M&A Thriving in the Industrials Industry in the U.S. and Canada

In 2021, M&A volume in the Industrials industry in the U.S. and Canada proliferated**, making a significant recovery from the COVID-impacted deal activity recorded in 2020. The Industrials Investment Banking Team from Capstone Partners — IMAP USA share insights from the firm's recent "Annual Industrials Industry Report — Middle Market Deal Activity & Outlook," looking at current valuations and outlining the key trends forecast to drive M&A activity in the industry over the upcoming year.

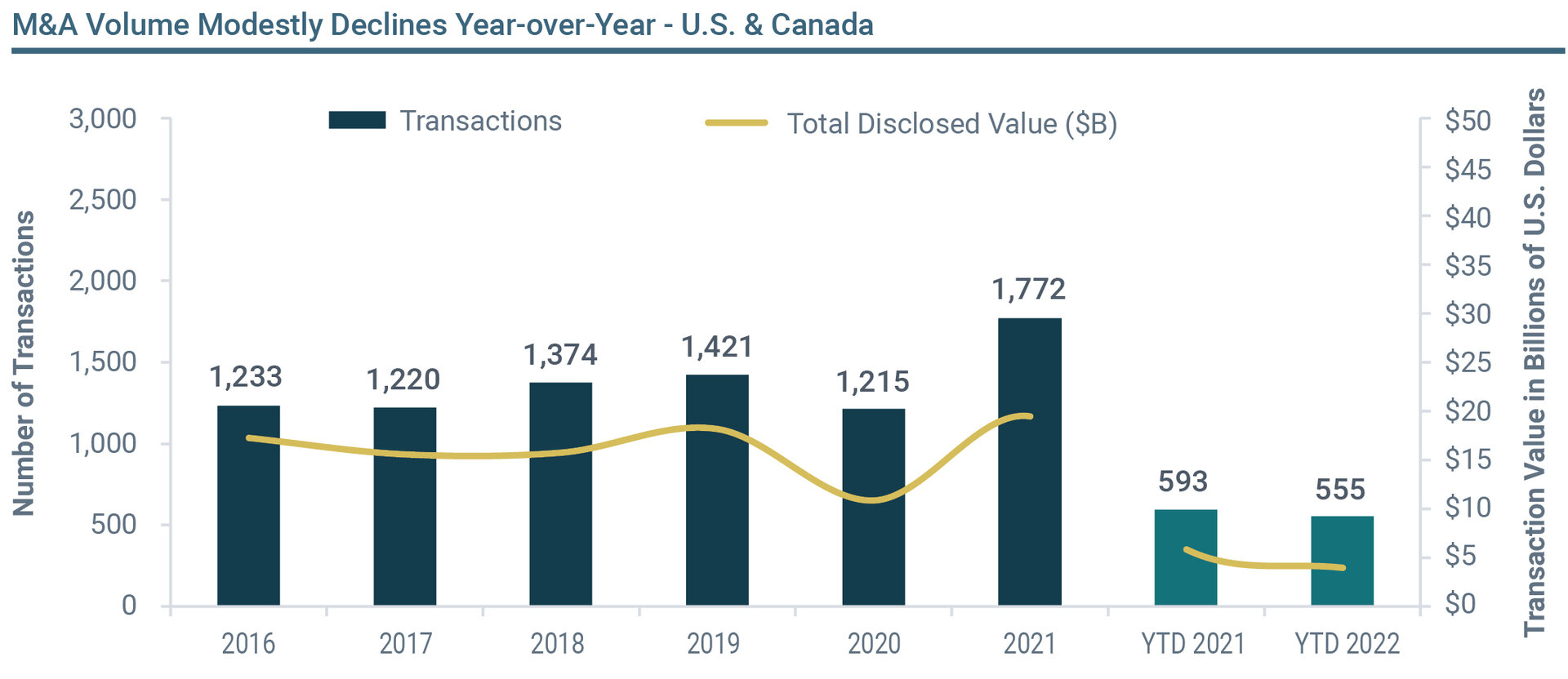

The Industrials industry moved at a record pace in 2021, rising 45.8% year-over-year (YOY), as business owners were encouraged to go to market by the reopening of the economy, pent-up M&A demand, prospect of a capital gains tax increase, and frothy M&A purchase multiples.

Moving into 2022, year-to-date (YTD) transaction volume has remained healthy, declining a modest 6.4% from the same period last year as many of the elements that drove M&A volume in 2021 remain intact, including record levels of capital overhang and an elevated backlog of companies looking to engage in a sales process. Amid economic uncertainty, acquirers continue to pursue well-established businesses in defensible spaces.

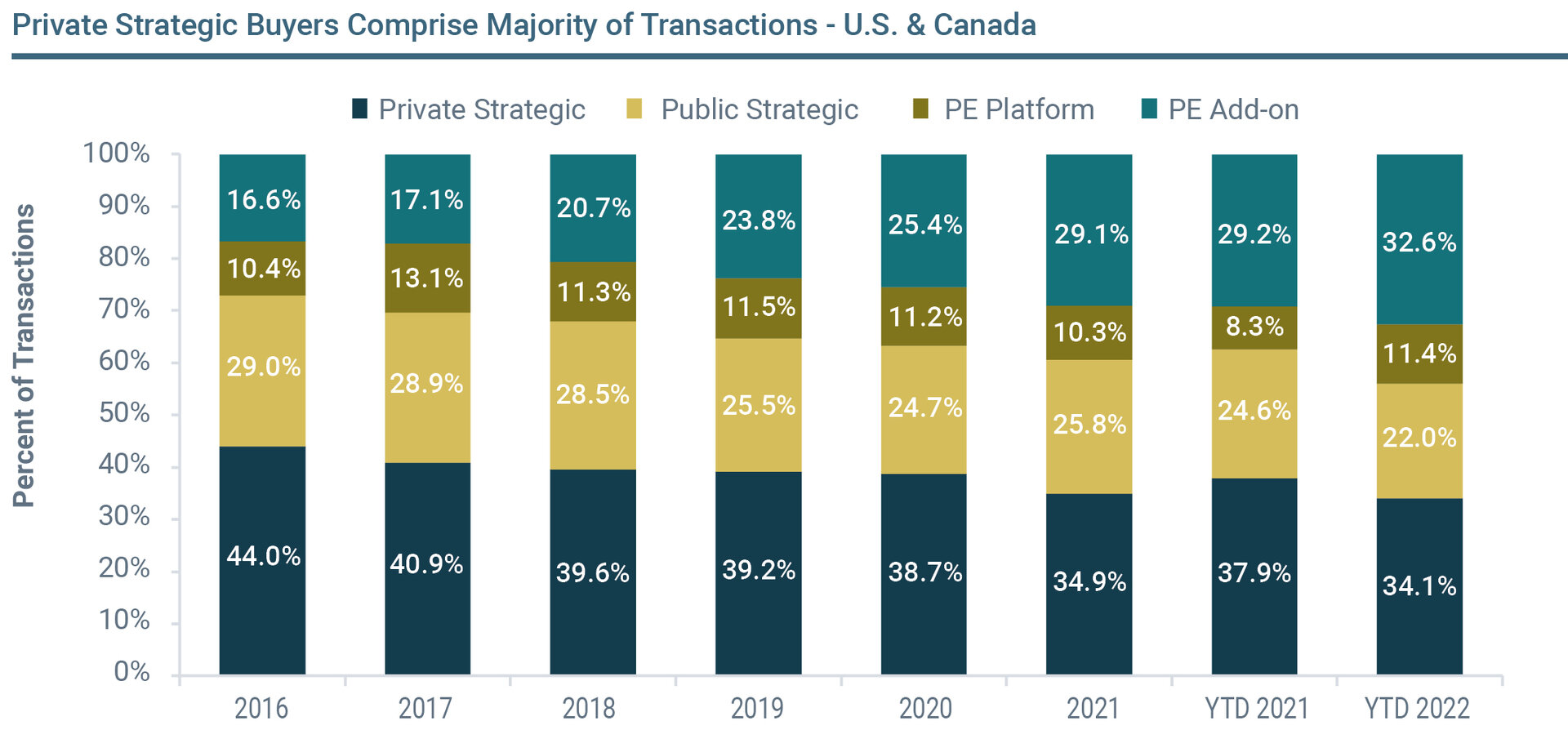

Strategic Buyers Driving Most Activity

Leading deal activity YTD 2022 (56.1% of deals announced or completed) are the strategics, with buyers pursuing accretive targets with complementary offerings and exposure to lucrative end markets. Financial buyers also remain active, with private equity (PE) add-on acquisitions accounting for a growing share of the deals, comprising a notable 32.6%, portfolio companies leverage PE backing to consolidate competitors. PE direct investments totaled 14% of deal activity as sponsors look to put capital to work and spend down record levels of dry powder by building platforms utilizing buy-and-build strategies in promising and growing sectors.

Interest rate increases remain top-of-mind for business owners as the Federal Reserve and other central banks aim to curb inflation while minimizing the adverse economic effects, though it is not entirely clear whether interest rate increases could hinder deal activity.

Due to the abundance of assets that went to market in 2021, "story deals," or deals with complications, were not popular last year. However, the current market has provided a better environment for "story deals" involving target companies that may have weaker sales growth, customer concentration, tight margins, or require additional positioning during the sales process.

Key Themes Driving Industry Activity & M&A Volume

Buyers will be attracted to segments performing well during the pandemic, as well as those related to e-commerce as consumer behavior shifts. Improved balance sheets and record levels of capital overhang will bolster carveout activity, meanwhile industrial companies aligning long-term strategies will drive divestiture activity.

Manufacturers are increasingly under pressure. Consumers are pushing back on increasing prices driven by input price inflation, forcing manufacturers to take measures to improve margins through horizontal or vertical integration.

The pandemic caused their supply chains to be pushed to the limit, as a result obliging them to look at new options, including reshoring their production and integrating operations through M&A, add to this labor shortages and for some, consolidating competitors is the only solution to gain the skills or technology required for long-term sustainability of the business.

Ever more stringent Environmental, Social, and Corporate Governance (ESG) regulations will increase demand for sustainable solutions, and as a result, industrial companies supporting the expansion of sustainable products and practices will be in higher demand.

Capitalizing on Pandemic Tailwinds: The pandemic has impacted consumer behavior as increased time at home has shifted consumer preferences towards goods and away from services. Exposure to growing end markets is expected to drive industrials M&A activity as companies aim to establish platforms in market segments that have performed well amid the economic downturn. Means of consumption also shifted as consumers utilized e-commerce platforms as an alternative to in-person shopping. Acquirers are expected to pursue target companies with exposure to online shopping activity.

Strengthening Supply Chains & Reshoring: COVID-19 has tested global supply chains, with government-imposed shutdowns resulting in dislocations and decreased visibility. In addition, manufacturers in sectors such as Disinfectants and Personal Protective Equipment (PPE) were unable to meet the unprecedented demand. As the economic impacts of the pandemic subside, manufacturers are expected to fortify supply chains and enhance visibility by investing in advanced automation technology, moving production closer to headquarters, and leveraging M&A to integrate operations and create a competitive advantage in their markets.

Shedding Non-core Assets & Businesses: Divestiture activity is expected to continue at a healthy pace as industrials companies continuously reassess their portfolios to ensure that all assets align with their long-term growth strategies. In addition, carveout activity is expected to be bolstered by a favorable deal environment, with strategics leveraging improved balance sheets and financial buyers, with record levels of capital overhang, looking to put their money to use. In addition, sellers are expected to continue to expedite their exit timelines to maximize up-front consideration ahead of any potential capital gains tax increases.

Bolstering Sustainable Offerings: Elevated consumer awareness of sustainability practices, rising Environmental, Social, and Corporate Governance (ESG) interest, and the prospect of more stringent environmental regulations under the Biden administration are expected to continue to increase demand for sustainable solutions. Industrials companies that support the expansion of sustainable products and practices, both organically and through demand in the foreseeable future. We also expect that companies in higher-polluting sectors will be increasingly pushed to pivot investment towards sustainable solutions that align with growing calls for green production methods.

Improving Margins Amid Rising Prices: Across nearly all segments, industrials businesses are experiencing input price inflation, putting downward pressure on the profit margins for intermediate and final goods. Due to the high demand backdrop, some companies have been able to pass elevated input costs onto the consumer by increasing the price of the good. However, input prices often rise faster than adjustments to the price of the end-good, resulting in immediate margin leakage. In addition, consumers are expected to push back on manufacturers for non-essential goods if prices for such items continue to increase. Companies can reduce input costs through horizontal integration, leveraging economies of scale to increase profit margins, or through vertical integration, acquiring material suppliers to reduce overhead and streamline processes.

Meeting Labor Force Needs: Federal stimulus checks exacerbated labor force challenges as many workers opted to collect unemployment rather than work. While the unemployment rate has returned to pre-pandemic levels, many employers continue to struggle to find workers amid the Great Reshuffle. Rising demand and lower production due to labor force shortages have resulted in supply/demand imbalances among manufacturers. In addition to paying higher wages, industrials companies are expected to address labor challenges by consolidating competitors to gain skilled workers and adding automation technology that reduces the number of employees necessary for production.

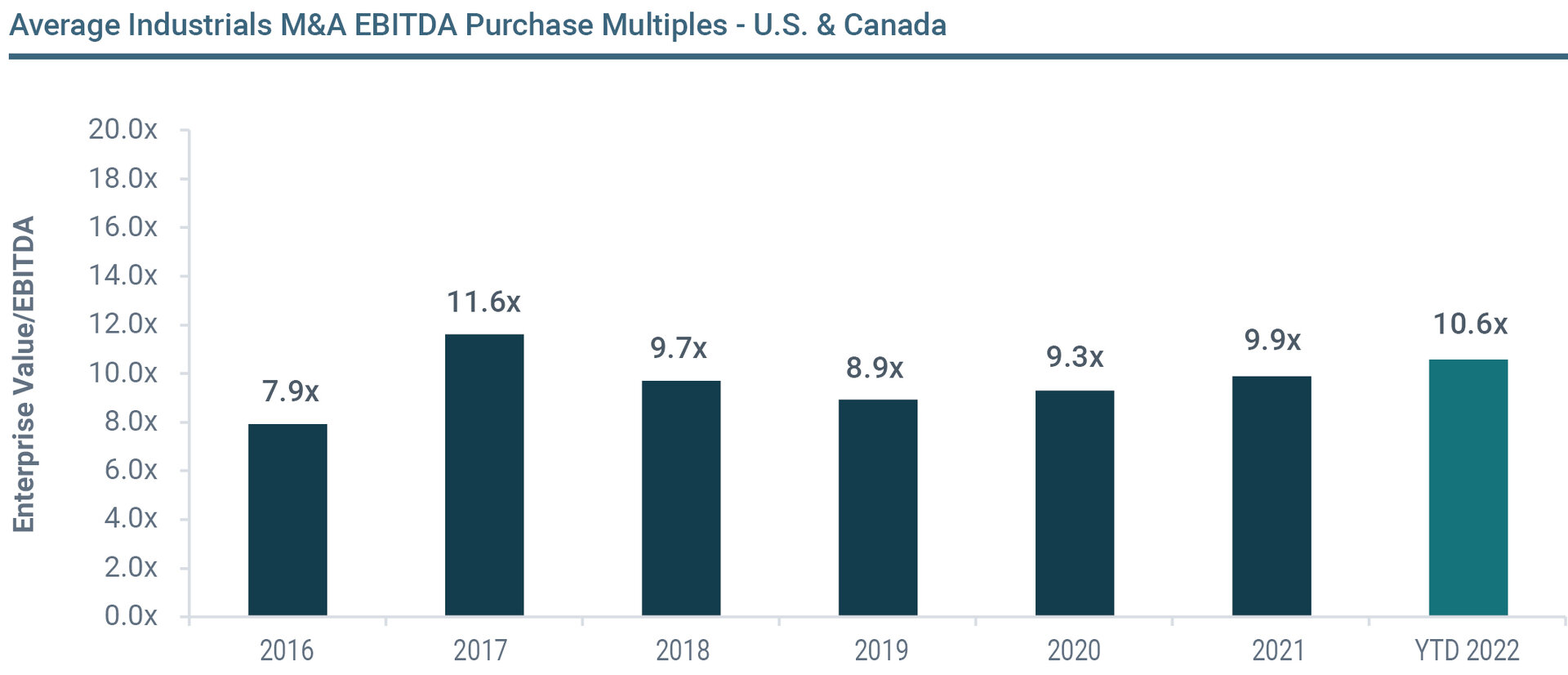

Transaction Valuations Remain Elevated

In 2020, Industrials transaction EBITDA multiples averaged 9.3x with buyers hesitant to pay premiums amid economic uncertainty, manufacturing shutdowns, supply chain disruptions, and volatile profit margins due to input price inflation. Fast forward to today and following a strong valuation environment in 2021, the average EBITDA multiple for Industrials transactions stands at 10.6x YTD 2022, outperforming historical levels. Both strategics and PE buyers are demonstrating a willingness to pay premiums for high-quality targets, businesses with healthy financials that demonstrated defensibility amid the pandemic-induced downturn.

Premium Prices Amid Economic Uncertainty

Historically, strategic buyers have sought businesses that diversify offerings, enhance end market exposure, establish economies of scale, create synergies, and strengthen supply chains. PE buyers have demonstrated a willingness to pay more for businesses that align with their investment theses, penetrate growing segments, or enhance the market share of portfolio companies. Acquisition multiples are expected to remain strong in the near-term as buyers pay premiums for defensible assets amid economic uncertainty.

Due to the surplus of coveted assets and record levels of capital overhang, lenders increased leverage to win deals in 2021, as evidenced by the rise in Manufacturing industry debt multiples which reached 40x in Q4 2021, compared to 36x in Q3 2021, according to GF Data®. While the market for quality deals remains competitive as bidders continue to utilize leverage to win deals in the near-term, interest rate increases could result in a normalization of debt multiples throughout 2022.

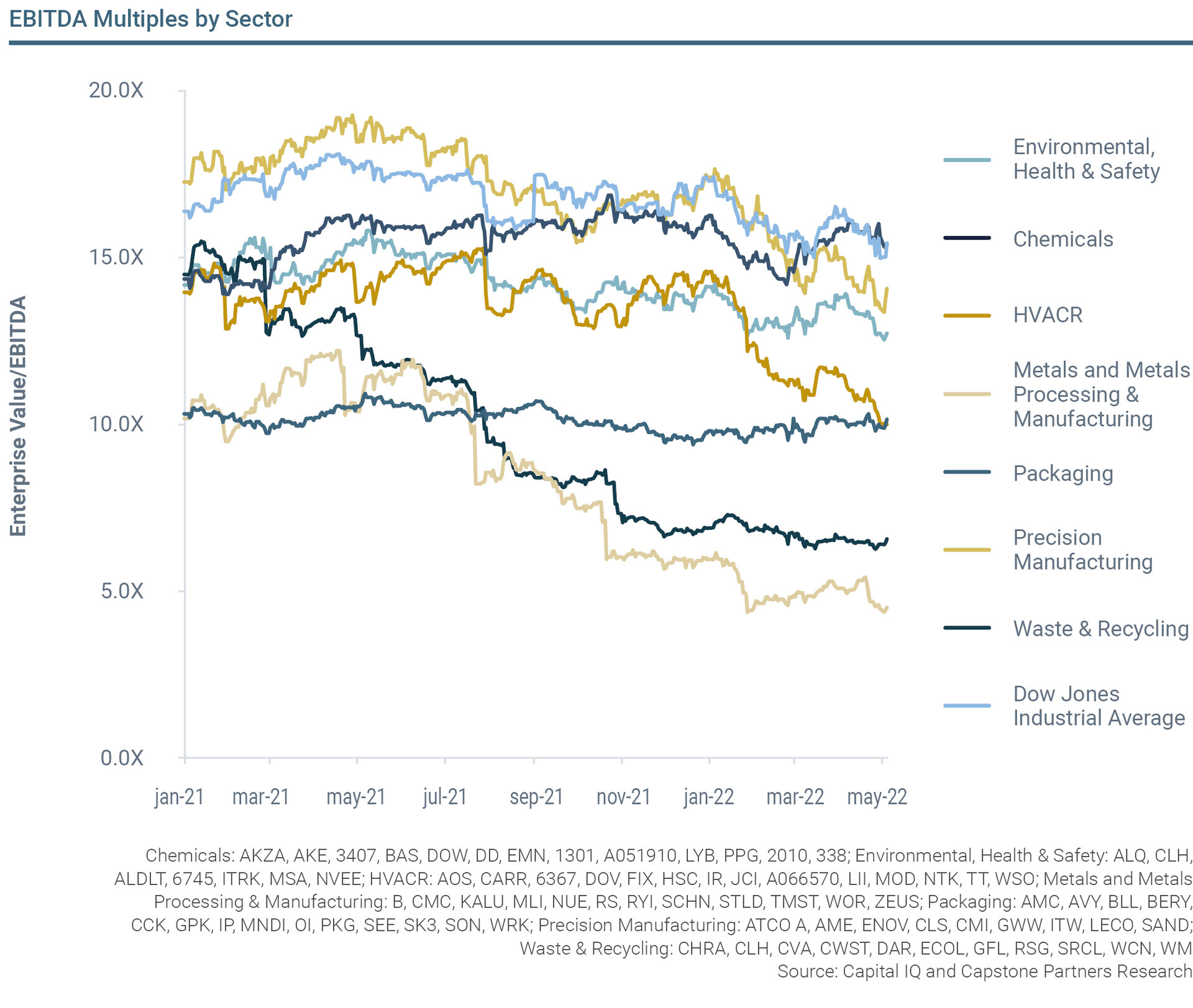

While cost inflation has undoubtedly impacted industrials companies, with the Chemicals and Metals and Metals Processing & Manufacturing sectors experiencing substantial declines in EBITDA trading multiples, transaction valuations have remained strong across the Industrials industry, demonstrating substantial acquirer competition for quality businesses serving resilient end markets.

The ability to pass input costs onto the consumer will continue to be a key factor in preventing margin leakage and preserving financing strength. Due to persistent buyer appetite and a backlog of businesses looking to go to market, Capstone Partners — IMAP USA expects acquisition activity to continue at a healthy pace through 2022 despite economic uncertainty, supply chain disruptions, and interest rate increases.