IMAP advised Rotagegruppen AB on sale to Weland AB

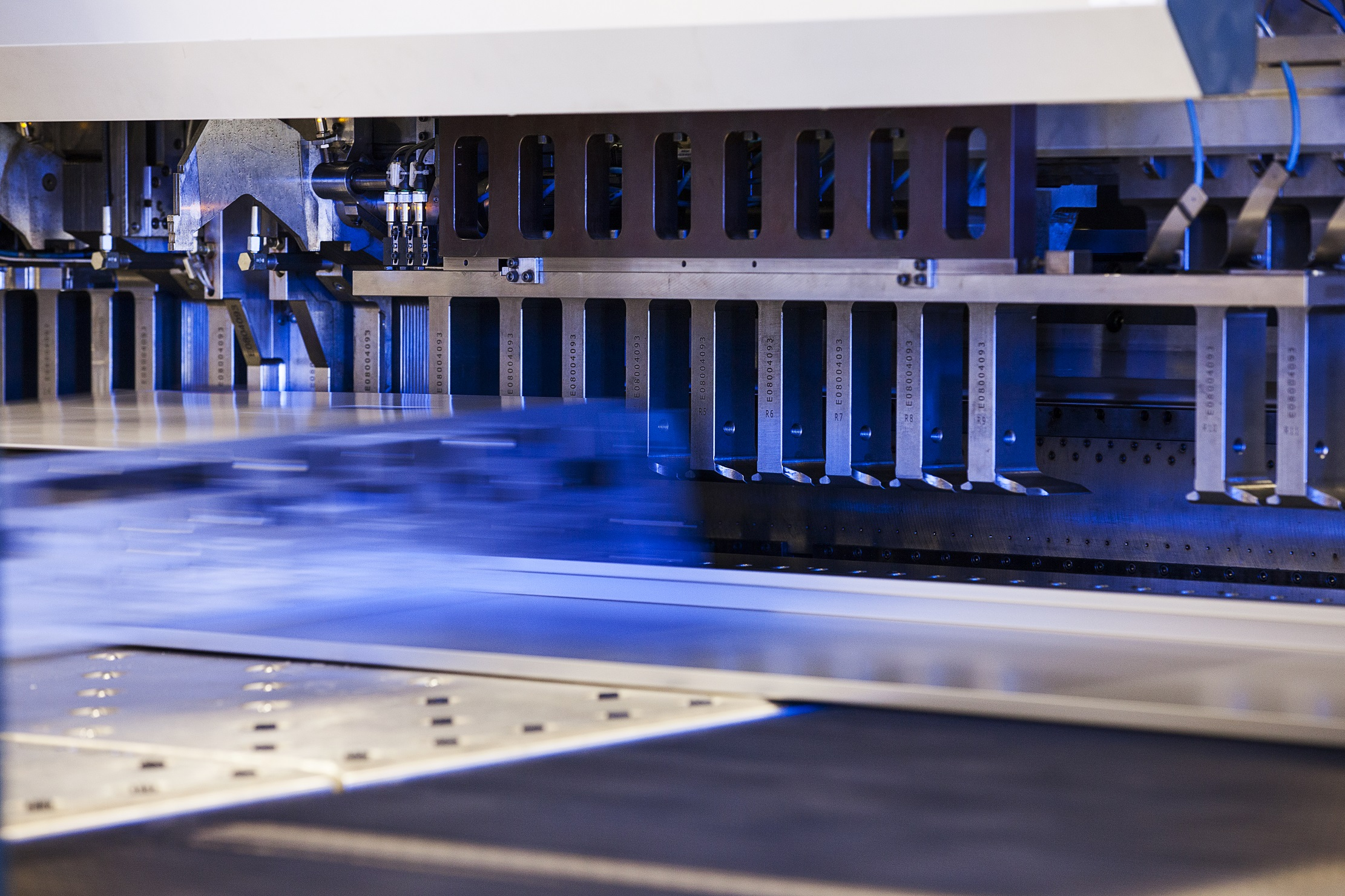

Rotage is a leading Swedish contract manufacturer offering services such as laser cutting, punching, bending, assembly and surface treatment. With the group’s complete and modern machinery, the company has established themselves as a highly competitive production partner for sheet metal components.

Rotage is a leading Swedish contract manufacturer offering services such as laser cutting, punching, bending, assembly and surface treatment. With the group’s complete and modern machinery, the company has established themselves as a highly competitive production partner for sheet metal components. The transaction also includes Rotage’s subsidiary, Plåtmodul i Mjölby, which is contract manufacturer for primarily the heavy lifting and the construction machinery industries. The group has a turnover of EURO 26 million and 130 employees.

Weland is a family-owned conglomerate with production and headquarter in Smålandsstenar, but also operates in Denmark, Finland and Norway. The company is a leading manufacturer and supplier of grating products, staircases, railings, mezzanine and gangways. The company is also one of Sweden’s largest contracting manufacturers within sheet metal. Weland had a turnover of EURO 200 million in 2018.

Björn Henriksson, Vice President Weland, comments:

“We are enlightened of the acquisition, which expands and improve our total offering within sheet metal production. Weland is today one of Sweden’s largest producers of sheet metal components. Rotage and Plåtmodul are two well-known companies, which operates in the same market as us. The acquisitions will provide synergies for all included parties.”