Securing the Future Through Partnership: Succession for German SMEs

Taking the next step toward growth together

The challenge of corporate succession is hitting German SMEs head-on. But successful generational change does not have to mean saying goodbye; it can be the basis for sustainable growth. The partnership between Fischer Weilheim and Schwenk shows how strategic decisions can blend tradition and the future, and how succession can become a growth story rather than a risk factor.

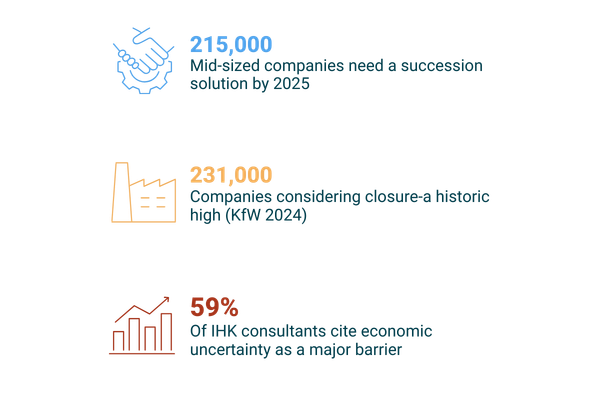

The situation is urgent: by the end of 2025, around 215,000 mid-sized companies need a succession solution. Yet only slightly more than half have realistic prospects of success. According to KfW Succession Monitoring 2024, 231,000 companies are considering closure - a historic high. The main reason: owners are near retirement, coupled with a shortage of potential successors. This uncertainty weighs heavily on succession planning.

According to the DIHK report on business succession 2024, 59% of IHK consultants cite economic uncertainty as a major reason firms do not seek a successor. In the previous year, the figure was 44%. Geopolitical tensions, rising energy costs, and regulatory challenges add to owner doubts about future viability. Nearly three-quarters of mid-sized companies see finding suitable successors as their biggest hurdle in the looming German Mittelstand succession wave.

Company at a Crossroads: German SME Succession in Practice

In this environment, the Fischer Weilheim Group faced a crucial question: How can a successful family business secure its future without compromising what it built? As a leading supraregional recycling service provider for transport logistics, soil management, demolition, and construction waste recycling, Fischer Weilheim had built a strong regional market position over many years in the Baden-Württemberg recycling industry. The shareholders recognized early on that sustainable growth in a changing market requires more than organic growth - it requires the right partner.

The Construction industry is transforming. The circular economy is no longer a nice-to-have; it's a key requirement for the future. The Circular Economy in Construction Initiative's monitoring report shows recycled construction materials have grown, yet investment and innovation needs remain enormous. The government is developing a national circular economy strategy. Companies that fail to keep pace risk losing their competitive edge in areas such as construction waste recycling in Germany.

Responsibility Means Shaping the Future Actively

Letting go of your life's work is never easy. The emotional side of company succession is often overlooked. At Fischer Weilheim, the situation was different: This was neither retirement nor a distress sale, but a conscious choice for a strategic partner who shares the company's values and guarantees further development for employees, customers, and the region. It was a deliberate change of course. Fischer Weilheim’s shareholders acted from a position of strength. They recognized that future challenges - digitalization, sustainability, regulatory requirements, and a shortage of skilled workers - could be handled better with a strong partner and a clear concept for company succession planning.

Strategic Addition for Sustainable Growth

On the other side was Schwenk, a family-owned company combining consistency and innovation since 1847. With more than 4,500 employees, Schwenk is a leading family-owned company in the German Building Materials industry. The company stands for innovative, sustainable, and future-oriented building material solutions - regionally anchored, internationally networked. CEO Thomas Spannagl highlighted the strategic significance: "Fischer brings high expertise and supraregional strength to the table - an ideal addition to our portfolio. Together, we want to develop sustainable building material solutions with a focus on sustainability and the circular economy."

This is more than words; it reflects the spirit of the times. Recent studies show family-owned companies increasingly pursue strategic growth through partnerships and acquisitions. The KPMG Global Family Business Report 2024 shows German family businesses focus on long-term thinking and sustainable value creation. Schwenk saw not only operational synergies in Fischer Weilheim but also shared values crucial for long-term success. Both companies share a commitment to reliability, quality excellence and corporate responsibility and provide a concrete example of succession in German family business through strategic partnership.

A Partnership Approach to Shared Goals

M&A transactions in the SME sector are highly complex with many hurdles. These range from price and payment terms to legal and tax issues. In this deal, professional transaction expertise and the necessary tact for family businesses played a key role. Claus Bechlars, Chairman of the Management Board of Fischer Weilheim Group, said: "We thank the IMAP team for outstanding support on our journey into this new phase and their commitment and expertise across all aspects of the transaction process."

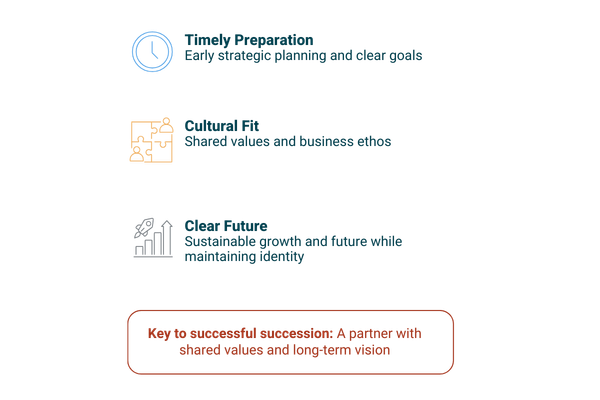

The deal's success rested on several factors:

-

Timely preparation for succession. Unlike many who act too late, Fischer took a strategic approach. IMAP recommends starting planning early and clarifying your wishes and goals – a crucial lesson, not just for German SME succession

-

Cultural fit. Finding a partner with the same values was essential. Schwenk met this perfectly: As a family business with more than 175 years of history, it understands what entrepreneurship means across generations and what makes family business succession in Germany particularly sensitive

-

Clear future prospects. Fischer Weilheim will remain independent - with its familiar team, structure, and operational focus. This continuity was crucial for employees and customers.

An M&A advisor played a key role. As a global M&A partnership, IMAP brought technical expertise and the necessary tact for family businesses.

As a leading supraregional circular economy service provider for transport logistics, soil management, demolition, and building material recycling, Fischer Weilheim built a strong regional market position over many years and demonstrates how growth through succession can work in practice.

Growth While Maintaining Identity

The partnership opens new perspectives. Schwenk gains Fischer Weilheim's operational excellence and market knowledge; Fischer Weilheim strengthens its market presence and sustainability efforts. Both companies join forces for future generations. In an industry facing enormous challenges - from circular economy policy to stricter environmental rules and skilled labor shortages - this is a strategic move within the broader context of corporate succession in Germany’s industrial groups.

Actively Shape Succession, Don't Just Manage it

This is more than a successful deal; it's a wake-up call for German SMEs. With hundreds of thousands of successions pending in the next five years, doing nothing is not an option. Those who explore partnerships early can actively shape their company's future. Success comes from forward-looking planning, clear values, and the courage to take new paths. With the right strategy, opportunities grow. There are ways out of unresolved succession issues. Selling as part of a structured M&A process is one option, provided values, vision and trust align. Fischer Weilheim and Schwenk prove this works and show how strategic partnership in SMEs in Germany can turn a succession challenge into a competitive advantage.

Selling is not Giving up

The two companies' history shows selling does not have to be a breakup. With the right chemistry, shared values, and a long-term view, a sale becomes a success story for owners, employees, customers, and the region. As succession grows more complex, courage to embrace change matters. We need entrepreneurs who shape the future, not just preserve the past. Fischer Weilheim took this step and found in Schwenk a partner blending tradition and innovation. This partnership shows how choosing the right partner is key to sustainable success and how succession in Germany can become a driver of innovation, circular economy construction and sustainable building materials.

The message for German SMEs is clear: those who act in good time, think strategically, and find the right partner can turn succession into a growth opportunity. Taking responsibility for your life's work today means actively shaping the future - with courage, vision and the right partners.