Warehousing & Fulfillment Sector Sees Growth Amid Slowdown in Transportation & Logistics Deals

The Warehousing & Fulfillment sector has experienced the most e-commerce-driven transformation of any part of the logistics ecosystem.

Linear networks have transformed into distributed multi-way networks with warehouses and fulfillment centers closer and closer to end-customers. The Logistics market has experienced three consecutive years of recession, dampening sector deal activity.

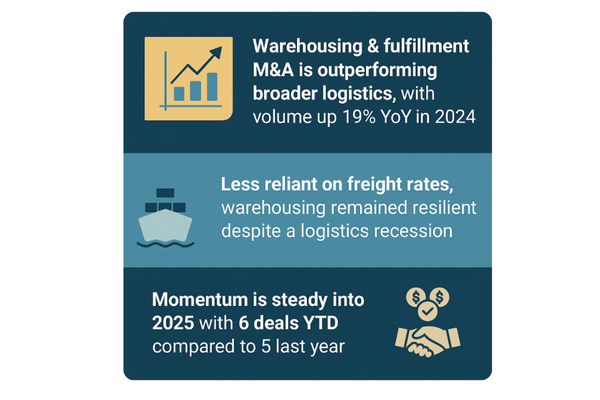

However, less reliance on freight rates among Warehousing & Fulfillment providers helped buoy sector M&A activity while the broader Transportation & Logistics (T&L) industry deal flow remained plagued by low freight rate pressure.

While the Warehousing & Fulfillment sector has been a bright spot within the T&L industry, sector deal volume continues to trail levels seen before the freight recession started in 2022 and will likely remain dampened until a sustained uptick in freight rates is realized and trade policy settles.

Trade Policy Uncertainty Clouds Sector Growth Outlook

Uncertainty around trade policy and ensuing economic headwinds have weighed on sector sentiment, investment, and deal activity in 2025. These economic headwinds have kept warehouses full, but goods have been moving at a slower rate due to weaker end-demand across most sectors of the economy. Looking ahead, flexibility will remain paramount for the Warehousing & Fulfillment sector as providers attempt to diversify operations away from tariff target regions and potentially bring supply chains more onshore.

In the long term, accelerated tariff-driven manufacturing onshoring will likely act as a tailwind for sector investment. However, global supply chain alignment has typically been a multi-year process, and uncertainty around whether tariffs will remain in place will likely mute investment activity. The uncertainty-driven economic headwinds will likely be the predominant force affecting sector investment and deal activity in the foreseeable future.

Private Equity Underpins Warehousing & Fulfillment M&A Growth in 2024

Warehousing & Fulfillment sector M&A activity bucked broader T&L industry activity trends, with volumes rising 19% YOY to 50 transactions announced or closed in 2024. In contrast, T&L industry deal flow remained plagued by low freight rate pressure, falling 6.7% YOY in 2024. To date, sector M&A volume has kept pace year over year (YOY), with deal volume up from five deals in year to date (YTD) 2024 to six in YTD 2025.

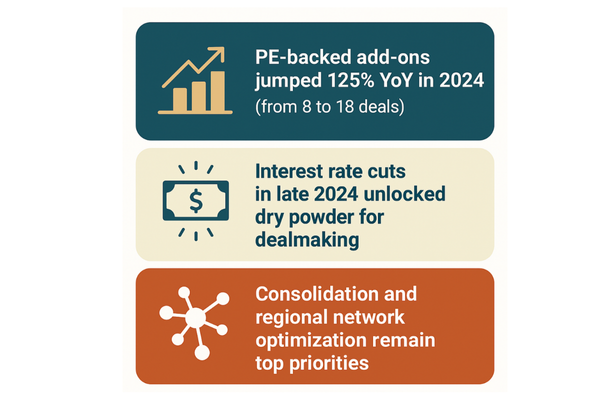

Increased deal volume has been attributed to private equity buyers looking to mobilize elevated dry powder levels amid late 2024 interest rate cuts.

In particular, sponsor-backed buyers pulled sector deal volume up in 2024, with add-on transactions rising 125% YOY from eight deals in 2023 to 18 in 2024. In contrast, sector volatility has kept new platform formations muted, with deal volume on par YOY.

Revenue pressure amid the low freight rate environment has continued to pressure strategic buyer deal volumes to date. While private buyers kept activity on par YOY in 2024, revenue and shareholder pressure has pushed public strategic M&A activity down for the third consecutive year in 2024. Looking ahead, bolt-on and consolidation activity is expected to accelerate and remain top of mind for sponsor-backed and private strategic buyers looking to invest in technology and optimize regional networks through acquisitions. Additionally, easing sector pressures and additional interest cuts will likely support a sustained uptick in sector M&A activity when realized.

"Warehousing & Fulfillment market transaction activity has been a proverbial port in the storm of a Logistics ecosystem that has experienced three straight years of recession. The relative resilience of warehousing and fulfillment business models will continue to support the sector as an outperformer, but hopes for an acceleration in activity in 2025 have been dashed by trade policy driven economic uncertainty".

Gordon, Mackay

Managing Director, Capstone partners – IMAP USA

Equity Financing Activity in Warehousing & Fulfillment-related Supply Chain Technology Continued to be Subdued

Equity financing invested in Warehousing & Fulfillment-related supply chain technology continued to fall in 2024, largely driven by investor pullback due to market volatility. Total sector equity financing deal value reached USD 3.9 billion in 2024, representing a YOY decline of 21.1%.

Similarly, equity financing deal volume fell 21.3% YOY in 2024. Amid sector pressure, growth capital investors in the space pursued larger deals, targeting mature businesses with clearer exit visibility. This was evidenced by the median pre-money valuation for sector participants rising 10% YOY to USD 242 million in 2024. While still early, YTD 2025 sector equity financing has shown signs of improvement, with volume rising by two deals and total capital invested up 2.4% YOY, totaling 5 deals and USD 312 million to date, respectively.

The above is an excerpt from Capstone Partners’ Warehousing & Fulfillment Market Update – A Port in the Freight Recession Storm. For over 20 years, Capstone Partners – IMAP USA has been a trusted advisor to leading middle market companies, offering a fully integrated range of investment banking and financial advisory services uniquely tailored to help owners, investors, and creditors through each stage of the company's lifecycle.