Medical Device Outsourcing M&A Rebounds, Uptick in Deal Activity Driven by Private Equity Buyers

Merger and acquisition (M&A) activity in the Medical Device Outsourcing sector is poised to rebound in 2025, with year-to-date (YTD) transactions announced or completed increasing 25.9% year-over-year (YOY).

This heightened level of deal activity comes after an 18.4% YOY decrease in volume during 2024. Recent transactions have been driven by acquirers seeking to secure access to advanced manufacturing capabilities and strengthen supply chain resilience via nearshoring strategies. Additionally, the complex regulatory landscape has elevated demand for outsourced regulatory, compliance, and testing services, prompting both strategic and financial buyers to pursue tuck-in acquisitions of highly focused technical partners with deep domain expertise.

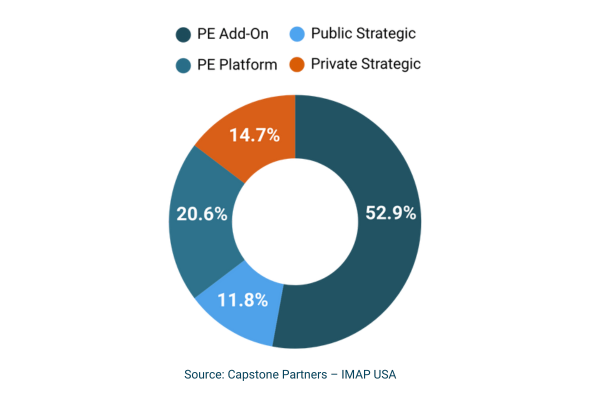

Meanwhile, tariff-related uncertainty has prompted sustained participation from public and private strategic acquirers (26.5%), as they pursue deals to mitigate risk and enhance supply chain resilience in a volatile global trade environment.

Sponsor-backed buyers have significantly expanded their presence in the M&A market, accounting for 73.5% of transactions year-to-date. Private equity add-on activity represents 52.9% of total deal volume, driven by the desire to scale manufacturing operations, expand offerings, diversify client mix, and better leverage sales, marketing, and back-office infrastructure.

Regulatory Pressures Reshape Contract Sterilization Market

The Contract Sterilization Services segment has been propelled by stringent regulatory oversight of Medical markets, advancements in drug delivery devices, heightened concern regarding the use of Ethylene oxide gas (EtO), and transition to more eco-friendly sterilization modalities.

EtO, the most commonly used sterilization method for medical devices, was flagged in 2019 by the Environmental Protection Agency (EPA) as harmful to workers, the surrounding community, and the environment due to toxic, carcinogenic biproduct emissions. In response to mounting pressure from the FDA and new regulations from the EPA in 2024 as well as legal and financial risks—highlighted by Sterigenics’ USD 408 million ethylene oxide (EtO) settlement in January 2023—medical device original equipment manufacturers (OEMs) are increasingly turning to alternative sterilization methods.

EtO currently accounts for approximately 48.1% of the Global Contract Sterilization market, creating a projected USD 2.2 billion opportunity for providers to garner market share by offering safer solutions, according to Coherent Market Insights. One promising alternative, vaporized hydrogen peroxide (VHP), has gained traction as a safe and effective substitute. Its credibility was further solidified in January 2024 when the FDA officially recognized VHP as an established sterilization method for medical devices.

With the rising cost of litigation for medical companies and growing pressure to safeguard brand integrity, assurance of sterility is of utmost importance driving many OEMs to adopt an outsourced sterilization strategy. When combined with existing benefits including operational optimization and cost efficiencies, these escalating regulatory pressures have opened new opportunities for quality providers of contract sterilization services.

Ongoing efforts to curb hospital-acquired infections (HAls) have intensified regulatory oversight. The FDA has expanded this scrutiny to the Medical Device sector, placing particular emphasis on manufacturing practices. In January 2024, the agency revised its Current Good Manufacturing Practices (CGMP) framework which more clearly define-and rigorously promote-robust sterilization standards for the production of devices and components.

Eric Williams - Director, Capstone Partners - IMAP USA

Supply Chain Realignment Fuels Medtech Outsourcing Growth

Shifting global tariff policies and ongoing trade negotiations in 2025 have complicated supply chain and sourcing decisions for medical device OEMs. While ongoing initiatives by industry groups such as AdvaMed, American Dental Association, American Hospital Association, and Medtech Canada have lobbied the governments of multiple countries to globally exempt medical devices and associated components from ongoing trade wars, the prospect of tariff-related impacts on the bottom lines of Medical Device market participants have led many to strategize on long-term risk minimization.

Several public companies in the sector have enacted strategies in response to tariffs. Beckton Dickinson (NYSE:BDX) has worked to shift its supply flows, optimize supplier locations, and leverage dual-sourcing options across its portfolio to mitigate future tariff-related risk beyond 2025.

A key component of its long-term tariff mitigation strategy is a five-year, USD 2.5 billion investment in U.S. manufacturing to bolster its tax-exempt supply sources, according to the company’s fiscal Q2 2025 earnings call. Bruker (Nasdaq:BRKR) has reengineered its supply chains with the goal of reshoring production to the respective regions where its products are primarily sold, including shifting manufacturing from Asia and Europe to the U.S. Teleflex (NYSE:TFX) has reorganized its supply chain to introduce a greater proportion of United States-Mexico Canada Agreement (USMCA)-compliant components into its production flows, while Zimmer Biomet (NYSE:ZBH) has shifted sourcing closer to end markets as well as optimized their portfolio by emphasizing less tariff-sensitive products.

Favorable End Market Trends Fuel Medical Device Market

Advancements in clinical capabilities and changes in patient preferences have shifted healthcare institutions towards favoring minimally-invasive surgery (MIS). Significant levels of forecasted growth in the MIS market provide favorable opportunities as OEMs increasingly depend on outsourced suppliers for specialized manufacturing solutions (e.g., micro molding, superfinishing, close tolerance machining) required to bring minimally-invasive medical devices (e.g., endoscopes, imaging equipment, robotic platforms/surgical instruments) to market.

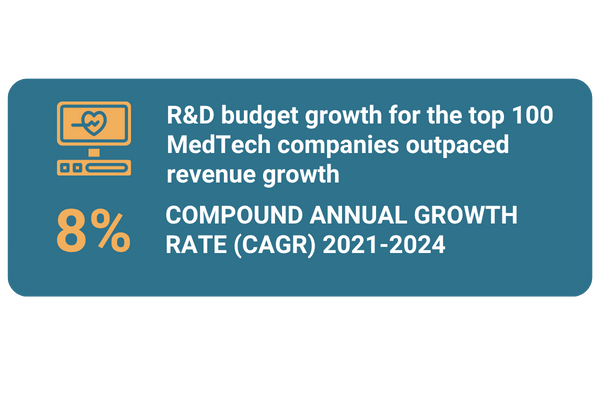

Research and development (R&D) has become a core focus of leading medical device OEMs. R&D budget growth has continued to outpace that of revenue for the top 100 medical technology (MedTech) companies, increasing at a compound annual growth rate (CAGR) of 8% from 2021 to 2024, according to Medical Design & Outsourcing.

Increased levels of R&D spending will likely fill OEMs’ pipelines with projects that require specialized outsourced services including product development, engineering, clinical trials, regulatory support, testing and validation, and commercial rollout planning.

The above is an excerpt from Capstone Partners – IMAP USA’s Medical Device Outsourcing M&A Coverage Report. For more than 20 years, Capstone Partners has been a trusted advisor to leading middle-market companies, offering a fully integrated range of investment banking and financial advisory services uniquely tailored to help owners, investors, and creditors through each stage of the company's lifecycle.