Electronics Sector in India: Accelerating Growth, Manufacturing Ambitions, and Investment Opportunities

The Electronics sector in India is undergoing a profound transformation, fast emerging as a global growth engine and attracting attention from investors, manufacturers, and policymakers alike.

Fueled by strong domestic demand, assertive government policy, and increasingly sophisticated capabilities in areas including semiconductor manufacturing and electronic manufacturing services, the industry is set to redefine India’s economic landscape through 2030.

A New Era for India’s Electronics Industry

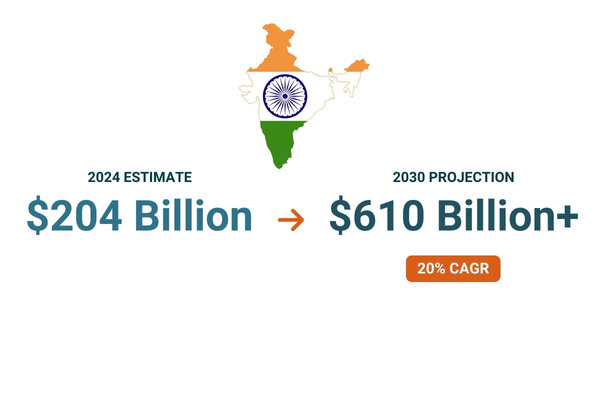

India’s electronics manufacturing output is estimated to surge from USD 204 billion in 2024 to USD 610+ billion by 2030, representing a compound annual growth rate (CAGR) of more than 20%.

This explosive expansion is driven by three primary areas:

-

Rising domestic demand for consumer electronics

-

Import substitution, reducing reliance on foreign-made products

-

Focused manufacturing incentives via government schemes

Collectively, these trends are increasing transaction velocity throughout the entire value chain, fueling high growth among electronics manufacturers and stimulating capital markets activity, including IPOs and aggressive mergers and acquisitions.

Government Policy and Investment Incentives

The government of India has deployed a series of targeted initiatives to foster growth in the Electronics sector:

Production Linked Incentive (PLI) schemes have been rolled out for categories including mobile phones, IT hardware, white goods, telecom/network equipment, and medical devices, with combined outlays exceeding USD 9 billion since 2020.

In January 2025, an additional USD 3 billion PLI package was approved for electronic components, especially bare printed circuit boards (PCBs), display and camera modules, and passive components such as resistors and capacitors, providing further incentive for manufacturers and investors. Incentive durations generally span five to six years, rewarding incremental sales above base-year benchmarks. The sectors within the Indian electronics domain that are seeing good traction include:

Electronic Manufacturing Services: Growth and Opportunity

The backbone of India’s Electronics sector is its Electronic Manufacturing Services (EMS) industry. EMS output is projected to leap from USD 33 billion in 2024 to USD 155 billion in 2030 - a CAGR of 30%. While currently holding only 4% of the global EMS market, India is on track to contribute one-third of the incremental global EMS growth in the coming years.

Key factors driving EMS growth include:

-

Penetration of smartphones, consumer electronics, and adjacent domains such as computers

-

Expansion across industry verticals, including Aviation, Defense, Telecom, Industrial Automation, Automotive Components, and Medical Devices

Major EMS providers are pursuing international expansion through acquisitions, joint ventures, and partnerships. A few notable transactions include:

-

Dixon Technologies’ partnership with Longcheer Electronics (China) for smartphone manufacturing

-

Kaynes Technology’s acquisition of August Electronics Inc. (USA) to strengthen its North American footprint

-

Tata Electronics securing partnership with Pegatron Technology India to strengthen its position in the iPhone supply chain

-

Acquisitions by Cyient DLM and Syrma SGS targeting regional markets and medical devices

Printed Circuit Board (PCB) Manufacturing: Scaling Up

India’s bare PCB market is forecast to grow from USD 3.5 billion in 2024 to USD 8.2 billion by 2030 (15% CAGR), while the associated copper clad laminate (CCL) market will expand from USD 135 million to USD 335 million over the same period (20% CAGR).

Breakdown of Demand:

HDI and 8-layer PCBs-critical for mobile phones, IT hardware, and industrial applications represent the fastest growing segment, though domestic capabilities in this area remain limited, with much of the demand still served by imports. Domestic manufacturing is strongest in single, double, and lower-layer PCBs, serving lighting, white goods, automotive, and other simpler use cases.

Recent investment and partnership activity includes Syrma SGS Technology’s joint venture with South Korea’s Shinhyup Electronics for multi-layer PCB and CCL production, and the Amber Group’s partnership with Korea Circuit targeting HDI, flex, and semiconductor substrate PCBs.

Semiconductor and Electronics Components: Building From the Ground Up

India’s aspirations in chip manufacturing, semiconductor packaging, and development of electronic components are beginning to materialize, with a wave of investments from both domestic and international firms:

-

Semiconductor Fabrication Space: Tata Electronics has committed over USD 10 billion partnering PSMC, Taiwan, for a 28nm semiconductor fab

-

Semiconductor Packaging Space: Several players are setting up facilities or have announced projects. These include Tata Semiconductor Assembly, CG Semi (a JV between CG Power, Renesas, Japan and Stars Microelectronics, Thailand), Kaynes Semicon (in JV with UST, US), and Micron Technology and 3D Glass Solutions (company backed by Intel and Lockheed Martin) among others

-

Overall Electronic Components Space: There have been several new businesses - SiCSem (Si-C wafers in partnership with Clas-SiC Wafer, UK), Continental Devices (high-power discrete device manufacturing using Si and Si-C technologies), Murata, Japan (for multilayer ceramic capacitors), HCL-Foxconn JV (for display driver chips), and Jabil Circuits (for Optical Transceiver)

These developments signal the emergence of a robust semiconductor industry in India, supported by favorable policy, access to global markets, and technological integration.

Stock Market Valuations and Active Companies

The rich valuation of Indian EMS companies is a testament to the sector’s dynamism and investor confidence. Fast-growing companies not only attract capital but also engage in aggressive expansion and diversification into adjacent industries.

Top Listed Players and Performance

|

Company |

Industry |

5yr Revenue CAGR |

EV/EBITDA |

Market Cap (USD Bn) |

|---|---|---|---|---|

|

Dixon |

Consumer Durables, Healthcare |

55% |

37.7x |

10.1 |

|

Amber |

Consumer Durables |

20% |

32x |

2.9 |

|

Syrma SGS |

Automotive, Industrials |

34% |

35x |

1.8 |

|

Kaynes |

Defense, Aerospace, Industrial |

49% |

58.4x |

4.3 |

|

DCX Systems |

Cable, Wire Harnessing |

25% |

17.3x |

235 |

These companies are pursuing cross-border acquisitions and partnerships to bolster capabilities, diversify product offerings, and expand into high-growth sectors.

Current Opportunities in the Indian Electronics Sector

India’s Electronics sector is currently very vibrant with several players backed by capital seeking opportunities through acquisitions, JVs, and partnerships. The segments that they are keen to consider for investments include:

-

EMS Companies: Indian EMS companies are considering acquisitions of EMS companies globally which either have scaled up profitable businesses with diverse and blue-chip customers (Kaynes and Syrma are actively seeking such targets) or specialized EMS companies with strong capabilities in the Medical, Defense, and Automotive sectors

-

PCB and Laminates: Companies are looking for targets in PCB companies doing multi-layer PCB in defense, as well as JV partners for HDI and multi-layer PCB boards for the India market. Similarly, they are considering JV partnerships for setting up Copper Clad Laminate (CCL) facilities and polypropylene films (used for capacitor manufacturing) in India

-

Electronic Components Space: Companies are seeking JV partners across the following product categories: camera modules, display modules, passive components (resistors, capacitors, inductors, switches, relays, sensors, and connectors)

-

Other Areas: Outsourced Semiconductor Assembly and Test (OSAT) companies in India are looking for partnerships, Electro-mechanicals, enclosures for mobiles, and IT products

The Road Ahead

India's electronics manufacturing journey is entering a "decisive decade" with the clear opportunity to become a "true global electronics hub". The sector stands at an inflection point, with world-class ambitions and the policy tailwind needed to realize them. Ongoing investment in manufacturing, aggressive expansion by EMS providers, and the rollout of high-impact government incentives make the Electronics sector in India one of the best investment opportunities in Asia’s emerging markets today.

As India deepens integration into global supply chains and climbs the technological ladder in chip manufacturing, printed circuit boards, and electronic design, stakeholders ranging from international investors to domestic entrepreneurs will find a wealth of possibilities for value creation and profitable growth in this dynamic market.

India’s Electronics sector is entering a decisive decade - with a clear opportunity to emerge as a global manufacturing hub.

Praveen Nair - IMAP India