic vs. Cross-border: There is heavy interest from buyers in buying internationally, increasing year-on-year to 50% in 2024

Healthcare Distribution is a dynamic and growing sector, adapting to technological advancements and demographic shifts, particularly in countries like Ireland. While challenges such as regulatory hurdles and economic pressures persist, the overall outlook for the sector remains positive, driven by increasing demand, government support, and ongoing innovation.

“The Healthcare Distribution sector is ripe for strategic M&A activity, driven by rapid post-COVID transformation and technological advancements. As companies seek to scale and streamline their supply chains, we’re seeing robust interest from private equity and strategic investors alike. The market’s evolution – with a focus on preventative care and digital health – presents significant opportunities for consolidation, particularly in lower-middle-market firms where valuations remain attractive despite inflationary pressures.”

Niall Morris, Key Capital – IMAP Ireland

Key Takeaways

-

The global market for healthcare distribution was estimated at USD 1.27 trillion in 2024 with potential to reach USD 1.97 trillion by 2030, growing at a c.7.4% CAGR (1)

-

Ireland has seen outsized relative growth in demand due to demographic shifts such as ageing and worsening general health of consumers.

-

As a result, distributors are key to ensure supply chain shortages are avoided in Ireland and the subsector is seeing strong demand as a result