Stabilization & Improved Performance Expected to Accelerate M&A in T&L Sector

During the COVID-19 pandemic, the typically unsung $8 trillion logistics and supply chain ecosystem garnered unprecedented attention and became top-of-mind for consumers and businesses trying to procure then hard-to-find products. Seismic e-commerce and technology driven sector shifts accelerated, leading to record levels of deal activity starting in late 2020 and into early 2022.

GORDON MACKAY

Managing Director

Transport & Logistics Group

Capstone Partners – IMAP USA

JONATHAN ADAMS

Managing Director

Transport & Logistics Group

Capstone Partners – IMAP USA

As the world “opened up” in 2022, consumer spending shifted back from lockdown-driven goods spending to more service-related industries, the Federal Reserve started an historic tightening cycle and supply chain pressures subsequently eased. 2022 and early 2023 have presented a difficult environment for companies moving and facilitating the movement of freight, with pricing and volumes down substantially from 2021 highs.

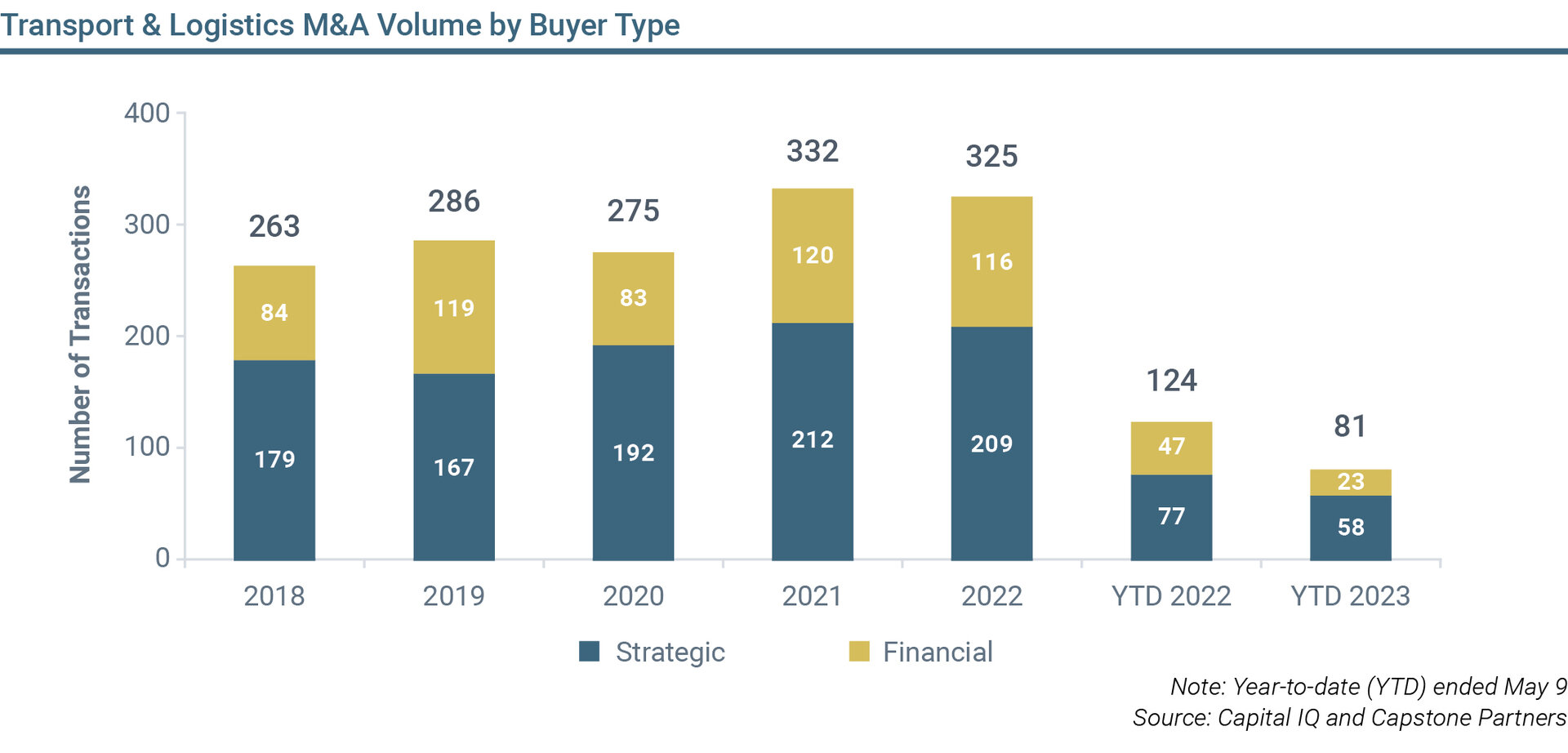

Sector M&A activity cooled in the second half of 2022 and is down substantially YTD. We expect sector stabilization and potentially improved company performance in H2 2023, which could provide a catalyst for accelerated deal activity leading into 2024. With high interest rates challenging private equity, strategic buyers have reasserted themselves as the dominant sector acquirors. The adoption of logistics and supply chain technologies will continue to shape the industry; however, we expect the growth capital raising environment for early-stage companies to continue to be challenged and the potential for M&A to substitute for what would have been capital raises in more accommodating capital markets.

Select Sub-sector Insights

Freight Brokerage & Digital Freight

Freight brokers, almost across the board, have seen 30%+ declines in revenue from Q1 2022 to Q1 2023 with corresponding declines in profitability. As a result, sector deal activity has been muted over the last 12 months. The Uber Freight/Transplace, Jordan Companies/Echo Global and AEA/Redwood transactions in late 2021 represented the last substantial flurry of M&A activity around the sector. We expect activity to be largely slow until pricing and volumes trend back to historical averages. There is a critical mass of potential sellers who may have potentially held on too long, reaping the rewards of the 2021 and early 2022 freight environment. When the freight market eventually tightens and conditions return to historical averages, we expect some of this pent-up activity to come to market. Business models more insulated from the dramatic shifts in spot pricing and/or that have niche capabilities continue to be of strong strategic interest and will continue to see strong strategic acquiror appetite, despite weakness in the broader environment.

Warehousing & Fulfillment

The Warehousing and Fulfillment sector has gone under the most e-Commerce driven transformation of any area withing the logistics ecosystem. The sector underwent a wave of deal activity in 2021 and early 2022. Nascent, tech-enabled platforms such as Shipmonk, ShipBob and Stord raised capital at $1 billion+ valuations. Large Logistics sector integrators such as Maersk and Ryder have made multiple acquisitions as they build a more comprehensive D2C offering for customers for which they had traditionally only provided B2B services.

Select Strategic M&A Activity

“For Flexport, this acquisition enables our vision for a full digital transformation of the global supply chain that we will bring to all customers. This democratization and pooling of scale will level the playing field for cost and speed of delivery for all businesses, not just the largest corporations in the world.”

Dave Clark

CEO of Flexport, in a press release

“With Whiplash, we gain a formidable e-fulfillment network supported by a best-in-class technology platform. With Midwest, we gain a proven model for multi-client warehousing and distribution, a capability that we’ve been targeting for some time. And, when you combine these expanded capabilities with Ryder’s end-to-end transportation logistics solutions, including our Ryder Last Mile delivery network for big-and-bulky goods, we are in a position to deliver significantly increased value for customers looking for more advanced supply chain solutions.”

Robert Sanchez

CEO Ryder Systems

“We have set out to build strong E-Commerce Logistics capabilities that complement our existing end-to-end supply chain offering. Visible SCM’s operating model and value proposition will strengthen our customers’ E-commerce Logistics, enabling them to sell through any sales channel, deliver in any way and manage their supply chains seamlessly.”

Vincent Clerc

CEO Maersk Ocean & Logistics

With e-commerce volume growth moderating in 2022 and into 2023 and Amazon slowing its footprint growth, 2023 will be a year of mixed performance and moderated deal activity. In the longer-term, we expect sector consolidation to be an important trend, with sector leaders differentiating with strategically placed nationwide (and sometimes international) networks and leveraging scale benefits to implement technologies across their networks. Niche sectors that have unique handling and environmental needs are of the highest strategic M&A interest and are also areas where smaller players can continue to thrive by providing focused customer service.

Logistics & Supply Chain Technologies

Underpinning the sector consolidation trends and evolution of business models and networks by eCommerce proliferation is the implementation of new technologies. With new digital technology comes scalability, repetition, and automation of processes across vast networks.

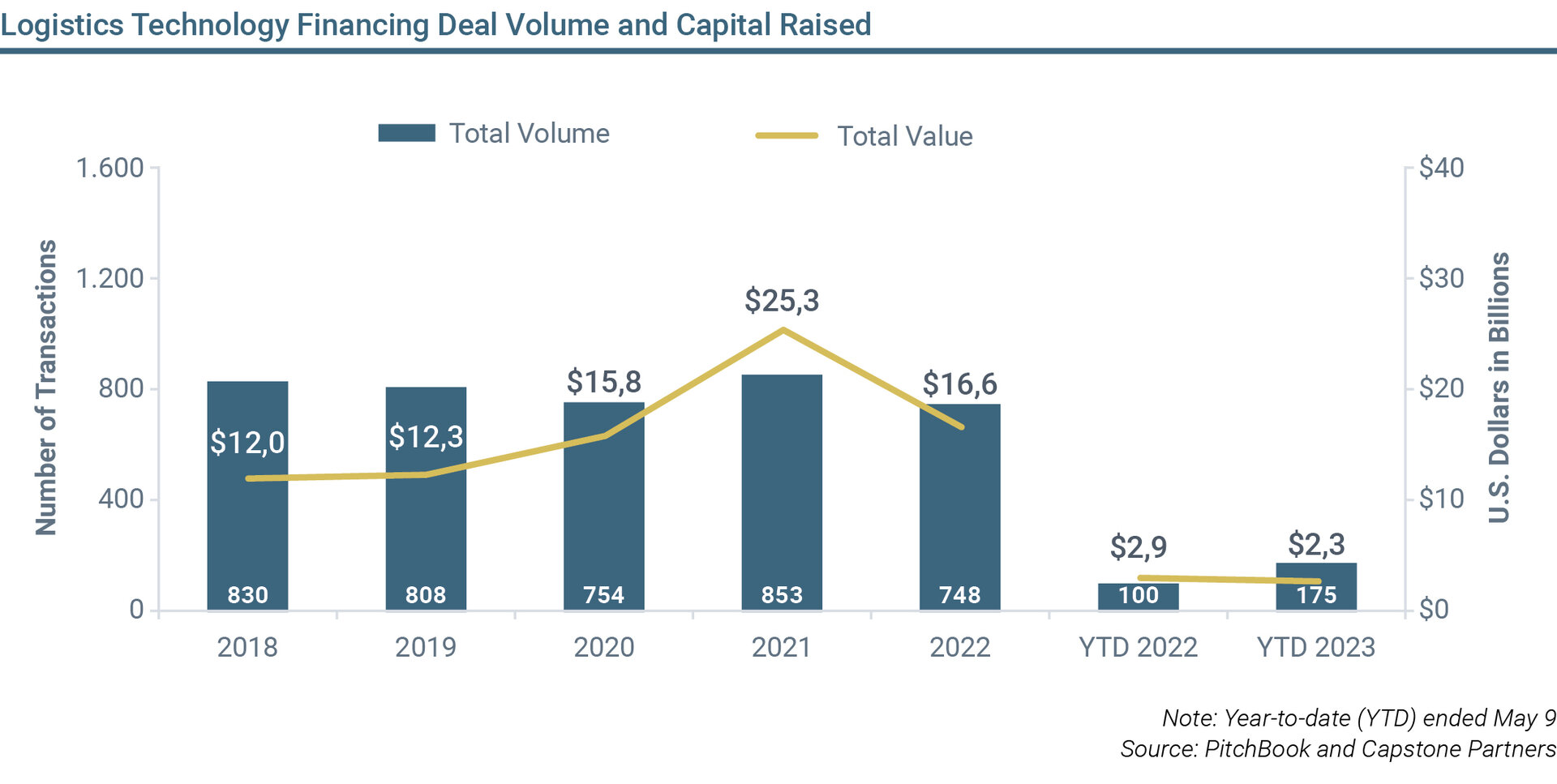

Sector funding has cooled markedly from its 2021 peak, with 2022 down 35% and 2023 continuing at a similarly slow pace. Investor interest in the space remains high, but the higher interest rate environment will continue to keep growth investors more selective about where and how they deploy capital. Combined with lower overall sector profitability, the tighter capital environment is having and will continue to have significant sector implications:

- Technology implementation will be more selective, as logistics and transportation companies will be more focused on implementing “need to haves” and be more discerning about implementing “nice to haves”

- Financial runway will have meaningful competitive implications. More capital constrained logistics technology companies are reigning in growth plans, allowing better capitalized sector participants to move ahead

- M&A will sometimes replace growth capital raises for companies with strategic and compelling solutions, but that need more capital

Trucking

The Trucking sector is acutely affected by slowing freight and freight rates. Early 2023 has seen an acceleration in sector bankruptcies by smaller, less diverse players that have difficulty absorbing even a small number of customer losses. A sector that was severely short on capacity in 2020 and 2021, is now estimated to have as much as 25% more capacity than it needs.

The sector challenges have created opportunity for well capitalized sector consolidators seeking to strengthen networks and add capabilities in strategic growth areas. In fact, Knight-Swift’s $800 million March 2023 acquisition of U.S. Xpress represents its largest acquisition in its history.

We expect these same trends to persist until sector capacity tightens. And even then, sector consolidation will continue at a pace as large players continue to have to scale to compete and differentiate by offering the most comprehensive services at the most competitive rates.

eCommerce Proliferation

eCommerce growth has a long runway and is estimated to grow at a strong pace for the foreseeable future. The implications across the logistics ecosystem are broad. As consumer expectations grow, fulfillment will become an even more important part of the end-customer experience. Speed of delivery and reliability will continue to be paramount, leading to continued migration of distribution centers closer to the end-consumer, accelerating development and adoption of automated delivery technologies (drones, self-driving vehicles, etc) and investment in technologies providing an enhanced buying experience.

Technology Implementation and Digitization

Technology implementation has been and will always be a driving force of the logistics system evolution. Today, technologies that provide visibility and platform integration, for example, are having some of the most transformative impacts. Generative-AI based technologies are poised to have some of the most profound impact, taking on operational and customer facing tasks once only thought could be done by humans. The continued digitization of business models will, on balance, favor more scale service providers with the capital to invest in the latest technologies and benefit from network effects.

Supply Chain Agility and

The 2020/21 supply chain crisis shone a new light on supply chain vulnerabilities. As a result, manufacturers are diversifying supplier bases and bringing more manufacturing and assembly closer to the consumer. Technology will also play a more critical role, providing critical predictive analytics, real-time visibility, and real-time control.

Labor Shortages

There is a global mismatch between labor supply and logistics ecosystem needs. More effort is being directed towards recruiting and training potential new entrants, but broader implementation of automation technology, particularly around warehouses, provides an even more sustainable solution. Labor outsourcing to lower-cost countries to handle back-office operations and IT are and will continue to grow.

Collaboration Over Competition

The logistics ecosystem is complex and involves several participants just to get a single good to market. Shippers, carriers, and customers reward service providers that offer integrated, seamless, and reliable services. Bringing together the optimal, integrated suite of services requires extensive collaboration. Those that strategically collaborate with ecosystem participants are poised for the most success.