DEAL SUMMARY Q1 2024

IMAP closes 47 M&A transactions in Q1 2024

The uptick in middle-market deal activity registered towards the end of last year carried into 2024 and IMAP dealmakers closed 47 M&A deals around the world worth more than $3 billion in Q1. Confidence has generally strengthened over the past several months with fears of a recession essentially dismissed, inflation lower, but still high relative to pre-2020 standards, improvements in the financing environment and buoyant stock market gains. Company earnings and profits are recovering compared to this this time last year and high-quality businesses with strong margins continue to attract interest from well positioned strategic buyers who remain the dominant force in M&A.

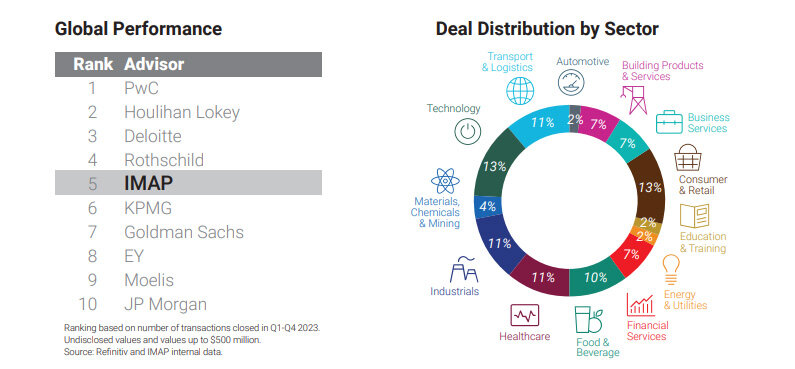

Many financial buyers continue to sit on the sidelines pending visibility regarding the timing of interest rate cuts. Moreover, there is still an ongoing disconnect between seller and buyer valuation expectations. Overall confidence has increased in Q1, although buyers continue to be very careful in their analysis of the strategic fit of target companies and when performing due diligence. About a third of IMAP transactions in Q1 were cross-border as IMAP dealmakers continued to leverage their international reach and help clients seize opportunities abroad. From a sector perspective, IMAP was most active in the Consumer, Industrials, Technology, Healthcare and Services segments.

Going forward, the global economic and geopolitical landscape will remain dynamic, but IMAP partners are reporting strong and growing pipelines. The bubbling sense of optimism in the market could grow further with potential rate cuts later this year, and perhaps most importantly, if PE players start to make moves. In fact, many PE funds are under increasing pressures to put their capital to work.

"Q1 was another great quarter for IMAP, and now, after what effectively was a global trade and manufacturing recession, it seems that we are past the worst and are at an inflection point of sustained growth. There are, of course, geopolitical dangers that could derail this recovery, but IMAP advisors will continue to help clients navigate whatever conditions lie ahead.” - Jurgis V. Oniunas - IMAP Chairman

IMAP Partner Global M&A Perspectives & Forecasts

Netherlands

Headlines in the financial press these days reflect that there are more buyers active in the Dutch mid-market. Both PE and strategic buyers are more active now compared to previous quarters since interest rates and inflation are stabilized and profits in the mid-market segment are recovering.

Profits in the mid-market segment are recovering After a decrease in number of deals and lower valuations we are now seeing higher numbers of deals as well as valuations.

Jan-Pieter Borst - IMAP Netherlands

Germany

IMAP Germany started the year with a strong –mainly sell-side– pipeline across a variety of sectors. Furthermore, the activity level in terms of leads and pitches is currently high despite the challenging economic and political environment. This is mainly due to our focus on privately held mid-sized companies and on solving succession issues for their owners.

Activity level is high mainly due to our focus on priately held mid-sized companies and on solving succession issues Hence, we remain optimistic for 2024. In sectors that have been struggling with structural change for years, such as the automotive and consumer/retail industries or mechanical and plant engineering, the many crises seen in recent years have left their particular marks. We are observing an increase in challenging banking situations in these sectors and expect more distressed deals in the coming months. We are also prepared for these situations and can offer our clients both M&A and debt advisory solutions

Henning Graw - IMAP Germany

France

M&A activity in France clearly rebounded in Q1 2024 after a dismal year in 2023. The prospect of rate cuts, activity in the debt markets and pressure on private equity funds to redistribute cash to their investors should support activity going forward.

Pressure on PE funds to redistrivute cash should support activity going forward Agility is key as the intensity and speed of the recovery is different from one sector to another and there still remains uncertainty due to ongoing macroeconomic and geopolitical challenges.

Cyril Kammoun - IMAP France