Polish Banking Sector: Consolidation, Exits & Investment Trends

The Polish Banking sector is undergoing a phase of consolidation and strategic reorientation, driven by a combination of international bank exits, evolving ownership patterns, and a relatively fragmented market.

As 2025 progresses, deal activity has accelerated, underpinned by both the rotation of assets by foreign investors and the emergence of local players seeking to increase their footprint in the attractive Banking market in Poland.

This article analyses the key trends shaping Poland’s Banking landscape, with a focus on market structure, recent mergers, and the future trajectory of the sector.

Fragmentation and the Impetus for Consolidation

Poland’s Banking sector fragmentation remains a defining characteristic, with sub-optimal sized players operating alongside several dominant institutions controlled by state and foreign capital.

This fragmentation has created ground for ongoing Polish banking consolidation, as both incumbents and new entrants leverage opportunities to acquire assets and expand their reach. Seen as “underbanked”, the Polish Banking market is an attractive investment opportunity to new entrants.

International Banks Exit Poland, Opening Doors for Change

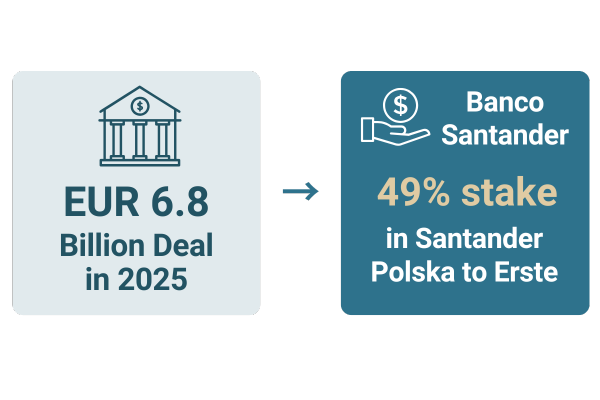

The exit of international banks from Retail Banking in Poland has been pronounced in recent years, reshaping the sector. In 2025, Banco Santander sold a 49% stake in Santander Polska to Erste for EUR 6.8 billion and Citi disposed of its Polish Consumer Banking business to Velobank.

“It is not uncommon for foreign investors to look at asset rotation”, said Trigon Investment Banking – IMAP Poland’s Managing Partner, Piotr Chudzik. “For example, selling parts of its Polish assets provides the funds for Banco Santander to expand in North and South America.

Earlier exits have set a precedent. Societe Generale’s 2018 sale of Euro Bank to Bank Millennium, Raiffeisen Bank International’s disposal of its Polish operations to BNP Paribas the same year, as well as its sale of Nordea Bank Polska to PKO BP marked significant milestones in this ongoing withdrawal of foreign capital.

“This is a great opportunity for local groups to increase their market shares” Chudzik says, “a fragmented market also makes it easier for new entrants to stake out positions.”

The Role of State-Controlled and Local Banks

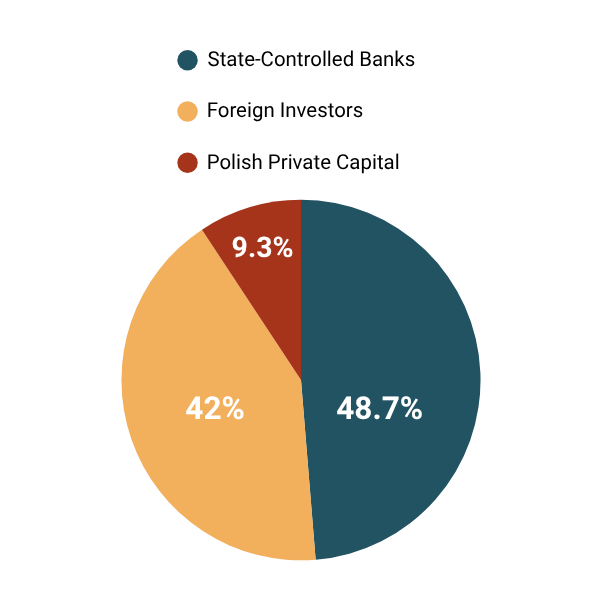

A notable dynamic within Poland’s Banking ecosystem is the weight of state-controlled banks Poland assets, which accounted for 48.7% of the sector as of April 2025. Foreign investors held 42%, with Polish private capital owning a relatively modest 9.3%.

This distribution highlights significant intersections of public and private market forces shaping the sector's competitive environment. Amidst the foreign exit wave, local banks increasing market share is a pronounced trend. It follows that state-backed institutions benefit from acquisitions and reconfigurations sparked by international divestments, further intensifying Retail Banking consolidation Poland.

A case in point is the recent memorandum of understanding between Bank Pekao, a major state-influenced bank, and insurance giant Powszechny Zakład Ubezpieczeń (PZU) on a potential merger. This deal signals the drive toward larger consolidated players better positioned to compete domestically and regionally.

Underbanking and New Entrants Stimulate Market Activity

Despite historic progress, Poland remains comparatively underbanked versus many Western European peers, with low credit saturation and relatively few bank branches.

In Poland, banking assets are at the level below GDP, while in Western European economies they far exceed GDP in relative terms,” says Chudzik.

This structural gap offers fertile ground for both organic growth and inbound investment by new entrants attracted by Poland's expanding economy and digitization leadership.

Leaders in Digitization

Poland’s banks are highly digitalized in part thanks to the country’s thriving IT hub, which makes them attractive targets for investors looking to leverage their know-how. UniCredit’s entry through its acquisition of fintech companies Aion Bank and Vodeno exemplifies this trend of integrating innovative platform-based services that facilitate modern banking experiences.

Moreover, new entrants, including European and Asian investors, are increasingly eyeing Poland as a gateway to Central and Eastern Europe. This complements pressures in the market from ongoing Banking sector fragmentation Poland, providing opportunities for organic market share gain, as well as inorganic expansion through acquisitions.

Key Players and Potential Targets

The Polish Banking market's competitive landscape is dominated by a mix of established state-controlled and large foreign-owned banks, alongside several mid-sized players with varying degrees of private ownership.

Altogether, some 13 banks are listed on the Warsaw Stock Exchange, many with retail arms too small to compete effectively at scale. As the industry evolves, numerous smaller entities are likely to become targets, continuing the wave of spin offs in Polish banks and strategic portfolio realignments.

Outlook: Future Consolidation and Market Evolution

Looking forward, the interplay of Poland’s banking consolidation, ongoing mergers in Polish banks, and shifts in ownership are expected to accelerate. Fragmented market segments will likely be absorbed by larger players - including both local and foreign institutions - in pursuit of scale and digital transformation.

International banks retreating from the Polish market provide the opportunity for new entrants and local institutions to reshape the competitive landscape. Combined with the market’s underbanked status and strong digital infrastructure, Poland represents a dynamic frontier for financial consolidation and innovation.

Investor focus will increasingly center on value creation from operational synergies, technological advancement, and expanded retail footprints. Meanwhile, evolving regulatory frameworks and political oversight of state-controlled banks will also play a critical role in defining the pace and shape of future consolidation in Poland.